Every client relationship in accounting begins with an engagement letter. It defines scope, sets expectations and establishes the legal foundation for professional services.

Yet most UK practices still create these critical documents using outdated methods that risk liability, scope creep, fee disputes and compliance issues. By leveraging technology to automate engagement letters, firms can eliminate these risks.

Automating engagement letter solves the problem, but most existing solutions only go halfway. They still require manual setup, duplicate data entry or clunky workflows, leaving practices exposed to errors, inefficiencies, and poor client experiences.

The Problem with Current Tools & Processes

Most accounting practices handle engagement letters in one of two equally problematic ways: manually creating each letter or using basic automation tools that don’t truly automate engagement letters.

The Manual Approach

Creating engagement letters from scratch means starting with blank documents, researching current regulatory requirements, and customising terms for each client and service type.

The inconsistency is immediate. Different team members create different versions, leading to:

- Varying terms and conditions across similar engagements

- Missing regulatory clauses that create compliance risks

- Formatting inconsistencies that look unprofessional

- Outdated language that doesn’t reflect current standards

Regulatory compliance becomes a constant concern. Manual creation increases the chance of missing required ACCA, ICAEW or CIOT disclosures that could expose your practice to professional liability.

The “Automated” Tool Problem

Most so-called automation tools are just glorified templates with basic mail merge functionality, which means they don’t fully automate engagement letters for accounting practices.

These generic solutions ignore the specific requirements accounting practices face. They generate standard legal language that doesn’t reflect UK accounting regulations or professional body standards.

Here’s what’s wrong with packaged AI tools and generic automation:

- Templates designed for general business, not accounting services

- No understanding of different service types or client risk profiles

- Missing integration with practice management systems

- Outdated regulatory language that creates compliance gaps

- Generic formatting that lacks professional accounting presentation

Neither manual processes nor generic automation tools understand what makes accounting engagement letters different from standard service agreements.

How FigsFlow Does It Differently

FigsFlow’s engagement letter automation is built specifically for UK accounting, bookkeeping, and tax advisory services. By using FigsFlow, accountants can automate engagement letters to ensure compliance, efficiency, and professional quality.

Here’s what makes FigsFlow unique:

Expert-Designed Templates for Professional Bodies

FigsFlow offers templates for ACCA, ICAEW, CIOT, ATT and more, created by legal and tax experts. Templates stay updated with industry changes, UK law, and regulatory requirements, ensuring your letters always meet professional standards.

Intelligent Service Pricing Integration

Built-in advanced pricing calculators remove guesswork. The system considers client risk, engagement complexity, and market trends to generate accurate fees that reflect the true value of your services.

Professional Quality & Legal Compliance

Every engagement letter maintains professional standards regardless of who creates it. Legally binding e-signatures are built in, so clients can review and sign seamlessly without switching tools.

Streamlined Professional Workflow

Client information flows directly into letters without manual re-entry. Documents generate instantly, integrate with your workflow and reduce administrative overhead, enabling faster onboarding and consistent quality.

How to Make an Engagement Letter with FigsFlow

Step 1: Add Client Information

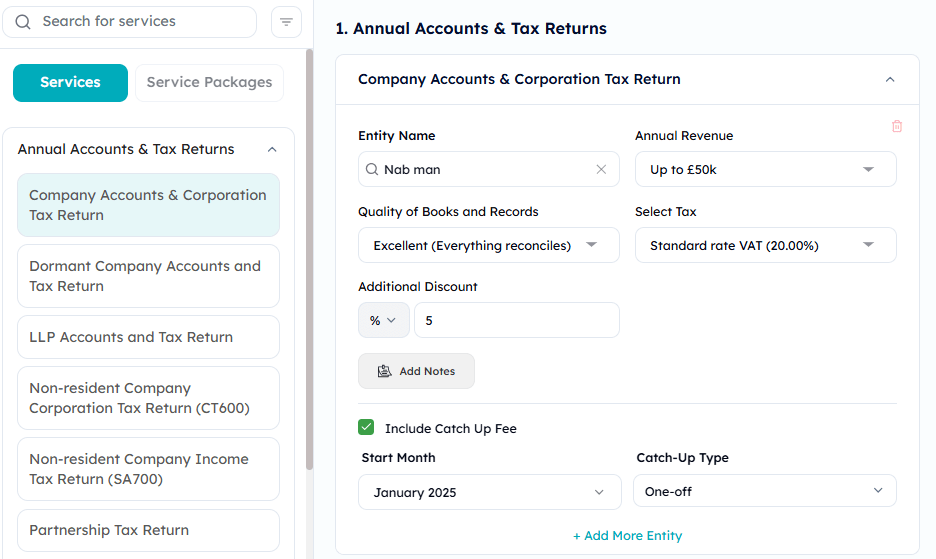

Start by adding your client’s details. FigsFlow lets you import data automatically or via HubSpot integration. Simply select the appropriate service type from each service category, add the entity name and point of contact.

At this stage, you can also decide whether to create both a proposal and engagement letter or just the engagement letter.

Step 2: Set Your Pricing

Next, set your pricing. FigsFlow’s advanced pricing calculator does the heavy lifting, considering engagement complexity, client risk and market trends, helping to automate engagement letters with accurate and tailored pricing. You can review the suggested fees, make manual adjustments (if needed) or offer custom discounts.

Once you’re happy with the pricing, click “Proceed to Preview.”

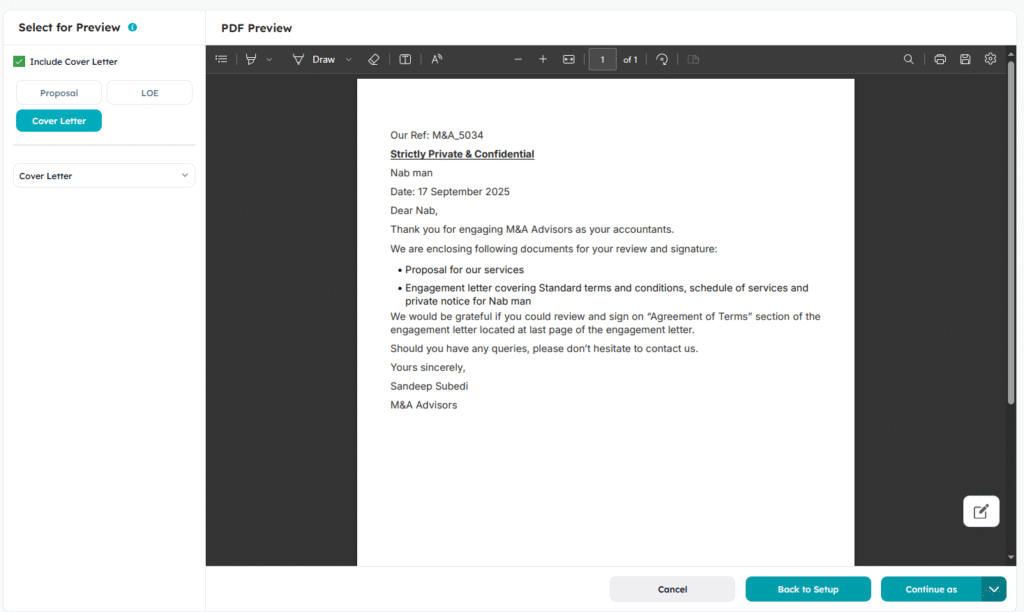

Step 3: Send the Engagement Letter

Finally, send the engagement letter. You can optionally add a cover letter with a single click, then choose to send it live to the client or save it as a draft.

The letter is fully generated, compliant and ready for client review, all within a single integrated workflow.

Here’s what your engagement letter looks like:

Don’t just take our word for it! Register today for a 30–day free trial and see how quickly you can create compliant, professional engagement letters with FigsFlow.

Conclusion

Engagement letter automation only works when it’s designed for the specific needs of accounting practices. Generic templates often create more problems than they solve, AI tools generate standard language that overlooks professional requirements, and manual processes leave firms open to inconsistency and compliance risks. By choosing the right software to automate engagement letters, firms can avoid these pitfalls.

Purpose-built automation changes everything. FigsFlow’s specialised approach ensures your engagement letters reflect expertise, regulatory compliance, and professional quality turning them into a competitive differentiator that strengthens client relationships while protecting your practice.

The choice is clear: continue struggling with inadequate solutions or embrace automation designed specifically for accounting practices.