In the context of contractual agreements, parties seek to limit their liability in the event of a breach. One of the common ways to achieve that is through the inclusion of limitation of liability clauses, which define the maximum extent to which a party can be held liable for damages arising out of the contract.

Those clauses are widely used across a range of industries and serve to provide certainty and mitigate risk. However, while limitation of liability clauses can provide much-needed protection, they must also be fair and reasonable to be enforceable.

Exclusions in limitation clauses are certain types of damages or liabilities that are excluded from the scope of the limitation. The fairness and reasonableness of these exclusions are crucial as overly broad or unjust exclusions may render a clause unenforceable or void.

Understanding what constitutes a fair and reasonable exclusion when defining limitation of liability is important for both parties in ensuring the contractual terms are legally enforceable.

This article will explore what constitutes fair and reasonable exclusions in limitation of liability clauses, examining the key principles, common types of exclusions and relevant legal frameworks. It will also explain the factors to consider when drafting such clauses and how to ensure they comply with industry standards and legal requirements.

Understanding Limitation of Liability Clauses

Limitation of liability clauses are provisions in engagement letters and proposals that specify the maximum amount a party may be liable for in the event of a breach. These clauses set boundaries on possible financial exposure and can help both parties understand the limits of their responsibilities.

Typically, limitation clauses take one of the following forms:

-

- Cap on Liability – This sets a maximum financial limit on damages a party can be held liable for.

-

- Exclusion of Certain Types of Liability – These clauses may exclude liability for certain damages such as consequential, punitive, or indirect damages, or may exclude liability entirely for certain risks.

While limitation clauses are common, exclusion clauses—which attempt to limit or eliminate liability for certain types of damages—are more contentious. Exclusion clauses have to meet higher standards of fairness and reasonableness when one party is attempting to exclude liability for heavy types of damages.

Role of Fairness & Reasonableness in Exclusions

Exclusion clauses are inherently problematic because they seek to avoid or limit liability for specific damages, which could unfairly benefit the party seeking to exclude liability. As such, these clauses must meet the standard of fairness and reasonableness so they are enforceable.

In many jurisdictions including the United Kingdom and the United States, the fairness of exclusion clauses is a matter of public policy. Courts typically look at the circumstances under which the contract was made including whether the exclusion was negotiated or imposed unilaterally.

In jurisdictions like the UK, the Unfair Contract Terms Act 1977 (UCTA) provides a legislative framework for determining whether an exclusion clause is reasonable. According to UCTA, exclusion clauses that limit or exclude liability for negligence must be reasonable, and the party seeking to rely on the clause has the burden of proving reasonableness.

Some factors that courts and regulatory bodies may consider in determining fairness include:

-

- Bargaining Power – Whether the parties had equal bargaining power or if the clause was imposed by one party.

-

- Clarity of Language – Whether the exclusion was clearly communicated and understood by both parties.

-

- Commercial Context – Whether the exclusion reflects common practices in the relevant industry or sector.

The key principle here is that the exclusion must not unduly disadvantage one party while benefiting the other. This is to prevent situations where a party is unfairly released from liability for damages that it could reasonably foresee and should be held accountable for

Common Types of Exclusions in Limitation of Liability Clauses

When drafting limitation of liability clauses, certain exclusions are commonly considered and accepted as fair and reasonable in many contracts. These exclusions seek to protect both parties so the risk distribution remains proportional to the parties’ roles and responsibilities in the agreement.

Below are some common types of exclusions often seen in limitation of liability clauses.

1. Consequential & Indirect Damages

Excluding consequential damages or indirect damages is one of the most common types of exclusions in limitation clauses. These types of damages are losses that do not directly result from the breach but are a consequence of it. For example, if a contractor fails to complete a project on time, the direct damage may be the cost of the unfinished work but the indirect damage might be the loss of business or revenue due to the delay.

Consequential damages are typically excluded from liability because they can be highly speculative and unpredictable. For instance, in many contracts, a party will exclude liability for any loss of profits or business interruption resulting from a breach.

These exclusions are generally considered reasonable when the party seeking to limit liability could not have reasonably foreseen the exact nature or extent of the indirect damage at the time the contract was formed.

2. Punitive or Exemplary Damages

Punitive damages are intended to punish the wrongdoer and deter others from engaging in similar conduct. They are usually awarded in cases of gross negligence or willful misconduct. Excluding punitive damages is seen as reasonable because these damages go beyond mere compensation for losses suffered and punish the breaching party.

In many contracts, exclusion of punitive or exemplary damages is a standard provision. This is considered fair because punitive damages are not compensatory in nature and may exceed the actual harm caused by the breach. However, in cases of serious misconduct or fraud, some jurisdictions may limit the enforceability of such exclusions.

3. Loss of Data

In the modern digital age, data loss has become a serious concern. Excluding liability for loss of data is common in contracts involving technology, software, or data storage. Because data loss can be a foreseeable risk in those industries and the damage caused by such loss may be difficult to quantify.

Excluding liability for loss of data is generally considered reasonable when the contract includes provisions for data backup and disaster recovery and when the party seeking to exclude liability is taking steps to mitigate the risks of data loss.

4. Third-Party Claims

Exclusion clauses include provisions excluding liability for third-party claims. This means claims brought against the contracting parties by third parties like customers or competitors. These exclusions are enforceable when they are specifically stated in the contract.

Excluding third-party claims is considered fair when the parties have no direct control over the third-party interactions and could not reasonably foresee or prevent such claims. This exclusion helps to protect parties from liability that may erupt from unforeseen external factors.

Legal Framework & Judicial Scrutiny of Exclusion Clauses

The enforceability of exclusion clauses is subject to legal scrutiny in most jurisdictions. In many cases, a court of law will assess the fairness of an exclusion clause based on the specific facts of the case, including the bargaining position of the parties and the clarity of the clause.

1. The Contra Proferentem Rule

One of the fundamental legal principles that apply to exclusion clauses is the contra proferentem rule. This rule dictates when there is ambiguity in the terms of a contract, the interpretation that is least favourable to the party that drafted the contract will be adopted. This means exclusion clauses are not used to exploit the other party or to avoid liability through unclear or convoluted language.

2. The Unfair Contract Terms Act 1977 (UCTA)

Under UCTA, exclusion clauses that limit or exclude liability for negligence must meet the test of reasonableness. Section 2 of UCTA requires any exclusion clause attempting to limit liability for negligence must be reasonable in the circumstances

The test for reasonableness is based on a number of factors like the relative bargaining power of the parties, the availability of alternative remedies and the knowledge and expertise of the parties at the time the contract was entered into

3. Consumer Protection Laws

In addition to commercial contracts, consumer contracts are subject to additional scrutiny. Exclusion clauses in contracts with consumers must comply with the Consumer Rights Act 2015 in the UK. This means exclusion clauses in consumer contracts are transparent, fair and not misleading.

Similar laws exist in other jurisdictions to prevent consumers from being unfairly deprived of remedies or protections due to exclusion clauses.

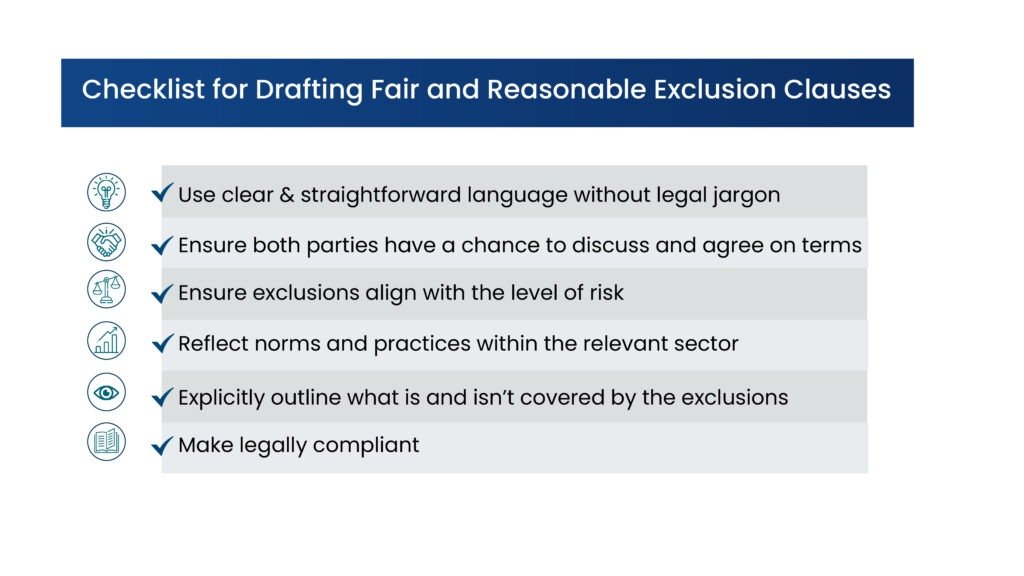

Drafting Fair and Reasonable Exclusion Clauses

When drafting exclusion clauses in limitation of liability agreements, several best practices should be followed for fairness and reasonableness. These are:

-

- Clarity – The exclusion clauses should be clear, unambiguous and easily understood by both parties. Complex legal jargon or unclear terms could render the clause unenforceable.

-

- Negotiation – Ideally, both parties should have the opportunity to negotiate the terms of the limitation of liability clause. A clause that is imposed without negotiation may be deemed unfair.

-

- Proportionality – The exclusion should be proportionate to the risks involved. Overly broad exclusions that attempt to cover all possible damages are more likely to be viewed as unreasonable.

-

- Industry Standards – The exclusion clauses should follow standard practices in the relevant industry. If the exclusion is out of line with what is commonly accepted in the industry, it may be considered unreasonable.

-

- Transparency – The implications of the exclusion should be clearly communicated to both parties so each understands the scope of the limitation and what liabilities are excluded.

-

- Compliance with Legal Requirements – Finally, exclusion clauses must comply with applicable laws like the Unfair Contract Terms Act 1977 (UK), the Consumer Rights Act 2015 and other consumer protection laws.

Enforceable vs. Unenforceable Clauses

| Enforceable Clauses | Unenforceable Clauses |

| Exclusion of indirect damages with clear wording. | Vague exclusion of “all possible liabilities.” |

| Exclusion of punitive damages in a business contract. | Attempt to exclude liability for gross negligence. |

| Limiting liability for data loss with a backup policy in place. | Broad exclusion of all liabilities related to data loss. |

| Exclusion of third-party claims with specific terms. | Ambiguous exclusion of liabilities for “third parties.” |

Conclusion

Limitation of liability clauses are used to mitigate risk and make contracts clear. However, any exceptions in these clauses must be fair, reasonable and easy to understand to be valid. It’s important to write these clauses carefully, following legal rules, so they are legal and fair for everyone. As laws change, businesses and legal professionals need to stay informed and adjust accordingly.

Frequently Asked Questions

What is a limitation of liability clause, and why is it important?

A limitation of liability clause restricts the amount or types of damages one party can claim from another in case of a contract breach. It is important because it helps manage risks, ensures liabilities are proportionate to the agreement, and provides clarity, reducing uncertainty for both parties.

What factors make an exclusion clause enforceable in court?

An exclusion clause is enforceable if it is clear, reasonable, complies with legal standards, and is properly incorporated into the contract. If it is ambiguous, unfair, or introduced after the contract is signed, it may be deemed unenforceable by the court.

What are examples of enforceable and unenforceable exclusion clauses?

Enforceable clauses are specific, such as those excluding liability for indirect damages, while unenforceable ones are overly broad or attempt to waive liability for gross negligence or fraud, which are often prohibited by law.