Most UK accounting firms undercharge.

They forget non-billable hours, underestimate overheads, or skip profit margins entirely. The result? A practice that works hard but barely grows.

This charge out rate calculator helps you fix that. It shows you exactly what to charge so your firm actually makes money.

Key Takeaways: Charge Out Rate Calculator UK

- Charge out rate is the hourly amount your firm charges clients for professional services. It covers total employment costs, business overheads, and profit margin to ensure sustainable operations.

- Billable hours are the time you can directly charge to clients for delivering services like accounts preparation, tax returns, or advisory work.

- Non-billable hours include CPD requirements, internal meetings, admin tasks, business development, and proposal writing. This significantly reduces chargeable capacity from total working hours.

- Part-time staff calculations follow the same methodology but require pro-rata adjustments for working hours, salary, and overhead allocation based on actual time worked.

- FigsFlow’s calculator handles the complex math instantly. Input employment costs, overheads, profit targets, and working patterns to get accurate charge out rates in seconds.

What is a Charge Out Rate?

A charge out rate is the hourly amount your firm charges clients for professional services. It’s not the same as salary or take-home pay. Rather, it’s the rate that covers all business costs and generates profit. By using a Charge Out Rate Calculator, you can easily calculate the ideal rate to cover all these components.

Your charge out rate has three essential components:

- Employment Costs – Base salary plus employer National Insurance and pension contributions

- Business Overheads – Rent, software, insurance, professional subscriptions, and running costs

- Profit Margin – The percentage that funds growth, reinvestment, and rewards risk

Most UK accounting firms use different rates for different service types and staff levels.

A partner’s advisory work commands higher rates than junior bookkeeping. Complex tax planning justifies premium pricing compared to routine compliance. The key is ensuring every rate covers costs and contributes to firm profitability.

Calculate Your Firm’s Charge Out Rate Now

Manual charge out rate calculation is hard, honestly, almost impossible these days with all the costs and factors you need to consider.

So, use our advanced charge our rate calculator. It takes into account:

- Base salary and employment costs (NI, pension)

- Business overheads (rent, software, insurance, subscriptions)

- Profit margin targets

- Billable vs non-billable hours

- Annual leave and bank holidays

- Number of employees and working patterns

The calculator does the complex math instantly and gives you your charge out rate in seconds.

Want to give it a try? Click here to calculate your rate

How to Calculate Your Charge Out Rate: The Complete Breakdown

Calculating an accurate charge out rate requires understanding four critical components. Miss any and you risk undercharging by 30% or more.

Step 1: Calculate Total Employment Costs

Start with gross annual salary, then add employer National Insurance contributions (roughly 13.8% above the threshold), pension contributions (typically 3% to 10%), and professional body subscriptions like ACCA or ICAEW memberships. Using Out Calculator ensures these employment costs are accurately included in your final rate calculation

Many firms calculate rates based purely on salary and wonder why profit margins disappear. The true employment cost is always 15% to 20% higher than base salary alone.

Step 2: Factor in Overhead & Operating Expenses

Business overheads often exceed employment costs. This includes office rent, utilities, software subscriptions (practice management, tax software, accounting platforms), professional indemnity insurance, marketing costs, and technology equipment.

Total overhead costs typically range from £12,000 to £20,000 per employee annually for small to medium UK firms. Larger practices with premium offices may spend £25,000 to £35,000 per employee.

Step 3: Determine Your Profit Margin

Profit margin ensures your firm can sustain operations during quiet periods, invest in training and development, and upgrade systems. Industry benchmarks for UK accounting firms suggest 20% to 35% profit margins depending on service mix.

Routine compliance work operates at lower margins around 20% to 25%. Advisory services and specialist consulting command 30% to 40%. Most established practices aim for 25% to 30% to balance competitiveness with sustainability.

Calculate profit on total costs, not just salaries.

Step 4: Calculate Billable Hours

This is where most firms get it wrong. They assume 2,000 working hours equals 2,000 billable hours. It doesn’t.

Subtract statutory holidays (28 days including bank holidays), sick leave (5 to 7 days average), training and CPD requirements, internal meetings, administrative tasks, and business development time.

Realistic billable hours for UK accounting professionals range from 1,200 to 1,400 hours annually. That’s 60% to 70% utilisation. The Charge Out Calculator automatically adjusts your rate based on realistic billable hours rather than theoretical maximums.

The Calculation

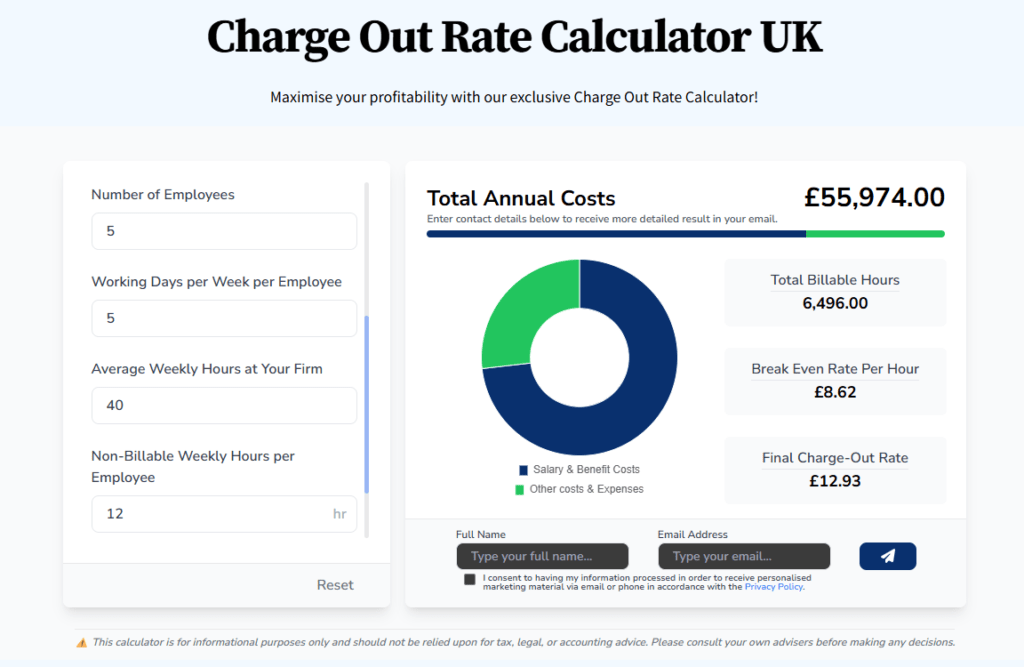

For our example, let’s suppose you have:

- Salary & benefits (including pension): £40,974

- Other costs and expenses (rent, utilities, software, insurance, taxes): £15,000

- Profit margin: 50%

- Number of employees: 5

- Working days per week per employee: 5

- Average weekly hours at your firm: 40

- Non-billable weekly hours per employee: 12

- Annual bank holidays and leave: 28 days

Below is your total charge out rate per hour:

Understanding Billable vs Non-Billable Hours

Billable hours are the time you can directly charge to clients for delivering services like accounts preparation, tax returns, or advisory work. Non-billable hours are everything else: the time you spend running your practice, developing skills, and managing the business that keeps client work possible.

Non-billable time includes:

- CPD requirements (ACCA requires 40 hours annually, ICAEW expects 35 to 50 hours),

- internal meetings and practice coordination,

- proposal development and business development activities, and administrative tasks like timesheet completion and file organisation.

The gap between working hours and billable hours determines whether your charge out rate delivers intended profitability.

Our advanced charge out rate calculator accounts for this automatically by factoring in your non-billable hours per week and annual leave days, ensuring your rates reflect realistic billable capacity rather than the common mistake of assuming every working hour generates revenue.

Common Mistakes When Setting Charge Out Rates

Most undercharging stems from recurring errors that slowly drain firm profitability. Avoid these and your rates will support sustainable growth rather than leaving money on the table.

Mistake 1: Forgetting Non-Billable Time

Firms assume 37.5-hour weeks mean 1,950 billable hours yearly. They price services accordingly and wonder why profitability disappoints. Reality involves 1,200 to 1,400 billable hours per professional due to CPD, meetings, admin work, and business development.

Price for actual capacity, not theoretical maximum. The difference between assumed and real billable hours can mean undercharging by 30% or more.

Mistake 2: Ignoring Hidden Overhead Costs

Software subscriptions seem manageable until you count everything: practice management, tax research, accounting platforms, document management, communication tools, and cybersecurity. That’s £200 to £500 monthly per professional before adding rent, insurance, equipment, and professional subscriptions.

These costs accumulate quickly and must be recovered through your charge out rates. Underestimate overheads and you’re subsidising clients from your own pocket.

Mistake 3: Not Including Profit Margin

Charging at cost might feel fair but provides no cushion for quiet periods, no funding for training, and no capital for growth. Profit margin isn’t optional for sustainable practice management.

It’s the difference between a practice that survives and one that builds real value. Industry benchmarks suggest 20% to 35% depending on service mix and market positioning.

Mistake 4: Not Differentiating by Service Type

Routine bookkeeping faces price competition and commands lower rates. Complex tax planning and specialist advisory work justify premium pricing because of the expertise and value delivered.

Use blended rates cautiously and ensure your service mix doesn’t drift toward lower-value work that damages overall profitability.

How to Calculate Charge Out Rates for Part-Time Staff

Part-time professionals require the same calculation as full-time staff, but inputs adjust for reduced hours. Pro rata means proportional to full-time equivalent.

Salary, employment costs, and overhead allocation should reflect the proportion of hours worked. Employer National Insurance and pension contributions scale naturally with reduced salary. Most firms allocate overheads proportionally based on time worked, and billable hours follow the same pattern using consistent utilisation percentages.

The calculator handles this automatically. The key inputs that change are working days per week per employee and average weekly hours at your firm.

Example

If you have three part-time staff working:

- Employee A: 3 days per week, 22.5 hours

- Employee B: 4 days per week, 30 hours

- Employee C: 2 days per week, 15 hours

Your averages would be:

- Average working days per week: 3 days

- Average weekly hours: 22.5 hours

Input these figures into the calculator along with pro-rated salaries and costs, and it calculates your charge out rate automatically.

Beyond Charge Out Rates: Other Essential Calculators

Beyond the charge out rate calculator, FigsFlow offers a comprehensive suite of tools to help UK accounting firms manage pricing, profitability, and compliance:

- Break Even Calculator – Determine the minimum revenue needed to cover all business costs and identify your break-even point for informed financial planning.

- Corporation Tax Calculator UK – Quickly calculate corporation tax liabilities for clients based on current UK rates and allowances.

- Profit Margin Calculator – Analyse profit margins across services and clients to identify which engagements deliver the best returns.

- VAT Calculator UK – Instantly calculate VAT amounts for invoicing, purchases, and client quotes using current UK rates.

- Billable Rate Calculator USA – Calculate appropriate hourly rates for US-based practices or international service delivery.

- Charge Out Rate Calculator AU – Work out charge out rates for Australian accounting practices using region-specific employment costs and regulations.

- Making Tax Digital Calculator – Estimate MTD compliance costs and help clients understand the investment required for digital record-keeping.

Conclusion

Accurate charge out rates separate profitable firms from those that struggle financially. Account for employment costs, overheads, profit margins, and realistic billable hours.

Use our free calculator to establish baseline rates in 30 seconds. It handles the complex math instantly and ensures cost recovery and profitability.

Review rates annually. Adjust when costs increase or margins decline. Successful UK firms maintain 20% to 35% profit margins through disciplined pricing.

Use our Charge Out Rate Calculator to get started today.

Take Your Pricing Further with FigsFlow

Frequently Asked Questions

A charge out rate is the hourly amount your accounting firm charges clients for professional services. It’s different from your salary or take-home pay. This rate must cover your total employment costs, business overheads, and generate profit for your practice.

The formula is: Charge Out Rate = (Total Employment Costs + Overheads + Desired Profit) ÷ Billable Hours. For example, if your total costs are £55,974, you want 25% profit (£13,994), and you have 1,300 billable hours annually, your charge out rate would be £53.82 per hour, rounded to £55.

Charge out rates vary by service type and staff level. Junior staff rates typically range from £40 to £70 per hour. Senior accountants and managers charge £70 to £120 per hour. Partners and directors charge £120 to £250+ per hour for specialist advisory and complex tax work. Rates also vary by region and firm positioning.

Review your charge out rate annually at minimum. Adjust when salary costs increase, business expenses rise, you gain qualifications or expertise, or profit margins fall below targets. Regular reviews ensure inflation and cost increases don’t erode your profitability.

Billable hours are time you can directly charge to clients for services. Non-billable hours include CPD requirements, internal meetings, business development, proposal writing, and administrative tasks. Most UK accounting professionals achieve 1,200 to 1,400 billable hours annually out of 1,950 total working hours.