Engagement letters are the backbone of a tax adviser’s work. They outline what services will be provided, set clear expectations, and protect both parties from misunderstandings. However, writing a new engagement letter for every client consumes valuable time that could be spent serving clients or growing your practice. That’s where LOE software for tax consultants comes to the rescue. Such software simplifies the process of developing engagement letters and frees up tax advisers’ schedules for more strategic work. So, if you are a tax adviser considering adopting engagement letter software, here are the five must-have features you should look for. LOE software for tax consultants is essential to modern tax consultancy.

KEY TAKEAWAYS

- LOE software transforms manual engagement letter processes into streamlined digital workflows that save hours of administrative time

- The five must-have features are customisable templates, automated workflows, digital signatures, compliance/security, and analytics capabilities

- Digital signatures allow clients to sign from any device within hours instead of waiting days or weeks for postal returns

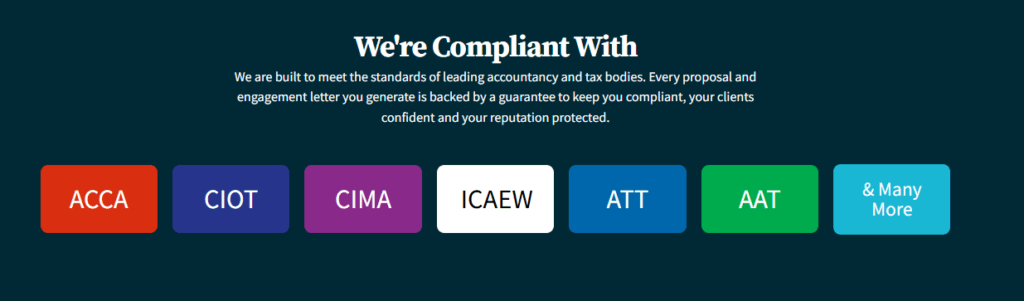

- Best software ensures GDPR compliance, meets professional body standards (ICAEW, ACCA, CIOT), and maintains secure audit trails

- FigsFlow is purpose-built for UK tax consultants with seamless integration, transparent pricing, and expert support

What is LOE Software for Tax Consultants?

LOE software for tax consultants encompasses digital solutions that enhance efficiency and compliance, making engagement processes smoother.

Defining LOE Software for Tax Consultants

LOE software, or letter of engagement software, is a digital solution designed to streamline how tax consultants create, manage, and track engagement letters. Instead of drafting each letter from scratch using Word documents or outdated templates, this software automates the entire process from initial creation to final signature.

Traditional engagement letter processes involve multiple steps:

- drafting the letter,

- customising it for each client,

- printing it,

- sending it by post,

- waiting for the signed copy to return, and

- Finally, filing it somewhere safe

This manual approach is time-consuming, prone to errors, and makes tracking status nearly impossible when you’re managing dozens or hundreds of clients.

Modern engagement letter software transforms this workflow into a streamlined digital process. Tax advisers can generate professional, compliant engagement letters in minutes, send them electronically, track their status in real time, and store signed copies securely in the cloud. The software handles version control, ensures compliance with current regulations, and provides a complete audit trail of every engagement letter sent and received.

The advantages of using LOE software for tax consultants are numerous, including significant time savings and improved client satisfaction.

What Counts as "Best LOE Software for Tax Consultants"

Not all engagement letter software is created equal, especially for tax professionals with specific regulatory and operational requirements. The best LOE software for tax consultants must balance several critical factors that directly impact your practice’s efficiency and compliance.

When considering options, tax professionals should focus on LOE software for tax consultants that prioritises customisation and user experience.

-

Tax-Specific Functionality

Generic contract management software won't cut it because tax engagements have unique characteristics. You need software that recognises different tax services, understands scope limitations specific to tax work, and includes appropriate limitation of liability clauses that protect your practice.

-

Regulatory Compliance

Your engagement letter software must help you meet professional body requirements from organisations like ICAEW, ACCA, or CIOT. It should ensure GDPR compliance for client data handling and provide the security features necessary for managing sensitive financial information.

-

Integration Capabilities

The best LOE software doesn't exist in isolation. It should connect with your practice management system, your accounting software, and your client relationship management tools. Without integration, you create data silos and duplicate work, which defeats the purpose of automation.

-

Scalability

Software that works for five clients might collapse under the weight of fifty. The best solutions grow with your practice, handling increased volume without performance degradation or proportional cost increases that make growth unprofitable.

-

User Experience

If your team finds the software confusing or clients struggle with the signing process, adoption fails regardless of technical capabilities. The best LOE software makes life easier for everyone involved, not just the person who configured it.

When evaluating engagement letter software, these five factors should guide your decision. The right solution understands your tax practice needs, protects your compliance position, and scales efficiently as your firm grows.

Tax practices that invest in LOE software for tax consultants often see a direct correlation between efficiency and client retention.

How We Evaluated the Top 5 Must-Have Features

Our evaluation comes directly from conversations with thousands of FigsFlow subscribers across the UK, USA, and Australia. We listened to tax professionals who’d experienced the frustrations of inadequate software, cataloguing the bottlenecks that slowed them down and the capabilities that ultimately convinced them to switch. Clear patterns emerged about which features deliver real value versus those that sound impressive but provide little practical benefit.

We also considered:

For tax consultants, choosing the right LOE software for tax consultants can drastically change the workflow dynamics within a practice.

-

Regulatory Requirements

We cross-referenced user feedback with compliance obligations from ICAEW, ACCA, CIOT, and data protection authorities to ensure features addressed legal requirements, not just conveniences.

-

Usage Data Analysis

We examined which features tax consultants actually use daily versus those they ignore, tracking measurable outcomes like time savings, error rates, and client response metrics.

The five features we identified represent the core capabilities that practising tax consultants identified as non-negotiable for professional-grade engagement letter software.

The implementation of LOE software for tax consultants allows for insights that can refine practice operations and client interactions.

5 Must-Have Features of the Best LOE Software for Tax Consultants

The difference between adequate and exceptional engagement letter software comes down to five core capabilities. These features consistently appeared in feedback from thousands of tax professionals who’ve experienced both inadequate solutions and transformative ones.

Engagement letter efficiency is significantly enhanced by LOE software for tax consultants, allowing for quicker response times and better tracking.

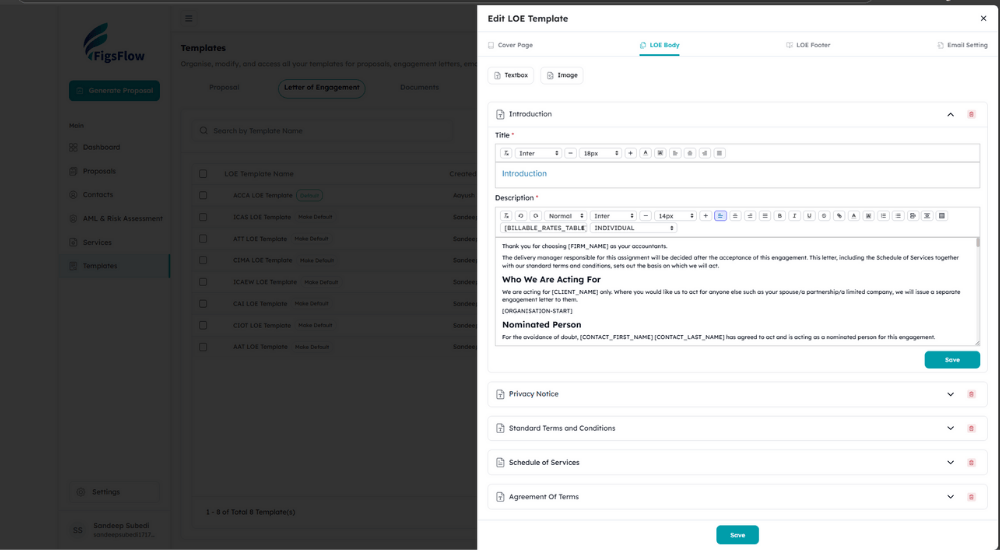

Customisable Templates: Foundation of Best LOE Software

The right LOE software for tax consultants also enables firms to maintain a professional image while addressing diverse client needs.

Every client has unique needs, which is why a one-size-fits-all template won’t cut it. The best LOE software for tax consultants provides ready-to-use templates that can be customised to match specific tax advisory services, client preferences, and your firm’s professional standards.

You need the ability to create master templates for different service types like self-assessment preparation, corporation tax compliance, tax planning, VAT returns, and HMRC enquiry support. Each service requires different scope definitions, limitation of liability clauses, and fee structures.

-

Dynamic Fields

The software should insert client-specific information automatically. Names, company details, tax registration numbers, and service dates populate without manual typing, eliminating errors and ensuring consistency.

-

Version Control

When HMRC updates requirements or your professional body revises guidance, you need to update templates quickly. The best software tracks versions clearly and prevents accidental use of outdated templates.

-

Conditional Logic

If a client selects tax planning services, the engagement letter automatically includes specific clauses about advisory work and HMRC compliance limitations. This intelligent automation reduces errors and ensures appropriate terms.

Template customisation should also extend to branding and tone, allowing multiple versions that preserve legal protections whilst adapting communication style to client preferences.

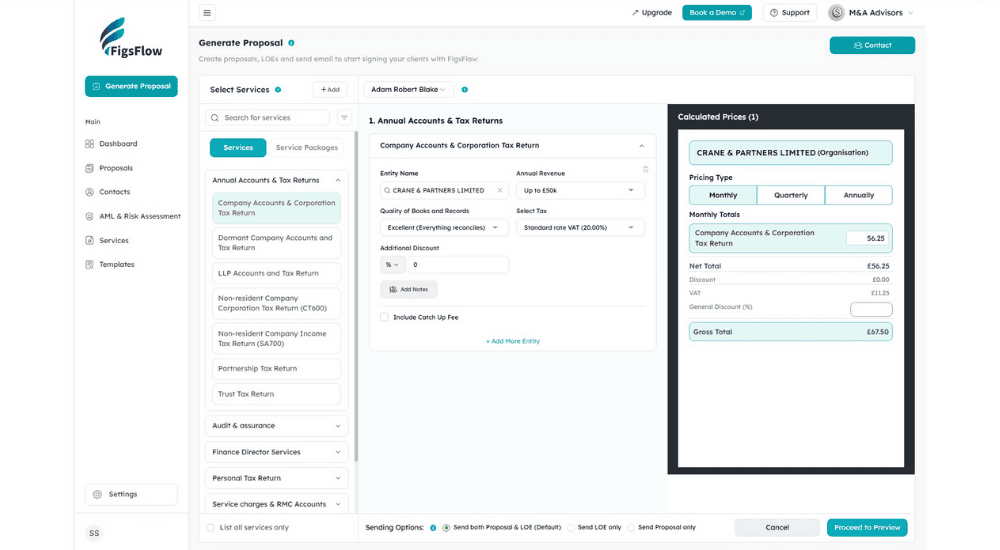

Automated Workflows: Time-Saving LOE Software Feature

Automation is a lifesaver for busy tax advisers. The right LOE software for tax consultants must instantly fill client details in engagement letters, track where each engagement letter stands, and send friendly reminders to clients who haven’t signed yet.

Moreover, the use of LOE software for tax consultants can lead to enhanced client engagement and satisfaction due to improved processes.

-

Automatic Generation

When you add a new client, the software automatically generates the appropriate engagement letter based on the requested services. No more opening blank templates or manually formatting documents.

-

Status Tracking

See at a glance which clients have received engagement letters, which have opened, which have signed, and which require follow-up. This eliminates spreadsheets or manual tracking systems.

-

Reminder Systems

The software sends polite nudges at appropriate intervals whilst you customise reminder frequency and messaging. This frees you from calendar alerts and manual follow-ups.

-

Internal Process Automation

When a client signs, the software automatically notifies the assigned tax adviser, updates client records, triggers onboarding next steps, and files the signed letter appropriately.

For practices with multiple team members, junior staff can draft engagement letters that automatically route to senior reviewers before sending.

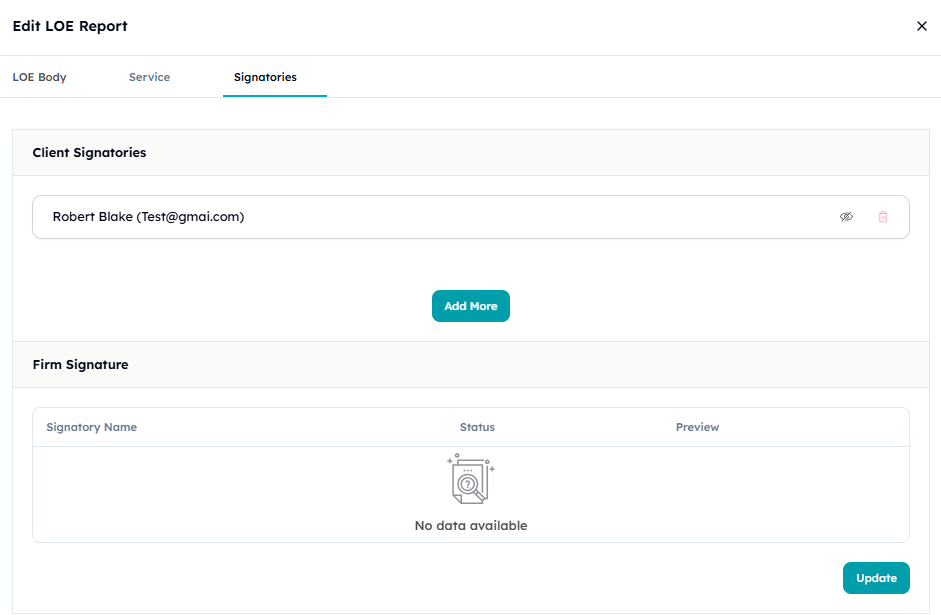

Digital Signature Integration: Essential for Modern Engagement Letters

In today’s digital age, nobody wants to print, sign, scan, and email documents. Digital signature integration means a seamless signing process for clients who can sign letters from any device, whilst completed documents are instantly saved and accessible.

Digital signatures dramatically accelerate client onboarding. Traditional postal processes take days or weeks, whilst digital signing typically happens within hours. This speed improves cash flow because work can begin sooner.

Digital signatures via LOE software for tax consultants provide an excellent way to modernise the client onboarding experience.

-

Legal Validity

The best LOE software uses digital signature technology that complies with UK electronic signature regulations and meets professional body requirements. These signatures carry the same legal weight as handwritten signatures.

-

User Experience

The software should not require clients to create accounts, download applications, or navigate complicated processes. A simple email link with a clear signing interface produces the highest completion rates.

-

Mobile Optimisation

The software must render engagement letters properly on small screens and provide touch-friendly signature interfaces for the many clients who prefer smartphones.

Digital signature integration should include appropriate identity verification, such as email verification and optional SMS confirmation.

Compliance and Security: Non-Negotiable LOE Software Requirements

Tax advisers deal with sensitive financial information. Top-tier engagement letter software ensures that developed engagement letters are compliant with legal and industry standards and securely stored.

LOE software for tax consultants builds a stronger compliance framework that is critical for today’s financial landscape.

-

GDPR Compliance

Your software must process personal information lawfully, store it securely, provide audit trails, and support data subject rights. Non-compliance risks substantial fines and reputational damage. Professional Body Standards ICAEW, ACCA, and CIOT provide guidance on engagement letter content. The best LOE software incorporates these standards into template libraries, ensuring your letters meet professional requirements.

-

Data Security

The software must encrypt data in transit and at rest, maintain secure cloud storage with redundant backups, and restrict access based on user roles and permissions.

-

Audit Trail Functionality

Every action relating to an engagement letter should be logged with timestamps and user identification, supporting professional indemnity insurance requirements and regulatory investigations.

Integrated software can link engagement letter acceptance to customer due diligence completion, preventing work from starting before proper client identification occurs.

Analytics and Reporting: Data-Driven Engagement Letter Management

Engagement letter tracking is streamlined with LOE software for tax consultants, ensuring no document is left unaccounted for.

Understanding how clients interact with engagement letters helps tax advisers improve their workflow. The ideal engagement letter management software includes analytics to see which letters perform best and reports to track the status of all engagement letters at a glance.

Analytics from LOE software for tax consultants help tax professionals make informed decisions about service offerings.

-

Performance Metrics

How long does it typically take clients to sign? Which service types have the highest acceptance rates? These insights help you optimise templates and identify friction points in your onboarding workflow.

-

Conversion Tracking

Measure how many proposals convert to signed engagement letters, identify which marketing channels produce clients who onboard quickly, and calculate the average time from initial contact to signed engagement.

-

Team Productivity Analytics

See how efficiently different staff members manage engagement letters and where bottlenecks occur. This visibility helps practice managers optimise workflows and provide targeted training.

-

Compliance Reporting

Generate reports showing that all active clients have current engagement letters, that letters meet professional body standards, and that proper client acceptance procedures were followed.

Financial analytics link engagement letters to revenue, allowing you to track which services generate the most activity and forecast fee income based on signed engagement letters.

What to Avoid in LOE Software for Tax Consultants

Understanding what to avoid is as important as knowing what to seek. Some engagement letter software appears capable on the surface, but contains hidden flaws that create problems after implementation.

Inflexible pricing models present the first red flag. Software that charges per user regardless of actual usage punishes tax practices with seasonal staffing patterns. You shouldn’t pay for licenses that sit unused during quiet periods or face expensive barriers when adding temporary staff during peak season.

Poor integration capabilities create endless headaches. If your engagement letter software cannot connect to your practice management system, you’ll spend countless hours manually transferring data between systems. This duplicated effort eliminates any efficiency gains from automation.

Data portability matters more than most practitioners realise. Solutions that lock your data into proprietary formats give vendors power to increase prices arbitrarily because switching becomes prohibitively difficult.

Finally, responsive customer support isn’t optional. When engagement letters are your gateway to new client work, software problems directly impact revenue. You need support teams that respond quickly and understand tax practice workflows.

It’s vital to avoid software that lacks integration capabilities, particularly with LOE software for tax consultants.

FigsFlow: Best LOE Software for Tax Consultants

FigsFlow represents a prime example of how LOE software for tax consultants can enhance operational efficiency.

FigsFlow delivers all five must-have features in a platform specifically designed for UK tax consultants, accountants, and bookkeepers. Built by practitioners who understand the daily realities of tax practice, FigsFlow solves real problems rather than adding complexity.

Here’s how FigsFlow brings these essential features together:

-

Customisable Templates Library

Our template collection includes engagement letters for every common tax service, all drafted to meet professional body standards and GDPR requirements. You can customise these templates to match your firm's branding and communication style while maintaining legal protections.

-

Automated Workflows

Guide clients from initial proposal through signed engagement letter without manual intervention. Status tracking shows exactly where each client stands in your onboarding pipeline, while automated reminders gently encourage clients to complete signing.

-

Digital Signature Integration

Make signing effortless for clients on any device. No downloads, no account creation, just simple, secure signing that completes in minutes rather than days.

-

Compliance and Security

Our platform maintains comprehensive audit trails, encrypts all data, and supports your professional obligations from AML verification to GDPR compliance. Every aspect of FigsFlow is built with regulatory requirements in mind.

-

Analytics and Reporting

Transform engagement letters from an administrative necessity into a strategic asset. You'll understand client behaviour patterns, measure team productivity, and connect engagement letter data to revenue forecasting.

FigsFlow integrates seamlessly with your existing systems, offers transparent pay-as-you-go pricing that grows with your practice, and provides expert support from people who understand tax advisory work.

Additional Resources

- Everything You Need to Know About Engagement Letter: Understanding Engagement Letters: A Guide for Professionals | FigsFlow

- Guide to Drafting Engagement Letters with FigsFlow: Complete Guide to Drafting Engagement Letters | FigsFlow

- What is an ACCA Compliant Engagement Letter?: What is an ACCA-Compliant Engagement Letter | FigsFlow

- The Only Difference Between LOI & LOE that Matters: Engagement Letter vs Letter of Intent: Key Differences Explained

- Automate Professional & Regulatory Compliant Engagement Letters with FigsFlow: Stop Wasting Hours: Automate Engagement Letters with FigsFlow

- Here’s Why Engagement Letter is Important for Your Practice: Engagement Letter: What It Is & Why It’s Important for Accountants

- Explore more detailed information on engagement letter software: Engagement Letter Software for Accountants.

Conclusion

Choosing the right engagement letter software makes your job as a tax adviser substantially easier. The best LOE software for tax consultants boosts efficiency, maintains professionalism, and ensures compliance while saving time and building client trust.

The five features we’ve explored represent the foundation of effective engagement letter management. When evaluating software, look beyond feature lists to actual implementation quality. The best software integrates these capabilities seamlessly, making them feel like natural extensions of your workflow.

FigsFlow offers all these features and more in a platform designed specifically for UK tax professionals. Why not contact us today to see what we can offer your practice?

In conclusion, the best LOE software for tax consultants not only streamlines processes but also fosters stronger client relationships.

Frequently Asked Questions (FAQs)

A tax engagement letter is a formal agreement between a tax adviser and their client that clearly defines the services to be provided. It ensures both parties understand exactly what’s included in the engagement and what falls outside the agreed scope. For instance, if you’re engaged to prepare a self-assessment tax return, the letter clarifies that representing the client in an HMRC enquiry would require a separate agreement and additional fees.

Tax consultants, accountants, and bookkeepers issue engagement letters to their clients before commencing any professional work. The letter is drafted by the professional adviser and sent to the client for review and signature. This establishes clear terms of engagement and protects both parties by documenting the agreed scope of work, timelines, and deliverables before any services begin.

Professional accountants typically use specialised accounting software platforms like QuickBooks, Xero, and Sage for bookkeeping and financial management. For engagement letter management specifically, many firms are adopting dedicated LOE software like FigsFlow that handles proposals, engagement letters, pricing, and client onboarding. These platforms integrate with accounting software to streamline the entire client management process.

Creating an effective engagement letter requires including several essential sections. Start with client and firm identification details, then clearly define the scope of services being provided. Specify the engagement period and outline your fee structure and payment terms. Include both parties’ responsibilities, reference the professional standards you’ll follow, and conclude with a section for client confirmation and signature. Using engagement letter software with pre-built templates ensures you don’t miss critical elements.

A consulting engagement letter is a formal agreement that defines the professional relationship between a consultant and their client. For tax consultants, this letter outlines the specific advisory services being provided, the consultant’s responsibilities and limitations, compensation terms, and the duration of the engagement. It serves as a legal safeguard and communication tool that prevents misunderstandings about the nature and extent of the consulting relationship.