Bookkeeping engagement letters are written documents that provide an explicit understanding of the expectations of bookkeepers for their clients. A well-constructed engagement letter outlines the services of the bookkeeper, the responsibilities of the bookkeeper and the client, and the terms on which the bookkeeping engagement shall be carried out. An engagement letter can protect you from any potential misunderstandings or disputes that could arise and help guarantee a smooth working relationship.

What should you then, therefore, include in your bookkeeping engagement letter? Let us break down and take a look at all the essentials.

KEY TAKEAWAYS

- Bookkeeping engagement letters establish clear expectations between bookkeepers and clients, preventing disputes and protecting both parties legally.

- Essential components include scope of services, client responsibilities, fee structures, data security provisions, and termination clauses.

- Common mistakes like vague scope language and missing data security provisions can expose practices to significant risk.

- Professional templates and software streamline creation while ensuring regulatory compliance and consistency across client engagements.

- FigsFlow offers comprehensive engagement letter templates specifically designed for UK accounting and bookkeeping practices.

- Well-drafted engagement letters reduce liability exposure while strengthening client relationships through transparency and professionalism.

What is a Bookkeeping Engagement Letter?

Defining Bookkeeping Engagement Letter

A bookkeeping engagement letter is a formal contract between a bookkeeper and their client that defines the professional relationship. This legally binding document outlines what services will be provided, how much they’ll cost, when they’ll be delivered, and what each party is responsible for throughout the engagement.

Think of it as your professional safety net. Without a properly drafted engagement letter, you’re operating on assumptions rather than agreements. Clients may expect unlimited phone support or monthly financial reports that you never intended to provide. Meanwhile, you’re left without legal protection if disputes arise over scope, fees, or deliverables.

The engagement letter serves three critical functions. Protection against scope creep and fee disputes. Clarification of exactly what you will and won’t do. Professionalism that positions you as a serious accounting professional rather than a casual bookkeeper.

For UK bookkeepers, engagement letters also help demonstrate compliance with professional standards from bodies like ACCA, ICAEW, and AAT. Under MLR 2017, you must conduct client due diligence, and the engagement letter formalizes this relationship while documenting your AML obligations.

Key Components of a Bookkeeping Engagement Letter

Introduction and Scope of Services

It is usually suggested that the first section of your engagement letter for bookkeeping properly define the scope of your services. What bookkeeping work will you be doing for the client? Will you be handling payroll, accounts, or monthly financial reports? This is also a place where you can indicate what services are not included unless specifically requested.

The introduction usually includes:

- A description of the services you will perform, such as general ledger maintenance and bank reconciliation

- What is not included in these services unless mentioned, such as tax filing and financial audits

- Any specialist services provided at an additional fee

Clearly note the services you provide so you and your client know the totality of your liability.

Responsibilities of the Client

This brings us back to the need to outline the client’s role. Good bookkeeping engagement letters explain what you will do and what the client will have to do so that you can provide them with effective service.

This section explains:

- Client-supplied material, such as bank statements and invoices

- Any deadlines for when the client must provide information

- Client’s responsibilities regarding accuracy and timeliness

This will help you do your work effectively and on time while ensuring the client knows their obligations.

Timeline and Deliverables

This section outlines when and how the deliverables will be performed. Clients must be informed when they can expect their financial reports, reconciliations, or whatever other services the engagement may call for.

It is suggested to include:

- Frequency of service, whether it is weekly, monthly, quarterly or even yearly

- Milestones and key deadlines for deliverables

- How the deliverables are to be submitted, whether by email in PDF or via an online portal

This also gives insight into the timeline, which could help manage client expectations, especially if the services rendered are time-sensitive.

Fee Structure and Payment Terms

Having well-defined bookkeeping engagement letters helps in reducing the likelihood of awkward billing conversations later on. You must clearly outline your fee and payment terms so that the client understands what they will be paying for from the beginning.

You must include the following:

- Total service costs, whether hourly or flat-rate

- Payment schedules, such as monthly or upon completion

- Any late payment penalties that may be applied

Transparency in this section helps show professionalism and also helps avoid any dispute that could arise over billing.

Confidentiality and Data Security

Two important factors that a bookkeeper must consider are confidentiality and data security. The profession requires you to deal with the client’s sensitive financial information, which helps make clients feel more at ease about how their information is protected and used properly.

You can include the following in this section:

- A statement with respect to the handling and protection of client data

- Reference to any third-party service providers who may gain access to data

- Specific confidentiality clauses for client information protection

Indeed, addressing these upfront can instill much confidence in your clients and make them comfortable sharing all financial data with you.

Termination and Dispute Resolution

This may be one of the most important sections of your bookkeeper engagement letters. It states the situations where the agreement might be considered null and void on either party’s end, stating what happens in the case of disputes.

Include the following:

- How and when either party can terminate the engagement

- Procedure for resolving disputes or differences

- Any fees or obligations that are outstanding in the event of early termination of the engagement

Having these terms mentioned can help prevent misunderstandings and make the end of the working relationship cleaner if it does come to that.

Agreement and Signature

Lastly, you will want to include a section where both parties can sign and agree to the terms of the bookkeeping engagement letter. This section solidifies the agreement between you and your client and should include the following:

- Names of both parties

- Signature lines for you and the client

- The date of the agreement

Both parties must sign the bookkeeping engagement letter and have a signed copy for each party to keep records.

Common Mistakes in Bookkeeping Engagement Letters

A poorly drafted engagement letter creates more problems than it solves. Many bookkeepers rush through this crucial document, only to face disputes, scope creep, and liability issues later. These five mistakes appear repeatedly in engagement letters that fail to protect both parties.

Vague Scope Language

Nothing creates disputes faster than ambiguous service descriptions. “General bookkeeping services” means different things to different people. Be ruthlessly specific about deliverables, timelines, and what’s included versus excluded.

Missing Termination Clauses

You need an exit strategy before problems arise. Without clear termination terms, clients can abandon engagements mid-month leaving you unpaid for work completed. Include notice periods, outstanding payment obligations, handover procedures, and what happens to client records upon termination.

No Data Security Provisions

Under GDPR and UK data protection law, you’re processing sensitive personal and financial data. Failing to address how you’ll protect this information isn’t just unprofessional; it’s potentially illegal. Your engagement letter should specify storage methods, encryption standards, software platforms, retention policies, and client rights under data protection regulations.

Inadequate Limitation of Liability

Many bookkeepers omit liability clauses entirely or include vague language that provides no actual protection. Professional engagement letters cap liability at a reasonable multiple of fees charged and explicitly exclude consequential damages. They also clarify that you’re not providing assurance services or conducting audits.

Unclear Fee Adjustment Mechanisms

Fixed monthly fees work until scope expands. The client who initially had 50 transactions monthly now processes 300, and you’re doing triple the work for the same fee. Build in escalation clauses tied to transaction volume, complexity increases, or additional services requested outside the original scope.

A well-drafted engagement letter protects your practice while setting clear expectations for clients. Address these five areas comprehensively, and you’ll prevent most disputes before they arise.

Bookkeeping Engagement Letter Sample

Understanding the components is helpful, but seeing how they work together in practice makes everything clearer. Below is an annotated sample from an actual bookkeeping engagement letter that demonstrates best practices in action.

The full sample engagement letter is displayed in the uploaded PDF document. Key sections worth noting include clear service scope definitions listing specific deliverables, client responsibility clauses that create accountability, transparent fee structures with adjustment mechanisms, GDPR-compliant data protection provisions, and termination procedures that protect both parties.

Free Bookkeeping Engagement Letter Templates

Creating professional engagement letters from scratch is time-consuming and risky. You might miss critical clauses, use outdated regulatory language, or create documents that don’t actually protect you legally.

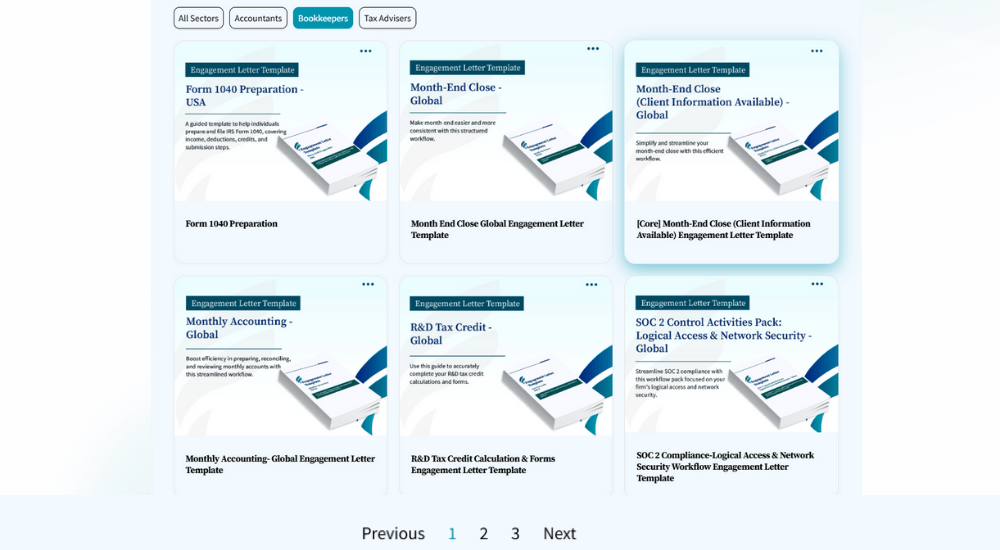

FigsFlow provides 25+ professionally drafted engagement letter templates specifically designed for UK accounting and bookkeeping practices. These templates are fully compliant with current UK regulations including Companies Act 2006, MLR 2017, GDPR, and professional body standards from ACCA, ICAEW, and CIOT.

The template library covers standard monthly bookkeeping, payroll administration, VAT returns, management accounts, year-end accounts preparation, self-assessment services, cloud accounting setup, and both fixed-fee and hourly-rate structures. Each template comes with guidance notes explaining what to customize and how to adapt the document for specific client circumstances.

Get Professional Engagement Letter Templatesow

Best Software to Create Bookkeeping Engagement Letters

Manual document creation works until you have multiple clients with similar but not identical engagements. You’re copying last month’s engagement letter, find-and-replacing client names, manually updating fee structures, and hoping you didn’t miss anything critical.

Then compliance requirements change. MLR 2017 gets updated. GDPR guidance evolves. Now you need to update 30+ engagement letters across all active clients while maintaining accurate records of who’s signed which version.

Here’s why FigsFlow is the perfect choice.

Automated Template Library

Access 25+ professionally drafted templates that automatically update when compliance requirements change. No manual tracking needed.

Client-Specific Customization

elect your template, customize service scope and fees, and generate professional PDFs in minutes while maintaining legal frameworks.

Built-In E-Signatures

Send engagement letters directly to clients with automatic tracking, reminders, and complete audit trails for compliance.

Integrated Workflow

Convert proposals to engagements automatically with pricing and services already populated. One seamless process from prospect to client.

Automate Your Engagement Letters with FigsFlow

Helpful Resources

- Here’s How You Can Automate Bookkeeping Engagement Letters with FigsFlow: Stop Wasting Hours: Automate Engagement Letters with FigsFlow

- Grab ICAEW Compliant Engagement Letter Templates for Accountants, Bookkeepers, & Tax Advisers (It’s Free for Now!): Your Short Guide to Using ICAEW Engagement Letter Templates

- Here’s the Must-Have Features Every Engagement Letter Software for Bookkeepers Must Have: Features of Engagement Letter Software for Bookkeepers | FigsFlow

- We Tested 42 Proposal Software for Accountants & Bookkeepers. Here’s the Best Ones: Top 10 Proposal Software for Accountants in 2026 | FigsFlow

- If You’re on the Hunt for AML Software for Bookkeepers, We Present FigsFlow – the Best AML Compliance Solution: Best AML Software for Bookkeepers | FigsFlow

Conclusion

Writing thorough engagement letters for bookkeeping is a critical first step in developing client expectations, protection, and trust. You will be able to make one clear and professional with all the information that the engagement will need to cover, from the scope of services to confidentiality agreements, which will assist in the success of the business relationship.

If done well, however, bookkeeping engagement letters are much more than a mere formality; they are one of the most powerful tools for managing your clients and determining how smoothly your bookkeeping service will operate.

Frequently Asked Questions (FAQs)

A bookkeeping engagement letter should clearly define the services you’ll provide, client responsibilities, and payment terms. Include essential sections covering timeline and deliverables, confidentiality and data security provisions, and termination procedures. Both parties must sign the document to make it legally binding. This formal contract protects both bookkeeper and client from disputes while establishing professional expectations.

A bookkeeping proposal should begin with a cover page and introduction that addresses the client’s specific needs. Detail the services you’ll offer, your qualifications and relevant experience, along with transparent pricing and payment terms. Include general terms and conditions, a clear implementation timeline, and provisions for confidentiality and data security. The proposal aims to win new business by demonstrating your value and professionalism.

The bookkeeper or accounting firm providing the services prepares the engagement letter. They draft the document outlining all terms, responsibilities, and conditions of the professional relationship. Once prepared, the engagement letter is presented to the client for review and signature. Both parties must sign to create a legally binding agreement.

A proposal is a marketing document designed to win new clients by showcasing your services and value. An engagement letter is the formal contract that follows, establishing the legal terms once the client agrees to work with you. Proposals aim to secure business, while engagement letters formalize the professional relationship with binding terms. Both serve distinct purposes in the client acquisition and onboarding process.

FigsFlow provides specialized software for creating professional bookkeeping engagement letters with 25+ UK-compliant templates. The platform includes built-in e-signatures, automated template libraries that update with regulatory changes, and integrated workflows from proposal to signed engagement. It streamlines document creation while ensuring compliance with GDPR, MLR 2017, and professional body standards.

Begin your engagement letter with the names of both parties involved in the professional relationship. Follow with a comprehensive introduction defining the scope of services you’ll provide and what’s specifically excluded. Include both your responsibilities as the bookkeeper and the client’s obligations for providing information. These opening sections establish the foundation for all subsequent terms and conditions.

Bookkeepers and accounting professionals issue engagement letters to their clients before commencing work. The service provider creates the document to clarify expectations, deliverables, and professional obligations. This applies to bookkeeping practices, accounting firms, tax advisors, and financial consultants. Issuing a formal engagement letter demonstrates professionalism and prevents scope creep throughout the working relationship.