In 2024 alone, the Financial Conduct Authority (FCA) issued over £176,045,385 in fines for breaches of anti-money laundering (AML) rules. Surprisingly, most of these penalties weren’t for firms involved in serious money laundering or terrorist financing. Instead, they were imposed on firms that simply failed to meet basic AML requirements or struggled to keep up with the constantly evolving regulations.

To be fair, it’s not entirely their fault. UK AML rules are constantly changing, with nearly a dozen new changes expected on the horizon. Still, as accountants, we can’t afford to overlook compliance.

In this post, we’ll break down the key AML updates for 2025 and beyond and show you how to stay compliant with ease. Stick around until the end for a bonus tip that makes keeping up with regulatory changes far easier.

Let’s kick things off with the changes to enhanced DAML/SAR reporting thresholds, effective 31 July 2025.

Enhanced DAML/SAR Reporting Thresholds

From 31 July 2025, the threshold for submitting a Defence Against Money Laundering (DAML) Suspicious Activity Report (SAR) has increased from £1,000 to £3,000. This change applies to:

- Deposit-taking bodies

- Electronic money institutions

- Payment institutions

This is the third increase in recent years, following the rise from £250 to £1,000 in January 2023. The aim is to reduce the volume of low-value DAMLs and allow law enforcement to focus on more serious cases.

Accounting firms must respond to this change by updating their AML policies, training staff on the new threshold, and adjusting transaction monitoring systems to reflect the change.

Introduction of Authorised Corporate Service Providers (ACSPs)

From 18 March 2025, individuals and organisations can register as Authorised Corporate Service Providers (ACSPs) with Companies House. By Spring 2026, registration will be mandatory for any agent filing on behalf of clients.

Companies House estimates up to 50,000 businesses will register as an ACSP within the first 12 months. This marks a major shift in how corporate services are delivered in the UK.

The ACSP regime increases accountability by ensuring all third-party providers are properly supervised and traceable. To register for ACSP, firms must be under AML supervision by one of the UK’s 25 recognised supervisory bodies and pay a £55 registration fee.

Importantly, ACSPs carry enhanced liability. Companies House will record who verified each individual and the original verifier may be held responsible if false documents are later discovered.

Mandatory Digital Filing Requirements

Starting 1 April 2027, the UK will require all companies, regardless of size, to submit digital accounts, including profit and loss statements, using digital software. This change aims to modernise and digitalise the filing process and enhance security and efficiency.

It will also remove previous distinctions between micro, small and large entities, and mark the end to abridged and filleted accounts.

For accountants, this shift requires the following immediate action:

- Upgrade systems to handle full digital submissions and expanded data requirements

- Train staff on new filing procedures and compliance expectations

- Review fee structures to reflect the increased workload across all client types

Enhanced Due Diligence for High-Risk Jurisdictions

The UK has strengthened its AML rules by requiring Enhanced Due Diligence (EDD) and ongoing monitoring for any client or transaction linked to a High-Risk Third Country (HRTC). These countries are listed by the Financial Action Task Force (FATF) and updated three times a year.

The obligations apply to both new and existing clients who are:

- Incorporated or resident in an HRTC

- Involved in transactions with parties based in an HRTC

Firms must take a risk-based approach, but the minimum EDD steps include:

- Collecting detailed information about the client and beneficial owners

- Verifying the source of funds and the source of wealth

- Understanding the nature and purpose of the relationship

- Getting senior management approval before proceeding

- Applying enhanced monitoring throughout the relationship

Accounting practices should now review and update their risk assessment frameworks, especially for clients with international links. Screening tools must be able to flag HRTC connections, and Staff should be trained to apply EDD measures proportionately.

Updated Guidance on Politically Exposed Persons (PEPs)

The Financial Conduct Authority’s publication of final guidance on 7 July 2025 introduces a more balanced approach to handling Politically Exposed Persons (PEPs).

Firms are now expected to treat UK-based (domestic) PEPs as lower risk by default, unless there are other unrelated risk factors. This means automatic Enhanced Due Diligence (EDD) is no longer required for domestic PEPs unless justified by specific risks.

The guidance also clarifies that non-executive board members of UK civil service departments should not be treated as PEPs, resolving previous uncertainty.

Accounting firms must now:

- Update PEP identification procedures to reflect a new risk-based approach

- Train staff to distinguish between domestic and foreign PEPs

- Review existing client files to identify domestic PEPs previously subject to unnecessary EDD

- Revise client communication materials to explain the updated treatment of PEPs

These changes aim to reduce disproportionate treatment while maintaining effective AML controls. Firms should document their rationale when deviating from standard guidance and ensure senior Staff are trained to approve PEP relationships appropriately.

Economic Crime Threat Priorities & Other Key Changes

The National Crime Agency (NCA) and Financial Conduct Authority (FCA) published 9 economic crime priorities to help regulated firms focus resources. These priorities highlight key areas of concern, including:

- Cash-based money laundering

- Money mule exploitation

- Fraud linked to overseas jurisdictions

With an estimated £100 billion laundered through the UK annually, this framework is designed to guide firms in allocating resources to the most pressing risks.

In addition to these strategic priorities, several other regulatory updates have been introduced.

- Trust Registration Service (TRS) – All non-UK trusts that acquired UK property before 6 October 2020 must now register with HMRC if they meet certain conditions, such as having a UK-resident trustee or entering into a business relationship with a UK entity.

- Fit & Proper Persons Test – The annual premises fee for AML-supervised businesses has increased from £300 to £400. Each beneficial owner, officer or manager (BOOM) must pay a non-refundable test fee, which is specific to the business and non-transferable.

Together, these changes signal a stronger regulatory push to improve transparency, accountability, and risk management across the financial and professional service sectors.

Summary Table of UK AML Rules

| Change | Effective Date | Key Impact |

|---|---|---|

| DAML/SAR Threshold Increase | 31 July 2025 | Threshold raised to £3,000; update policies and training |

| ACSP Registration Launch | 18 March 2025 | Optional registration; mandatory from Spring 2026 |

| Mandatory Digital Filing | 1 April 2027 | All accounts must be filed via commercial software |

| EDD for High-Risk Jurisdictions | Ongoing (Reg. 33 MLRs) | Compulsory EDD of clients linked to FATF-listed countries |

| FCA PEP Guidance | 7 July 2025 | Domestic PEPs treated as low risk; update procedures and communications |

| Economic Crime Priorities (NCA/FCA) | 21 July 2025 | Focus on cash laundering, money mules, and overseas fraud |

| Trust Registration (TRS) | Ongoing | Non-UK trusts with UK links must register with HMRC within 90 days |

| Fit & Proper Test Fee Increase | 31 July 2025 | Premises fee: £400; Test fee: £700 (currently under consultation until 29 August 2025) |

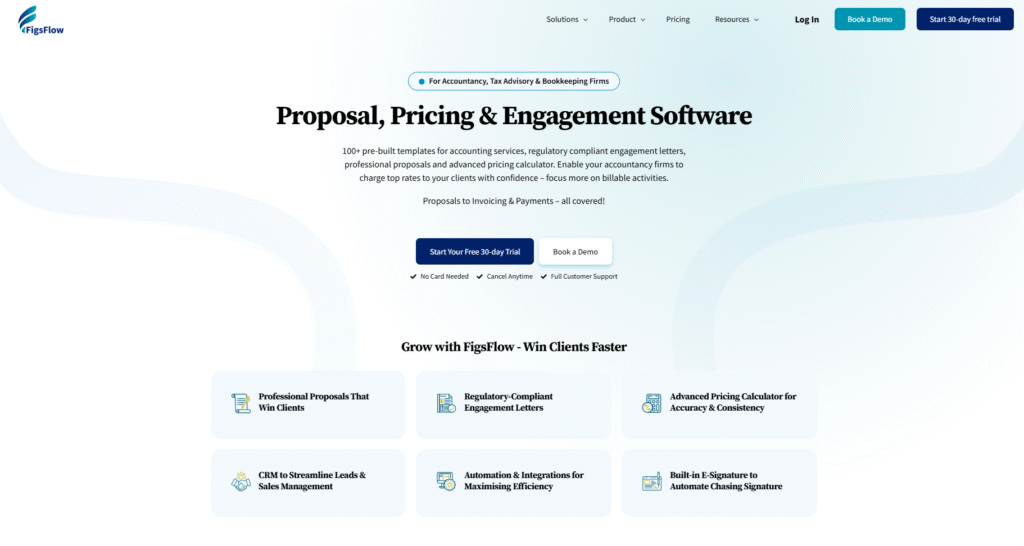

Simplify AML Compliance with FigsFlow

AML rules are constantly changing and keeping up is quite hard. That’s why FigsFlow includes integrated AML compliance directly within its client onboarding workflow.

FigsFlow is your all-in-one onboarding platform that handles proposals, engagement letters, service pricing, client onboarding, KYC, ongoing monitoring and full AML checks from one place.

Here’s what FigsFlow AML delivers:

- Verify client identities digitally using industry standard technology that checks documents against comprehensive databases

- Screen clients automatically against global sanctions lists, PEP databases and adverse media

- Automated KYC and client risk assessments using purpose-built templates designed for accounting practices

- Enhanced Due Diligence for high-risk clients and jurisdictions with scheduled automated checks at custom intervals

- Secure record-keeping with full audit trails and automatic timestamps for every compliance action

- Compliance reporting ready in just a few clicks

FigsFlow delivers enterprise-level AML capabilities at a price you’d have never imagined. While other solutions charge premium prices for standalone AML tools, FigsFlow gives you complete compliance plus proposals, engagement letters, pricing and client onboarding in one accountant-centric workflow. It’s the most affordable AML solution in the market without compromising on features, yet simple enough for anyone on your team to use from day one.

Ready to simplify your AML compliance? Try FigsFlow free for 30 days and experience how fast regulatory compliance can actually be.

Conclusion: Navigate the UK AML Rules with Confidence

There’s no doubt that AML rules are changing fast. The DAML threshold has jumped from £1,000 to £3,000, FCA PEP guidance is now in play, and several more reforms, like mandatory ACSP registration and digital filing are on the horizon.

Relying only on Companies House newsletter or tracking updates manually is the old way of doing things, and in today’s competitive accounting landscape, it simply won’t cut it.

You need an advanced system like FigsFlow that helps you stay compliant in minutes while automating your entire workflow from proposals and client onboarding to AML checks, work delivery and routine communication.

To see how this works in practice, check out our next blog on automating client onboarding with FigsFlow.