You’ve tried three different AML software in the past two years.

The first promised comprehensive compliance but couldn’t handle beneficial ownership verification properly. The second integrated poorly with your existing systems and created more administrative work. The third looked perfect in demos but proved clunky in daily use.

Now you’re sceptical of vendor promises and tired of implementation projects that disrupt operations without delivering results.

What you need is the best AML software that handles verification accurately, delivers great client experiences and maintains reliable compliance documentation. No gimmicks, no feature overload, just solid compliance infrastructure.

FigsFlow delivers exactly that for accounting practices navigating AML requirements in 2025.

What Makes Any AML Software "the Best" in 2025

Before naming names, it’s worth cutting through the marketing noise and focusing on what truly matters when choosing the best AML software for your firm.

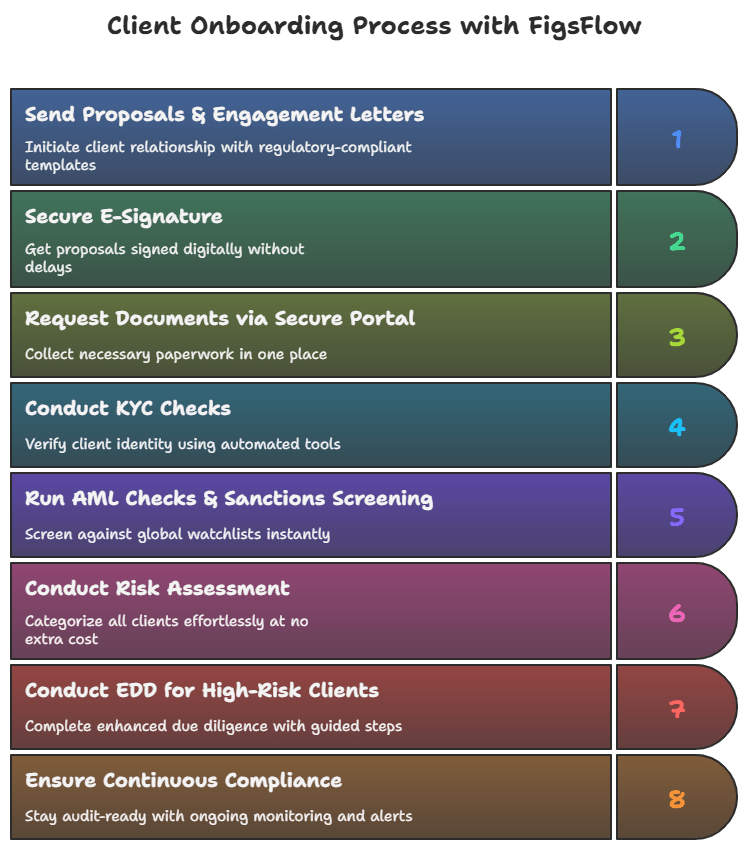

- Complete & Connected Workflow – The best AML software supports every stage of compliance. It brings KYC checks, sanctions screening, risk assessments, document collection and ongoing monitoring together in one connected system. This removes the need to switch between platforms or re-enter data.

- Built Around the Way Accountants Work – A strong AML tool integrates smoothly with your practice management and onboarding systems. Client information moves naturally from proposal to engagement letter to compliance review. It also allows flexibility in client communication, whether through secure online links or traditional email, so the process works for every type of client.

- Practical, Risk-Based& Easy for Teams to Use – The best AML software reflects how accounting firms actually operate. Risk assessments are built around your client types rather than banking models. The system supports collaboration between team members, provides transparency, and makes it easy for new staff to get up to speed.

- Intelligent Automation & Fair Pricing – Routine tasks such as completing Know Your Customer and Anti-Money Laundering screenings and reminders should happen automatically while key decisions remain under your control. Pricing should be predictable and fair, scaling sensibly as your firm grows without unnecessary costs.

Most AML tools in the market miss these principles. They either serve large financial institutions with complex structures or focus on a single piece of the puzzle. The best AML software for accountants in 2025 is designed around real accounting workflows, combining end-to-end coverage, team usability, automation and value in one cohesive solution.

Why Generic AML Software Falls Short for Accountants

Most AML solutions weren’t designed for accounting practices. They were built for banks, financial institutions or compliance departments within large corporations. Then vendors adapted them for accountants and called it a solution.

That’s why the problems show up immediately.

- Banking Workflows Don’t Translate to Accounting – Bank AML systems focus on transaction monitoring, account opening procedures and payment screening. Accountants need client onboarding workflows that connect to proposals, engagement letters and service delivery. You’re forced to work around features designed for different business models. Risk assessment questions ask about account types and transaction volumes instead of client structures and service engagements. The systems assume you’re screening transactions, not onboarding professional service clients.

- Fragmented Tools Create Coordination Nightmares – Some vendors offer excellent identity verification but no sanctions screening. Others handle screening perfectly but can’t manage risk assessments. A third tool stores documents but doesn’t connect to either verification or screening systems.

You end up managing three separate subscriptions, three different logins and three sets of client data that don’t synchronise. Client information gets entered manually into each system. Compliance status lives in spreadsheets because no single platform shows the complete picture.

The coordination overhead defeats the purpose of automation.

- Integration Promises Rarely Deliver – Vendors claim their software integrates with practice management systems. But what they mean is you can export a CSV file from one system and import it into another. That’s not integration. That’s manual data transfer with extra steps.

Real integration means client data flows automatically. Verification status appears alongside engagement letters. Risk assessments connect to client records. Compliance documentation lives where you actually manage clients.

Generic AML solutions sit in separate portals that your team accesses occasionally, not within the systems they use daily.

- Pricing Models Penalise Growth – Per-check pricing sounds reasonable until you scale. Onboarding 50 clients costs one amount. Onboarding 150 clients triples your compliance costs. Growth becomes expensive instead of profitable.

Some vendors charge per user, per client, per check, and per month. The pricing structure requires a spreadsheet to understand. You can’t predict annual costs because they fluctuate with every new client and team member.

This unpredictability makes budgeting difficult and creates hesitation about taking on new clients.

- One-Size-Fits-All Risk Assessments Miss the Mark – Generic questionnaires ask questions relevant to retail banking customers. They don’t reflect the clients accountants actually serve: property portfolios, trusts, partnerships, limited companies and the like.

You’re adapting generic templates to fit accounting engagements, which defeats automation’s purpose. Or you’re asking clients irrelevant questions that confuse them and make your process look unprofessional.

Purpose-built solutions understand accounting client types from the start and ask relevant questions without customisation.

This is why accountants who’ve tried multiple AML tools remain frustrated. The solutions technically work but don’t fit how accounting practices actually operate. They create administrative burden instead of eliminating it.

FigsFlow's Approach to AML Compliance

FigsFlow unifies every stage of AML compliance into a single, intuitive workflow that mirrors how accounting practices operate.

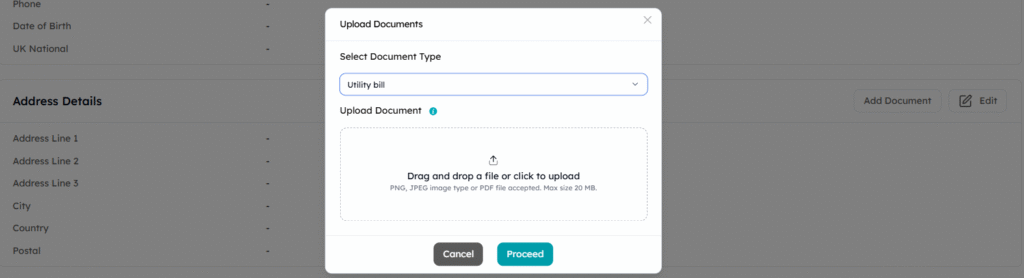

The process starts with client verification, collecting and confirming identity and address documents via email or a secure portal. Once verified, the details are added to the client record, creating a clear foundation for compliance.

Clients are then screened against global sanctions lists, adverse media, and government databases to ensure regulatory requirements are met. The system generates clear compliance reports, making review straightforward and reducing manual effort.

Risk assessments are tailored to each client type, allowing junior staff to gather information while senior staff assign the final rating. Based on this rating, the appropriate level of due diligence (CDD and EDD) is performed, whether simplified, standard or enhanced. Additional documentation can be requested as needed, ensuring the process remains consistent and policy-driven.

Deep Dive into FigsFlow's AML Features

Now let’s explore exactly how each feature works in practice and why the approach matters for your day-to-day operations.

How FigsFlow Simplifies KYC Verification

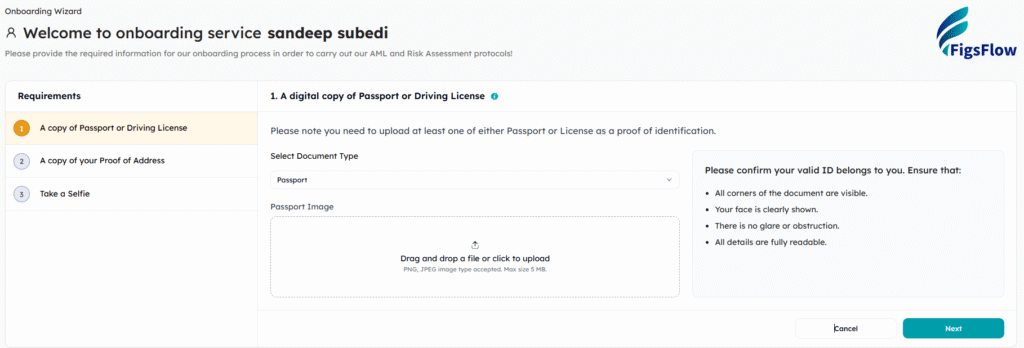

FigsFlow offers three ways to collect client documents: a TrustID link, a FigsFlow portal email link or a direct document request. This flexibility might seem small, but it solves real challenges you face every day.

Tech-savvy clients, like property investors, can use the TrustID link to quickly submit their details from their phones. Traditional clients, such as long-term sole traders bringing in new partners, benefit from the structured guidance of the FigsFlow portal link. Clients who prefer email can send documents directly, keeping communication simple while you maintain organised records.

Currently, client details must be entered manually from documents. Soon, this will be automated, and data such as name, date of birth, address and document information will populate the client record automatically, saving time and reducing errors.

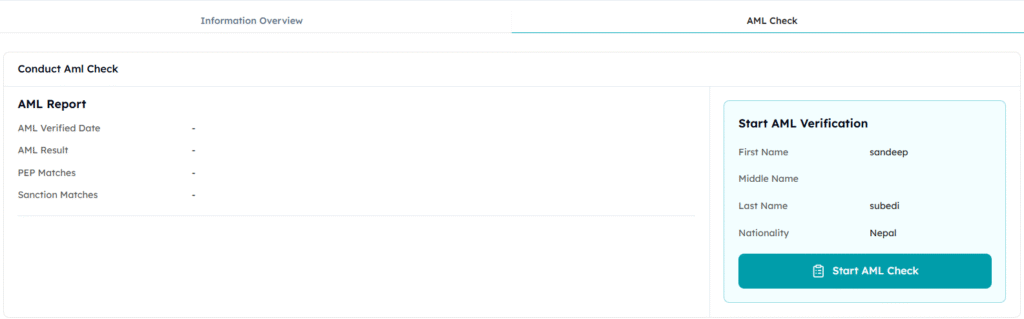

How FigsFlow Simplifies AML & Sanctions Screening

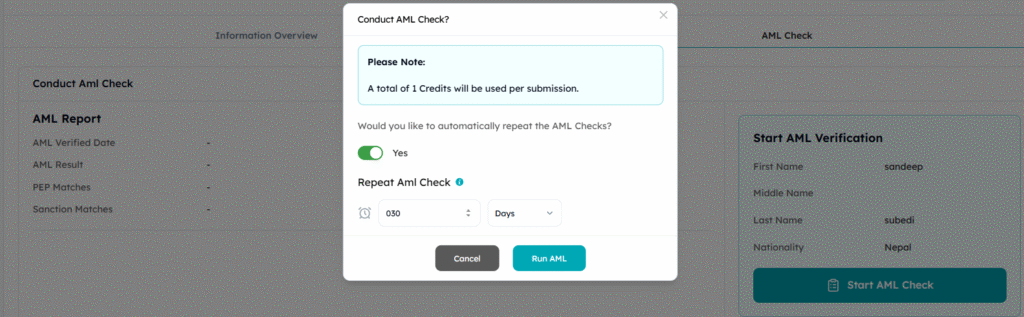

Once all client data is collected through KYC or earlier processes, you can request an AML check. You have the option to run it as a one-time check or schedule automated repeat checks at custom intervals.

After the check is completed, you receive a comprehensive AML report highlighting any potential risks or matches.

Behind the scenes, FigsFlow screens client information across vast databases, including global sanctions lists, politically exposed persons lists, media sources and other relevant regulatory data. This ensures a thorough view of potential financial crime or reputational risks without extra effort from your team.

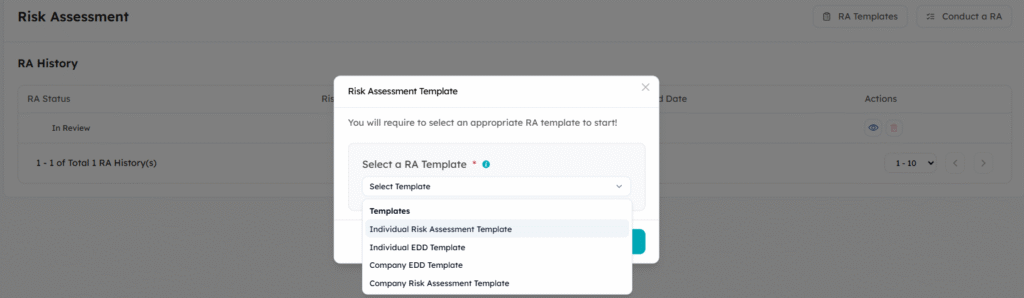

How FigsFlow Simplifies Risk Assessments

FigsFlow replaces generic AML templates with workflows built specifically for accounting practices.

You begin by selecting the appropriate template based on the client’s KYC and AML information, such as property portfolio, trust or trading business. Each template is purpose-built and tested in real accounting environments, ensuring that every question is relevant and easy to complete.

You then answer a series of yes or no and descriptive questions, attach the necessary supporting documents and submit the assessment for review.

A senior reviewer evaluates the submission, reviews the AML results, assigns the correct risk level (Low, Medium or High), and approves it. If required, they can carry out another assessment using a different template.

Every stage of the process, including who completed it, who reviewed it and what decisions were made, is automatically recorded to create a full audit trail.

This makes risk assessment in FigsFlow clear, structured and fully aligned with how accounting teams actually work.

How FigsFlow Simplifies Documentation Management

Once the client’s risk level is determined, your team identifies what supporting documents are needed and request the appropriate files through FigsFlow’s secure portal. Clients can upload everything safely and directly into the system.

For example, a high-risk client might be asked for bank statements, sale agreements or proof of source of funds. A trust client may need to provide trust deeds, identification of trustees and beneficiaries and evidence of source of wealth. For a low-risk trading business, standard ID and address verification may be enough.

All uploaded documents are stored neatly within the client’s profile alongside their AML results and risk assessment. Everything sits in one organised space, making it easy for your team to find the right information when needed and maintain complete and compliant records.

How FigsFlow Simplifies Ongoing Monitoring

FigsFlow automates AML checks at intervals you set.

It reviews sanctions lists, PEP lists and client ID documents to detect changes or suspicious activity. High-risk updates are flagged immediately so you can review them without manually tracking information.

Alerts provide relevant details, allowing you to document your response and update the client record. Your actions are stored in the file, keeping compliance current and creating a clear audit trail.

A wide range of additional features for ongoing monitoring is in development. These will further enhance how your firm tracks and manages client risk, making monitoring more comprehensive and integrated into your existing workflow.

What Does FigsFlow Cost?

FigsFlow’s AML module is live now, and pricing details can be obtained by calling the FigsFlow team. But you can rest assured that FigsFlow is the most cost-effective AML solution for accounting firms, designed to help small and medium practices thrive without draining budgets.

Most accounting practices underestimate their true AML costs. Between juggling multiple subscriptions, staff time coordinating systems and regulatory risk exposure, firms easily spend £3,000 to8,000 annually on AML compliance. What’s worse, they’re draining precious time on unproductive administrative work instead of serving clients.

But with FigsFlow, that’s going to change once and for all.

FigsFlow is the best AML software to consolidates everything into a single workflow:

Initial Proposal & Engagement Letter → KYC Verification → AML Screening → Risk Assessment → Client Risk Rating → CDD & EDD → Ongoing Monitoring.

All this within one integrated platform.

You eliminate multiple vendor subscriptions. Manual data entry disappears. Coordination time vanishes. Compliance errors decrease because information flows automatically. Faster client onboarding means faster revenue recognition. Predictable pricing means you can scale confidently without surprise costs.

So, the question is not just what FigsFlow costs, but what your firm saves. Time, subscriptions, errors, regulatory risk and headcount pressures are all reduced. Efficiency gains alone make the best AML software platform pay for itself while delivering a comprehensive, streamlined AML compliance infrastructure.

Why FigsFlow Is the Best AML Software for Accountants in 2025

FigsFlow delivers complete AML compliance in a single integrated platform. No other software handles the entire client lifecycle from proposals and engagement letters to KYC verification, AML screening, risk assessment, and ongoing monitoring within one unbroken workflow.

Here’s what makes FigsFlow stand out:

- Complete End-to-End Workflow – From proposals and engagement letters through KYC verification, AML screening, risk assessment, CDD and EDD, to ongoing monitoring. Other AML tools handle one or two pieces, leaving you to coordinate between multiple platforms. FigsFlow eliminates the juggling act entirely.

- Purpose-Built for UK Accounting Practices – Risk assessment questionnaires reflect the clients accountants actually serve: property portfolios, trusts, partnerships, limited companies. The workflow mirrors how practices operate, with junior staff gathering information and senior staff making risk decisions.

- Intelligent Automation with Professional Control – The system handles verification checks, sanctions screening, documentation prompts, and file organisation. But control stays with your professional judgment. You decide risk levels and client acceptance based on organized, complete information.

- Most Affordable Yet Reliable – At just £16/month base (£8 for proposals + £8 for AML) plus £2.10 per verification check, FigsFlow costs a fraction of standalone AML tools charging £60-£80 per check or £200+ monthly subscriptions. Plus, the risk assessment module is completely free. For practices onboarding 20 clients annually, your total cost is under £300/year.

FigsFlow is the only AML solution combining end-to-end compliance, intelligent automation, and accountant-focused design at a price that makes sense for practices of every size.

That’s why FigsFlow is the best AML software for accountants in 2025.

Conclusion

AML compliance isn’t getting simpler. Regulatory expectations continue rising, verification requirements become more detailed, and penalties for gaps grow steeper.

Choosing the best AML software determines whether compliance strengthens your practice or drains your resources. Generic solutions force you to coordinate between multiple platforms. Banking-adapted tools don’t understand accounting workflows. Fragmented systems create administrative burden instead of eliminating it.

FigsFlow stands apart as the best AML software for accountants in 2025 because it consolidates everything: proposals, engagement letters, KYC verification, AML screening, risk assessment, and ongoing monitoring within one integrated platform purpose-built for UK accounting practices.

Your team stops juggling multiple vendors. Your clients experience seamless professional onboarding. Your practice maintains comprehensive compliance without excessive manual work.

The difference between struggling with AML and managing it confidently comes down to having the right infrastructure.

Try FigsFlow free and see why it’s the best AML software for accounting practices in 2025.