“This template isn’t worth the paper it’s printed on.”

That’s what Marcus Chen’s solicitor told him after a client dispute cost him £12,000. Like thousands of UK accountants, Marcus had downloaded a professional-looking engagement letter template late one night, customised the header, and assumed he was covered.

Marcus isn’t alone. Across the UK, accounting professionals are learning expensive lessons about inadequate engagement letters, from regulatory penalties for missing MLR 2017 requirements to thousands in legal fees trying to recover unpaid invoices.

But getting your engagement letters right doesn’t require a law degree. With the right structure and attention to regulatory requirements, you can protect your practice and demonstrate professionalism.

What is an Engagement Letter?

An engagement letter is a formal written agreement between an accounting professional and a client that establishes the foundation of the working relationship. Think of it as a roadmap that guides both parties through the engagement, clearly defining what will be delivered, when, how much it costs, and what happens if things don’t go according to plan.

For UK accountants, bookkeepers, and tax advisers, engagement letters serve a dual purpose.

- First, they prevent misunderstandings and scope creep.

- Second, engagement letter demonstrate compliance with professional body standards and Anti-Money Laundering regulations.

The power lies in specificity. A properly drafted letter doesn’t just say “we’ll prepare your accounts.” It defines exactly which periods, which entities, what format, what deadlines, what information the client must provide, and what happens if they don’t.

Many practitioners confuse engagement letters with proposals or contracts, but they’re distinct. An engagement letter formalises an agreement after the client has decided to work with you, focusing on the specific engagement rather than general terms.

Key Elements of an Engagement Letter

Every comprehensive engagement letter should include these eight fundamental components:

-

Introduction and Purpose

Identifies all parties involved, states the date, and clearly expresses the purpose of the engagement with specific periods or deadlines.

-

Scope of Services

Defines exactly what you will and won't do. Be specific: "Monthly bank reconciliation for three nominated accounts" rather than vague "bookkeeping services."

-

Timeline

Specifies start dates, interim deliverables, final deadlines, and dependencies such as "Accounts prepared within 10 working days of receiving complete records."

-

Compensation

Details your fee structure, payment terms, late payment charges, and expenses. Include how fees might change if scope increases.

-

Confidentiality

Addresses how you'll handle client information, GDPR compliance, data storage, and circumstances requiring legal disclosure such as money laundering reporting.

-

Termination

Defines conditions for ending the engagement, notice periods, circumstances allowing immediate termination, and how work in progress will be handled.

-

Limitation of Liability

States the extent and limitations of your liability, such as capping liability at fee value or excluding consequential losses.

-

Regulatory Compliance Requirements

Documents obligations under Money Laundering Regulations 2017, professional body standards, client identification requirements, and the client's duty to provide accurate information.

Why is an Engagement Letter Important?

Nothing kills new client excitement faster than document chaos three months into an engagement.

Here’s why engagement letters are essential:

-

Clarity and Transparency

Engagement letters eliminate ambiguity that destroys client relationships. When expectations are documented upfront, both parties know exactly what success looks like and what they're paying for.

-

Professionalism

A comprehensive, well-structured engagement letter signals competence and attention to detail. It demonstrates you understand professional standards and operate systematically, which matters to both clients and regulators.

-

Legal Protection

Engagement letters provide critical evidence if disputes escalate. Courts generally uphold well-drafted letters, protecting you from non-payment disputes, professional negligence claims, and scope disagreements.

-

Scope Creep Prevention

When clients request work outside the defined scope, you can refer to the letter and explain that additional services require separate agreements. This isn't confrontational, it's professional.

-

Regulatory Compliance

For UK accountants, engagement letters aren't optional. They demonstrate compliance with Money Laundering Regulations 2017, professional body standards (ICAEW, ACCA, CIOT), and HMRC supervision requirements.

-

Client Relationship Management

Well-structured letters set expectations that create satisfied clients, facilitate smooth onboarding, and establish professional boundaries. Clear terms from the start lead to better referrals and practice growth.

How to Write Good Engagement Letters

Effective engagement letters start with specificity. Define exactly what you’ll deliver, including which periods, entities, formats, and deadlines. State your fee structure completely and document limitations explicitly. If tax planning isn’t included, say so clearly.

Write in language clients actually understand. Replace legal jargon with plain English, keep sentences short, and use headings for readability. Customise each letter for the client’s industry and circumstances. This shows attention to detail and makes clients feel valued rather than processed through a generic system.

Update your letters regularly to reflect regulatory changes and lessons learnt. Set an annual review schedule and invest in legal advice for limitation of liability clauses and termination terms. Professional review can prevent costly disputes down the road.

Common Mistakes in Engagement Letters (And How to Avoid Them)

Even experienced practitioners fall into these traps. Recognising them helps you avoid costly errors. Here are the most common mistakes and their solutions:

| Mistake | Solution |

|---|---|

| Vague Scope Language | Define every deliverable, report, and meeting explicitly. List what's included and excluded. Avoid open-ended phrases like "general accounting support." Attach a detailed schedule listing specific deliverables with timing. |

| Missing Termination Clauses | Specify notice periods (typically 30 days). Address immediate termination circumstances like non-payment. Explain what happens to work in progress and who owns the work papers. |

| Inadequate Limitation of Liability | Define who can rely on your work. Cap liability reasonably and exclude consequential losses. Have liability language reviewed by your solicitor and professional indemnity insurer. |

| Forgetting Regulatory Compliance | Include Money Laundering Regulations requirements, client identity verification, and risk assessment. Reference professional body membership. Address GDPR explicitly covering data collection, storage, and retention. |

| Using Generic Templates | Customise extensively. Remove irrelevant sections and add client-specific clauses. Build templates based on your actual client base and services. |

| Not Updating for Service Changes | Create new engagement letters before offering new services. Review existing client letters annually. Document all service changes in writing. |

| Ambiguous Fee Structures | State exact fees (fixed amount or hourly rates by staff level). Explain what triggers fee changes. Include payment terms, disbursements policy, and annual fee review clause. |

What Does an Engagement Letter Look Like?

Instead of describing what an engagement letter should contain, let us show you one. Below is an engagement letter created by FigsFlow.

Details:

FigsFlow is sending this engagement letter to Crane & Partners for LLP accounts and tax return services.

Engagement Letters vs Contract vs Proposal: What is the Difference?

Many practitioners confuse engagement letters with contracts and proposals, but they serve distinct purposes in the client relationship. Understanding these differences helps you use each document appropriately and at the right time.

| Element | Engagement Letters | Contracts | Proposals |

|---|---|---|---|

| Purpose | Confirms terms of an agreed working relationship after the client decides to work with you. | Creates legally binding obligations with specific performance requirements for complex engagements. | Presents services and pricing to persuade prospects to become clients. |

| Timing | Used after client agreement, before work commences. | Used when legally binding formality is required for complex or high-value work. | Used early in the sales process before any agreement. |

| Legal Status | May be legally binding depending on jurisdiction. Serves as evidence of agreed terms. | Always legally binding and enforceable in court. | Not legally binding. Forms basis for negotiation. |

| Tone | Professional and balanced, establishing partnership expectations. | Formal and precise, focusing on legal obligations. | Persuasive and value-focused, highlighting benefits. |

| Length | Typically 5-10 pages covering essential engagement terms. | Can be 20+ pages with detailed legal clauses. | Usually 10-20 pages combining persuasion, scope, and pricing. |

| Flexibility | Moderate. Can be amended by mutual written agreement. | Low. Amendments require formal variation agreements. | High. Easily revised during negotiation. |

| Audience | Both parties on equal footing after relationship is agreed. | Both parties with emphasis on legal protection. | Prospect-focused, designed to convince and convert. |

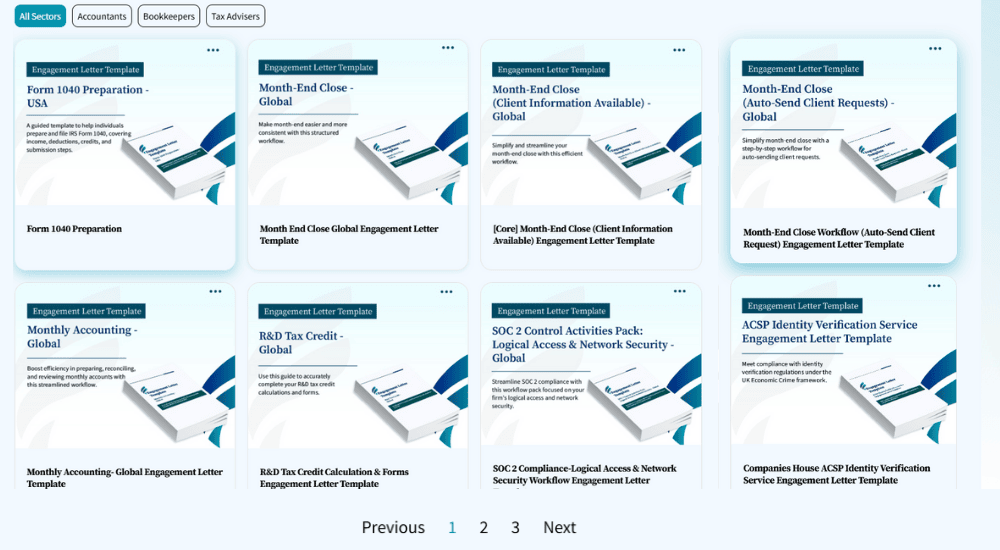

Free Engagement Letter Templates

We’ve created engagement letter templates ranging from statutory accounts and tax returns to bookkeeping and advisory services for accountants, bookkeepers, and tax advisers. All templates are fully compliant with UK and global accounting standards and professional accounting bodies including ICAEW, ACCA, AAT, and CIOT. Best of all, they’re completely free, downloadable, and customisable to suit your practice needs.

Let’s look at free engagement letter templates for accountants, tax advisers, and bookkeepers.

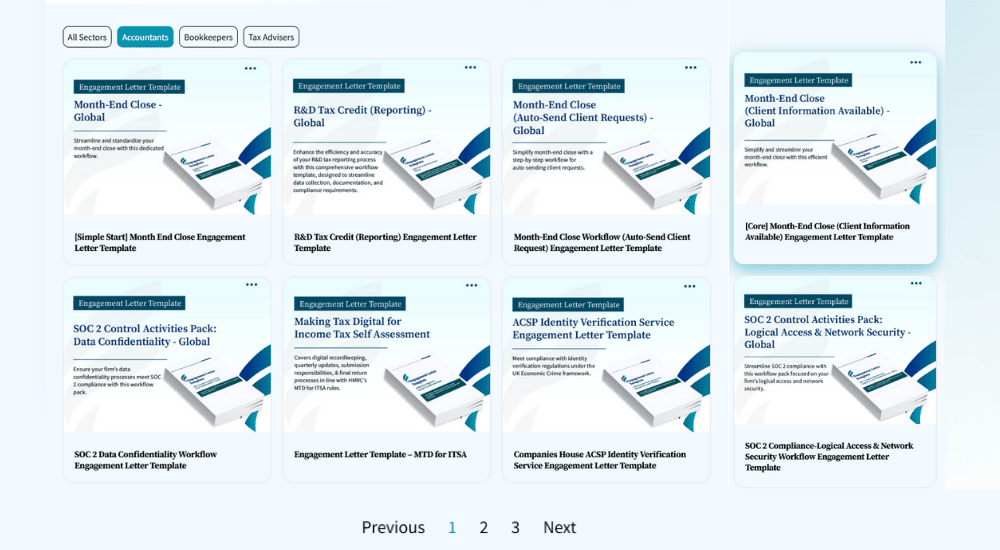

Free Engagement Letter Templates for Accountants

Our accounting engagement letter templates cover a comprehensive range of services including statutory accounts preparation, management accounts, virtual FD services, group accounts, charity accounts, and dormant company accounts. Each template includes essential regulatory compliance requirements, MLR 2017 provisions, professional body standards, clear scope definitions, fee structures, and limitation of liability clauses. Templates are designed to be specific enough to prevent scope creep whilst remaining clear and client-friendly.

Access Free Accounting Engagement Letter Templates

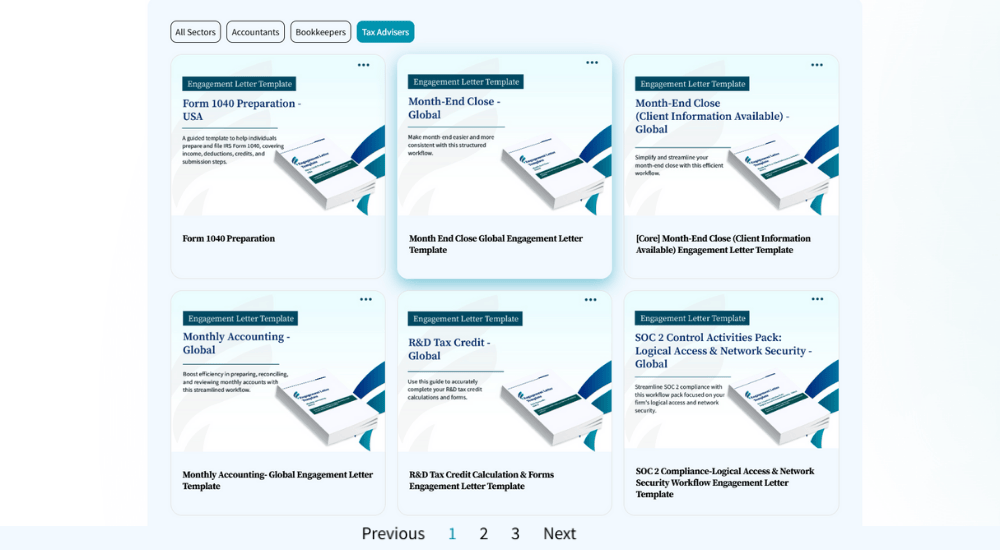

Free Engagement Letter Templates for Tax Advisers

Our tax advisory engagement letter templates include comprehensive coverage for personal tax returns, corporate tax returns, VAT returns, R&D tax credits, Making Tax Digital compliance, tax planning, and HMRC enquiry support. Each template addresses specific tax compliance requirements, HMRC deadlines, client information requirements, and the critical distinction between compliance work and advisory services. Templates include appropriate limitation clauses for tax advice and clear scope boundaries to prevent disputes.

Access Free Tax Advisory Engagement Letter Templates

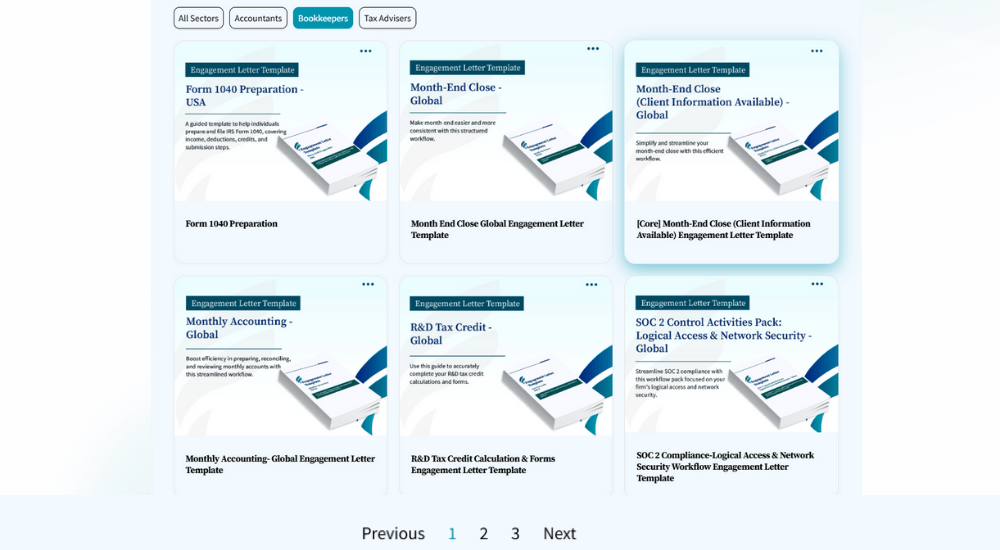

Free Engagement Letter Templates for Bookkeepers

Our bookkeeping engagement letter templates provide detailed scope definition for ongoing operational work including transaction processing, bank reconciliation, invoice management, VAT return preparation, payroll processing, and month-end procedures. Templates clearly define which accounts you’ll manage, reporting frequency, software requirements, client responsibilities for providing timely information, and what happens when information is delayed. Each template includes appropriate professional standards for bookkeepers and AAT members.

Access Free Bookkeeping Engagement Letter Templates

How Often Should You Update Engagement Letters?

Static engagement letters become obsolete quickly. Regular updates keep them effective and protective.

Set an annual review each summer to check all templates. Look for regulatory changes including Money Laundering Regulations, professional body standards, and MTD requirements. Update fee structures before signing new clients and tighten any ambiguous language that’s caused disputes during the year.

Some changes can’t wait for annual reviews. GDPR implementation and MTD rollout both required immediate updates. Professional body standard changes and anti-money laundering supervision updates also need prompt attention.

Launching a new service? Create an engagement letter template before signing your first client. When client circumstances change substantially, like sole traders incorporating or businesses adding entities, issue amended engagement letters documenting the new scope and fees.

Good version control matters. Date every template, store old versions, and document what changed in each update. This helps you know exactly what terms applied to clients signed in previous years.

Helpful Resources to Create Engagement Letters

- Create a Client-Winning Accounting Proposal (Free Templates Included) : Create Client-Winning Accounting Proposal (Free Template Included) | FigsFlow

- Master ACCA Compliant Engagement Letter in Less than 15 Minutes: What is an ACCA-Compliant Engagement Letter | FigsFlow

- Automate Regulatory Compliant & Professional Looking Engagement Letter with FigsFlow: Stop Wasting Hours: Automate Engagement Letters with FigsFlow

- Here’s the Reason You Probably Need Engagement Letter Templates As an Accountant: The Secret Weapon Smart Accountants Use: Engagement Letter Templates | FigsFlow

- Discover Engagement Letter Software Features for Accountants: Top Engagement Letter Software Features for Accountants | FigsFlow

Conclusion

Engagement letters protect your practice from scope disputes, fee arguments, regulatory failures, and costly relationship breakdowns.

Without them, you’re exposed. With comprehensive letters customised to each client, you create clear expectations that prevent problems before they start.

The difference between adequate and excellent engagement letters comes down to specificity, regular updates, and attention to regulatory requirements.

If your letters use vague scope language, haven’t been updated since MLR 2017, or rely on generic downloaded templates, start fixing them today. Review your templates against the best practices covered here. Add missing sections. Clarify ambiguous terms. Document regulatory obligations.

Frequently Asked Questions (FAQs)

An engagement letter is a formal agreement between an accounting professional and their client that defines the working relationship. It outlines the services to be provided, fees, timelines, responsibilities, and terms including confidentiality, termination, and limitation of liability.

Include an introduction identifying both parties, detailed scope of services, timeline and deadlines, fee structure and payment terms, confidentiality provisions, termination clauses, limitation of liability, and regulatory compliance requirements. Each section should be specific rather than vague to prevent disputes.

Start with your firm’s details and client information, then define the scope of services precisely. Include timeline, fees, payment terms, confidentiality clauses, termination conditions, limitation of liability, regulatory compliance requirements, and signature blocks. Customise each letter for the specific client and service rather than using generic templates.

Engagement letters establish clear expectations between accounting professionals and clients, preventing scope disputes and fee arguments. They provide legal protection if disagreements arise, demonstrate regulatory compliance with professional body standards and Money Laundering Regulations, and create professional boundaries that protect sustainable practice operations.

A proposal is a persuasive document sent early in the sales process to convince prospects to become clients, whilst an engagement letter is a formal agreement sent after the client decides to work with you. Proposals focus on benefits and value, whilst engagement letters define legal terms, scope, and obligations.