Picture this: you’re onboarding a new property investor client who’s eager to get started with their tax planning. The engagement letter is signed, the ID check is done and then everything grinds to a halt over one small request: proof of address. Weeks later, after polite reminders and multiple email threads, you’re still chasing that one missing document.

It’s a familiar frustration for UK accountants. Proof of address feels like a simple box to tick, yet it’s one of the biggest bottlenecks in AML onboarding.

In this post, we’ll unpack what actually counts as valid proof of address in the UK, why it’s such an essential part of AML compliance, the common pain points firms face when collecting it, and how digital tools like FigsFlow are finally making the process seamless.

What is Proof of Address?

Proof of address (POA) is independent documentary evidence confirming that a client resides at the address they’ve declared, issued by a recognised and credible source.

In the UK, there are two main categories of acceptable documents:

Primary documents must be dated within the last three months and include:

- Utility bills for gas, electricity or water (but not phones)

- Bank or credit card statements

- Council tax bills

- Mortgage statements

- HMRC correspondence

These documents should clearly display the client’s name and current address, leaving no ambiguity about who they relate to or where the individual lives.

When primary documents aren’t available, alternative documents can be used. These include recent tenancy agreements, electoral register confirmations, or government-issued letters (e.g. benefit letters or driving licences). However, these often require additional checks to confirm the address is genuine and up to date.

Why Proof of Address is Crucial for AML Compliance

Under the Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017, accountants and other supervised entities must verify both a client’s identity and address for AML compliance. HMRC and professional bodies such as ICAEW and ACCA make it clear that address verification is a mandatory part of customer due diligence.

Proof of address supports AML compliance in three key ways:

- It Enables Accurate Risk Assessment:

Knowing where a client lives helps you assess risk appropriately. A client based in the UK presents different considerations from one connected to a high-risk jurisdiction. Without verified address information, it is impossible to apply the correct level of due diligence.

- It Enhances Traceability & Accountability:

If suspicious activity arises, verified address details create a clear audit trail. They are essential for submitting Suspicious Activity Reports and assisting investigations. Incomplete or unreliable data can make follow-up impossible.

- It Helps Prevent Fraud:

Address verification protects against identity theft, synthetic identities, and phoenix company schemes. Fraudsters often rely on firms that do not check addresses properly, as it allows them to operate under false details.

Proof of address works together with identity verification, beneficial ownership checks, and source of funds verification to build a complete client risk profile. Each element strengthens the others to give a clear picture of who your client really is and what level of risk they present.

Common Challenges Faced When Collecting Proof of Address

For UK accounting firms, proof of address collection is often one of the slowest and most frustrating parts of AML onboarding. The difficulties usually arise not from non-compliance but from how modern clients live and share information.

- Shift to Paperless Documentation – Most clients now receive bills and statements online, which reduces the availability of traditional proof of address documents. Electronic PDFs are convenient but harder to verify, and many firms lack tools to confirm whether a document has been altered. This adds time and uncertainty to what should be a simple step.

- Non-Traditional Client Situations – Some clients do not have documents in their own name or at a fixed address. Those who live with family, rent informally, or move frequently, including students, entrepreneurs, and international clients, often struggle to provide acceptable evidence. Even legitimate clients can be caught out by requirements that assume a traditional paper trail.

- Delays, Reworks & Manual Verification – Clients may not understand why address evidence is needed, which leads to slow responses or incomplete submissions. Staff then spend valuable hours chasing missing documents, reviewing outdated or unclear files, and manually checking details. This process drains resources and increases the risk of errors that can affect compliance.

- Inconsistencies in Verification Standards – Different clients require different levels of due diligence. Applying these standards manually is challenging and deciding when enhanced checks are necessary or what evidence is sufficient often relies on individual judgment. This can lead to inconsistency across the firm.

These challenges make proof of address collection one of the most resource-intensive parts of AML compliance and highlight why automation can significantly improve the process.

How FigsFlow Simplifies Proof of Address Collection & Verification

FigsFlow makes collecting and verifying proof of address simple, fast and fully compliant.

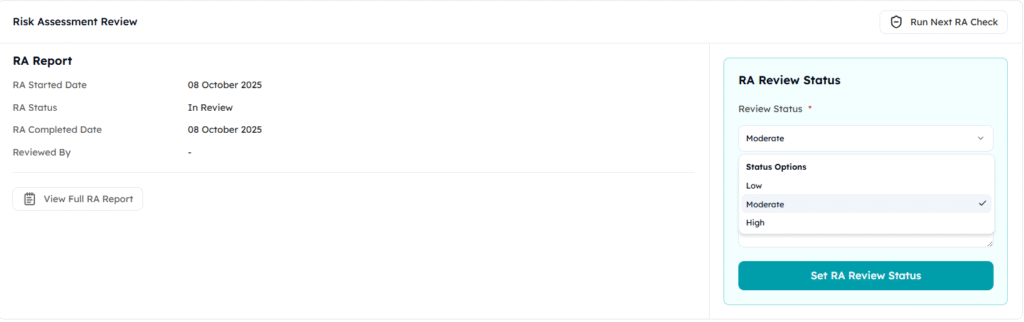

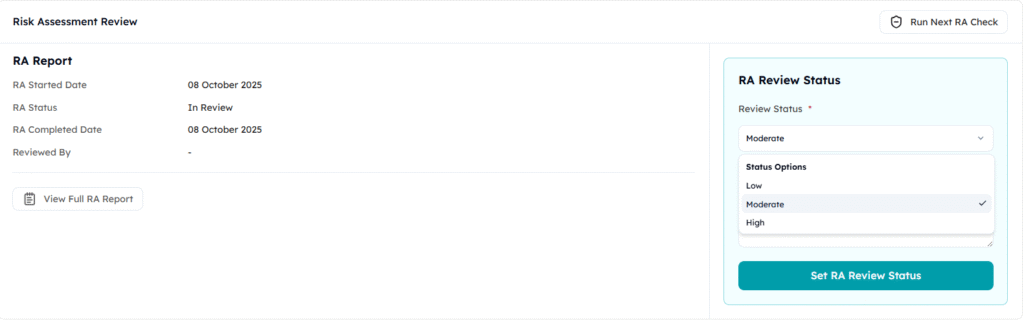

You can assign a risk level to each client using FigsFlow’s pre-built risk assessment templates. This helps your onboarding team select appropriate proof of address documents proportionate to the client’s risk.

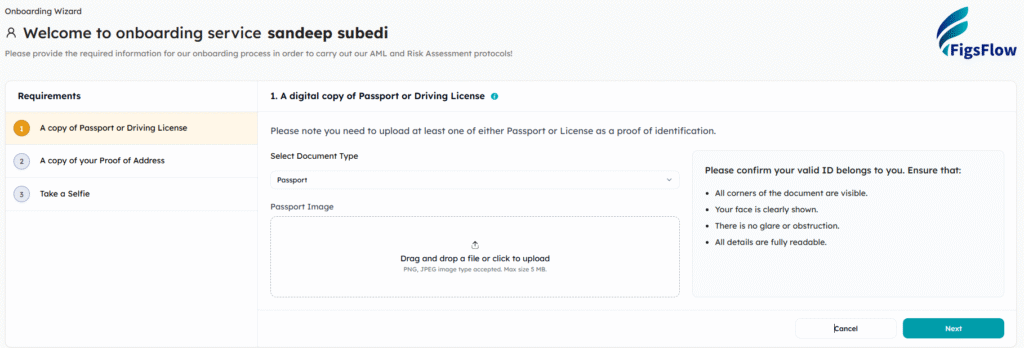

Clients receive a secure portal link where they can submit their documents at their convenience. This eliminates multiple email exchanges, reduces delays, and ensures documents are never lost.

Based on these submissions, you populate the appropriate contact and address information in the system. Everything is stored in one place, making it easy to retrieve when needed.

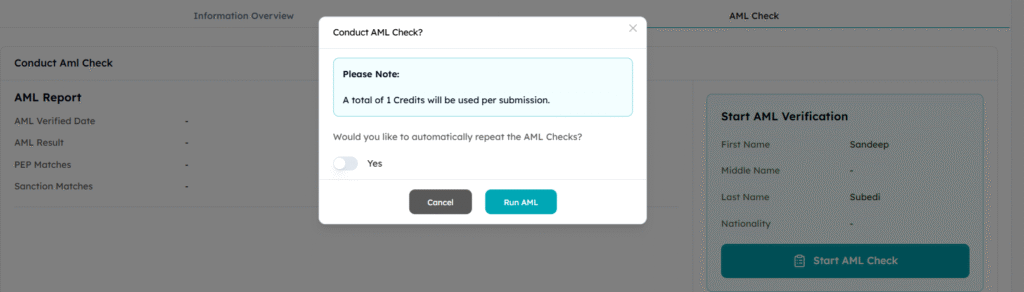

Once the documents are submitted, you can request an AML check. FigsFlow automatically verifies proof of address by searching across vast databases, ensuring accuracy without manual review.

This approach ensures that document collection and verification are efficient, accurate, and proportionate to client risk.

Conclusion

Proof of address verification consumes hours your team could spend on advisory work.

Chasing documents, reviewing submissions, confirming authenticity- it’s necessary for compliance but contributes nothing to client value or practice growth.

FigsFlow automates what should never have been manual in the first place. Clients submit documents through secure portals. The system verifies authenticity automatically. Your team maintains complete compliance without administrative overhead.

The result? Faster onboarding, happier clients, and compliance that doesn’t drain resources. Your practice meets regulatory requirements while your team focuses on work that actually generates revenue and strengthens client relationships.

Simplify proof of address collection and verification while keeping compliance effortless. Try FigsFlow for free with its 30-day trial.