- Fast & Secure Client Verification

Companies House ID Verification: The £2.10 Professional Solution

You can streamline identity verification of your clients using FigsFlow, the UK’s most affordable, automated identity verification platform for accountants, bookkeepers and tax advisers.

- No Card Needed

- Cancel Anytime

- Full Customer Support

- Identity Verification in Minutes

Why FigsFlow is the Top Choice to Carry Out Identity Verification

From 18 November 2025, identity verification is a mandatory legal requirement under the Economic Crime and Corporate Transparency Act (ECCTA). While GOV.UK offers a free route for individuals, FigsFlow provides an organised and systematic platform that all but eliminates errors.

Unbeatable Pricing

At just £2.10 per check, we are the UK's most cost-effective provider for bulk professional verifications.

Automated Workflow

We handle the end-to-end process using IDVT (Identity Document Validation Technology) to validate cryptographic features of biometric passports. This is a legal requirement for ACSPs.

11-Character Personal Code Management

Your clients receive their unique 11-character Companies House personal code. FigsFlow stores these centrally for your annual Confirmation Statement filings.

Mandatory 7-Year Record Keeping

Under the 2025 regulations, ACSPs must retain verification evidence for 7 years. FigsFlow automates this storage, ensuring your practice remains audit-ready.

- Judge for Yourself

FigsFlow vs. Others: Which is Better for Identity Verification?

Features

Others

FigsFlow

Price

Expensive, hidden fees

£2.10 per check

Management

Only suitable for individual accountants and clients

Bulk dashboard best for accountancy practices

7-Year Storage

Maybe not (Accountant responsible)

Yes (FigsFlow provides secure storage system)

Code Access

User must share it

Auto stored for filings

Audit Logs

Limited

Full audit trail for AML

- Limited-Time Benefits for You

Exclusive Offer for Accountants, Bookkeepers & Tax Advisers

Free Proposal and Engagement Starter Package + Subscription Benefits!

Get started with our Proposal and Engagement Starter Package for FREE when you subscribe to AML & ID verification checks.

What’s Free:

- When you subscribe for 1 month to AML & ID verification checks, get a month free for our Proposal and Engagement Starter Package.

- Subscribe for 1 year to AML & ID verification checks and get 1 year free for our Proposal and Engagement Starter Package.

- No hidden charges, no setup fees - just one straightforward subscription.

- Streamlined, Secure, Trusted

How FigsFlow Helps Accountants, Bookkeepers & Tax Advisers

Handle identity verifications for numerous clients under one roof. Track progress and manage all tasks via the FigsFlow dashboard.

Automate the identity verification process for directors and persons with significant control (PSCs), freeing up your time to focus on other tasks.

Ensure clients meet the deadline for mandatory verification and avoid costly penalties or delays.

Your clients’ data is kept secure and fully compliant with GDPR and other data protection regulations.

Our tool is trusted by accounting professionals for its reliability and ease of use.

- As Easy As 1,2,3

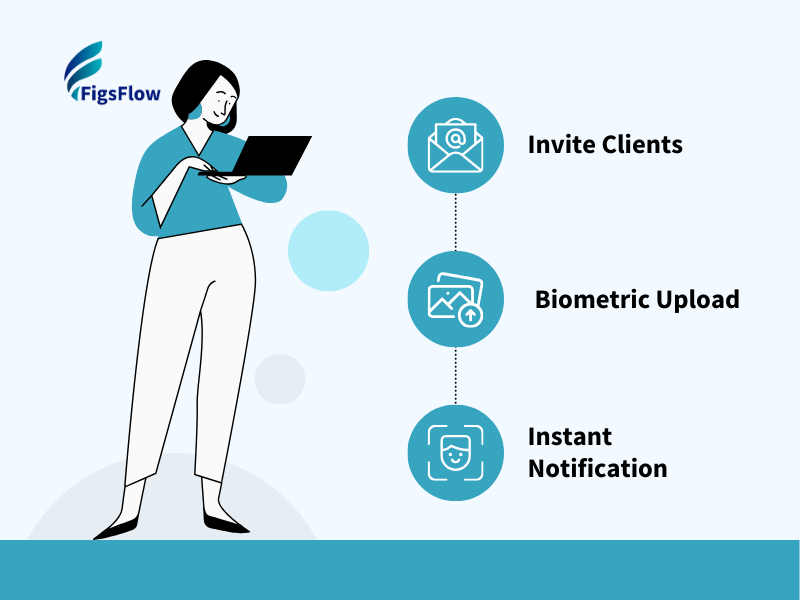

Secure 3-Step Verification Process

We meet the high standards of Companies House Identity Verification but without making things complicated for you. All you need to do is follow three steps.

Invite Clients

Send secure links from your dashboard.

Biometric Upload

Clients scan biometric passports, UK driving licences or BRPs. Our technology validates chips and physical security features.

Instant Notification

You receive an alert as soon as the 11-character personal code is issued to your client.

- Stay Ahead of Deadlines

Important Dates & Deadlines

Stay ahead with voluntary and mandatory verification deadlines for your clients.

Voluntary Verification

Already available for your clients since April 8, 2025.

Mandatory Verification

Begins November 18, 2025, for all new directors and PSCs.

Over 6 million Verifications Expected

Ensure your clients are part of the early adopters, staying ahead of the compliance curve.

- Created for Regulated Practice

Fully Compliant with UK Practice Standards

FigsFlow ensures adherence to all UK regulatory requirements, providing a reliable solution for identity verification that meets the highest compliance standards.

ACCA

CIOT

CIMA

ICAEW

ATT

AAT

& Many More

- Learn, Explore, Grow

All the Other Resources Waiting for You

Access a variety of resources to help you get the most out of FigsFlow and streamline your verification process.

Guides & Help Docs

In-depth walkthroughs, FAQs, and guides to help you get the answers you need.

- Quick Answers

FAQs to Keep You Moving

Get quick answers to common questions on saving time, managing clients, meeting deadlines, and ensuring security with FigsFlow.

What types of identity documents does FigsFlow accept?

FigsFlow accepts biometric passports, UK driving licences, and Biometric Residence Permits (BRPs). Our system uses advanced Identity Document Validation Technology (IDVT) to verify cryptographic and physical security features, ensuring compliance with Companies House requirements.

How long does the verification process take?

Most verifications are completed within minutes. Once your client uploads their document, FigsFlow validates it immediately and sends you an instant notification when the 11-character personal code is issued.

Do I need to manually store verification records?

No. FigsFlow automatically stores all verification evidence for 7 years, as required under the 2025 Economic Crime and Corporate Transparency Act (ECCTA). This ensures your practice remains fully audit-ready without additional effort.

Can I verify multiple clients at once?

Yes. FigsFlow is designed for accountancy practices managing multiple clients. Our bulk dashboard allows you to invite, track, and manage verifications efficiently, making it ideal for professional workflows.

Start Offering Companies House Identity Verification to Your Clients Today!

Experience FigsFlow firsthand: book a demo or start your 30-day free trial today to simplify client verification.