FigsFlow for Crafting the Best VAT Return Services Proposal

The customisation and ease of creating proposals are crucial features that make FigsFlow an accountant, bookkeeper or accountancy firm’s best friend. However, the template creation feature is the heart of FigsFlow. Also, expert accountants and technology-savvy individuals have teamed up to create ready-to-use templates for the most popular accountancy and property management services in the UK.

VAT return is one such service that a company must submit before their deadline to avoid late payments and penalties. So, with the help of our VAT return template, you can create proposals for your clients in seconds. Not to mention, you can customise each and every element of the template based on you, your client, or your accounting firm’s taste.

What is VAT Return and Why is it Important?

A VAT Return is a statement presented to a tax authority about the sales and profits of any VAT-registered business. In the UK, you must submit a VAT return to the HM Revenue and Customs (HMRC) either monthly or quarterly. If you are in the property investment or trading sector, you must file a VAT return only if your turnover exceeds £90,000.

You have to submit your VAT return monthly or every three months, which is an accounting period. The deadline for submitting your VAT return is 7 days after the end of an accounting period. If you do not comply with the requirements of VAT return, you will get a penalty point. After you reach a certain threshold, you will get a £200 penalty, which will add up. So, submitting a VAT return timely is crucial if you are a VAT-registered business.

What are the Features of FigsFlow’s VAT Return Template?

FigsFlow has a ready-t0-use VAT return template that can be downloaded through the website. The template includes all the necessary requirements to submit a VAT return. So, if you are an accountancy firm looking to help a client or an individual accountant, this service is for you. Here are the features of FigsFlow’s VAT return template:

- Custom Letter of Engagement – The template allows you to create a personalised letter of engagement tailored to your client’s specific needs. This ensures clear communication about the services you will provide and sets the stage for a professional relationship.

- Comprehensive Scope of Services – Clearly outline the scope of your VAT return services, detailing each task you will handle. This can include preparing and filing VAT returns, advising on VAT liabilities, and ensuring compliance with HMRC regulations.

- Clear Terms and Conditions – Define the terms and conditions of your service agreement, including timelines, responsibilities, and any conditions that apply. This helps prevent misunderstandings and ensures both parties are on the same page.

- GDPR Compliant Privacy Policy – Include a GDPR compliant privacy policy to reassure your clients that their data will be handled securely and in accordance with current regulations. This is particularly important in the accounting sector, where sensitive financial data is involved.

- Pricing and Payment – Clearly state your pricing structure and payment terms. This can include a breakdown of costs for different services, any applicable VAT, and payment deadlines. Transparent pricing helps build trust and ensures clients understand the value of your services.

How to Customise FigsFlow’s VAT Return Template?

Each and every element of the VAT return template can be customised using FigsFlow’s proposal management system. This feature helps accountancy firms and accountants to use the elements required and edit others according to their and their client’s needs.

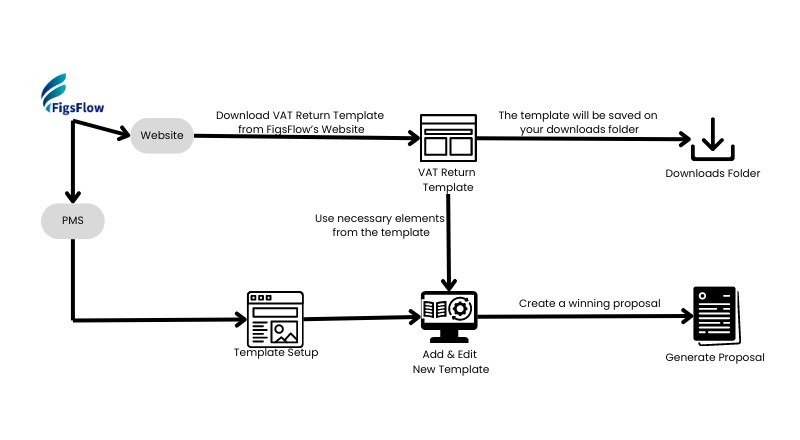

Here is a step-by-step process to customise the VAT return template:

- Go to the FigsFlow website and download the VAT return template from the templates section

- Check the template from your Downloads folder

- Login to FigsFlow PMS and go to the Templates Setup Section

- Under the Proposal tab, click on Add New Template

- Keep the necessary elements from the template Word file in the appropriate sections, which are the Cover Page, proposal Body, Proposal Footer, and Theme

- Then, select the created template for Proposal generation

With these few steps, you create a VAT return proposal for your clients. This helps to reduce the redundancy of steps and eases the accountant’s work.

Conclusion

FigsFlow’s VAT return template is meticulously crafted to simplify and expedite the creation of thorough, polished proposals for your VAT return services. Its highly adaptable features enable you to customise each proposal to perfectly align with the specific requirements of your clients, giving you a distinct advantage in the fiercely competitive field of accountancy. Using FigsFlow empowers you to guarantee punctual, precise, and regulation-compliant VAT return submissions, effectively avoiding penalties and enriching client contentment.