You budget £90 monthly for ID verification software. You onboarded eight clients in January, three in February, and twelve in March.

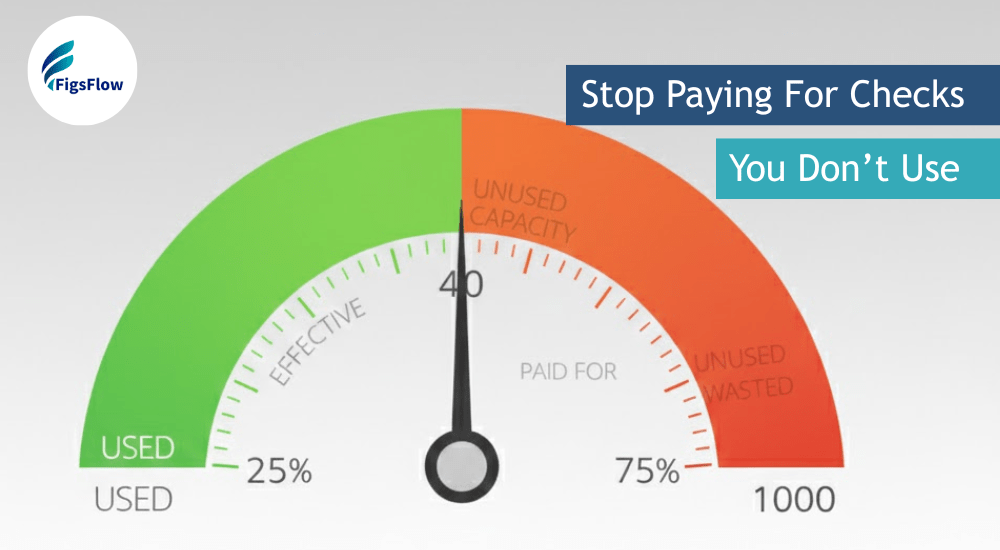

The subscription doesn’t care. You paid £270 for 23 verifications when you could have paid £69 at £3 per check. That’s £201 wasted on capacity you never used. This is the real cost of id verification for accounting practices: not just the per-check price, but wasted subscriptions, staff time, and compliance risk. For most firms, the cost of id verification is driven by pricing structure rather than the checks themselves.

Most UK accounting firms overpay for ID verification because pricing models assume constant client flow. Reality looks different. Client onboarding fluctuates with tax seasons, referral cycles, and market conditions. Fixed subscriptions punish this reality by charging for checks you don’t perform.

This guide breaks down what ID verification actually costs in 2025, exposes the hidden expenses nobody mentions, and explains why pay-as-you-go pricing gives you control over compliance costs without sacrificing quality. When assessing the cost of id verification, firms must account for both direct fees and indirect operational costs. When firms talk about the cost of id verification, they often focus only on software pricing. In reality, the true cost includes unused subscription capacity, manual processing time, system inefficiencies, and the financial risk of non-compliance under MLR 2017.

Key Points Summarised for Busy Readers

- The cost of id verification in the UK ranges from £2 to £15 per check, but subscription models often waste 30% to 60% of paid capacity

- Hidden costs hurt more than software fees. Staff waste 30 to 45 minutes per verification with poor integration, and compliance failures risk HMRC penalties

- Pay as you go eliminates waste. FigsFlow charges £3 per check with full verification, sanctions screening, PEP checks, and audit trails included

- Choose based on volume patterns. Subscriptions suit a stable monthly intake, usage-based pricing saves money for seasonal or growing practices

What is ID Verification?

Identity verification confirms that clients are who they claim to be by checking their identity documents against authoritative independent sources. This satisfies Customer Due Diligence requirements under the Money Laundering Regulations 2017.

Here’s how ID verification works in practice.

- Document Scanning & Data Extraction – Electronic verification reads data from passports, driving licences, or identity cards using optical character recognition technology. The system extracts information from the machine-readable zone, the section containing standardised data that border control systems read automatically.

- Database Verification & Registry Checks – The extracted data gets checked against government databases, credit reference agencies, and official registries simultaneously. For individual clients, this means verifying against DVLA records, passport databases, and electoral registers. Corporate clients require Companies House verification, including PSC register checks to identify beneficial owners.

- Sanctions & PEP Screening – Sanctions screening runs in parallel with document verification. The system checks if clients appear on PEP lists, financial sanctions lists, or adverse media databases.

The entire process generates compliance certificates and timestamped audit trails automatically. These records prove not just that you collected documents but that you verified them against independent sources and screened for sanctions as required by regulation 28 of MLR 2017.

Curious about how ID verification actually works?

ID verification may sound complex, but it follows three clear steps:

- collecting client documents,

- verifying authenticity against authoritative sources, and

- maintaining compliant records

Understanding this process helps you spot which providers offer genuine verification versus basic document storage.

See the complete guide to ID verification costs and pricing models →

What the Cost of ID Verification Really Looks Like in the UK

Understanding ID verification pricing requires looking beyond the per-check headline rate to examine how different models structure their costs.

Standard Price Ranges Per Check

Basic electronic identity verification typically costs £2 to £5 per check when purchased through subscription models with monthly minimums. This includes document verification against one or two databases but often excludes sanctions screening or Companies House integration.

Enhanced identity verification with comprehensive database coverage runs £5 to £10 per check. This adds:

- credit reference agency checks,

- electoral register verification, and

- basic sanctions screening against UK financial sanctions lists

Premium ID verification, including biometric matching, liveness detection, and international sanctions screening, costs £10 to £15 per check. Most UK accounting practices don’t need this level for standard Customer Due Diligence.

Pay-as-you-go rates without subscriptions generally range from £3 to £8 per check, depending on what’s included. The higher end usually bundles risk assessment tools and ongoing monitoring capabilities.

What Practices Actually Spend Annually

Small practices onboarding 5 to 10 clients monthly spend £600 to £1,200 annually on subscription models requiring minimum monthly fees. Actual verification costs might only be £180 to £360 if charged per use.

Medium firms handling 20 to 30 new clients monthly pay £1,500 to £3,000 annually for subscriptions with higher capacity tiers. Usage-based pricing would cost £720 to £1,080 for the same volume.

The discrepancy grows during seasonal variations. Tax practices onboarding heavily in January through April, then seeing reduced intake pay for full annual capacity while using 60% of it.

These figures show how the cost of id verification escalates when firms pay for fixed capacity instead of actual usage.

The Gap Between Subscribed Capacity & Actual Usage

Most subscription models assume even monthly distribution that doesn’t match accounting practice reality. A firm subscribing to 20 checks monthly uses all 20 during tax season but only 8 in summer months.

This creates wasted capacity that firms pay for regardless. Over time, this distortion inflates the cost of id verification far beyond its apparent per-check price. Over a year, practices with seasonal patterns waste 30% to 50% of their subscribed verification capacity.

Growing firms face the opposite problem. They outgrow their subscription tier mid-year and must either upgrade to the next expensive tier or purchase additional checks at premium rates.

Bottom line: Most firms overpay for ID verification

Subscription minimums force you to pay for 100 verifications whether you perform 20 or 80.

Beyond Subscriptions: The Hidden Costs of ID Verification

The price per check represents only the visible portion of ID verification costs. Hidden expenses multiply the total cost significantly. These hidden factors are often the largest drivers of the true cost of id verification.

Paying for Unused Capacity

Subscription models charge monthly regardless of verification volume. A practice paying £90 monthly for up to 30 checks performs only 12 verifications in a quiet month, but still pays the full £90.

This unused capacity compounds over time. Firms overpaying by £40 to £60 monthly waste £480 to £720 annually on verification capacity they never use.

Minimum monthly commitments lock firms into paying even when they onboard zero new clients. Holiday periods, market slowdowns, or practice transitions all create months where verification needs drop to zero but subscription costs continue.

Staff Time on Manual Processes

Manual verification processes consume 30 to 45 minutes per client when staff must log into separate systems, transfer data manually, chase document uploads, and record results across multiple platforms.

At £25 hourly staff cost, manual verification adds £12.50 to £18.75 in labor expense per client. For practices verifying 20 clients monthly, this hidden cost totals £250 to £375 monthly or £3,000 to £4,500 annually.

Systems requiring manual audit trail documentation double this time investment. Staff spend additional minutes logging what documents they reviewed, which databases they checked, what results they obtained, and when each action occurred.

Integration gaps between verification systems and practice management software create duplicate data entry. Client information entered in your CRM must be manually re-entered into standalone verification platforms.

Compliance Risk Costs

Incomplete audit trails create HMRC supervision risks that dwarf software costs. Recent ICAS reviews found 21% of firms conducting insufficient Customer Due Diligence, which triggers enforcement actions and potential fines.

Manual processes inevitably create documentation gaps. Someone forgets to record a verification check, loses track of when sanctions screening occurred, or can’t prove which databases were queried.

These gaps don’t just risk penalties. They invalidate your entire compliance defense if money laundering occurs through your client relationship. You can’t prove you performed adequate due diligence when audit trails are incomplete.

Missing sanctions screening exposes practices to facilitating sanctioned activity. A single client slipping through without PEP or sanctions checks creates regulatory liability exceeding years of software costs. In regulatory terms, this risk forms a critical part of the overall cost of id verification. In many cases, the regulatory consequences far exceed the visible cost of id verification software itself.

Bottom line: Software is your cheapest cost

Verification fees are nothing compared to the true cost of id verification when systems are inefficient. Manual processes waste £3,000+ annually in staff time, unused subscriptions burn £500+ yearly, and compliance gaps create HMRC penalty risks exceeding years of software spending.

Subscriptions vs Pay-As-You-Go: What the Numbers Show

Understanding when each makes sense requires examining actual usage scenarios and how they affect the cost of id verification over time.

The Subscription Trap

Fixed monthly subscriptions assume consistent client intake that rarely matches accounting practice reality. Seasonal patterns, referral cycles, and market conditions create inevitable variation. When subscriptions fail to match this reality, the cost of id verification increases rapidly without improving compliance outcomes.

Practices pay for peak capacity year-round to handle their busiest months. A firm needing 30 verifications in March subscribes at that tier but only uses 12 in July. They’re paying 2.5 times actual usage for half the year.

Subscription models with tiered pricing create additional inefficiency. Moving from 20 to 25 clients monthly might jump you from a £60 tier to a £120 tier. That’s £60 extra for five additional verifications or £12 per check.

Early termination penalties and annual contracts lock practices into subscriptions even when needs change. A practice reducing focus on new client acquisition still pays monthly minimums throughout the contract term.

The PAYG Advantage

Usage-based pricing charges only for verifications actually performed, keeping the cost of id verification aligned with real client onboarding volume. Onboarding 12 clients costs £36 at £3 per check. Onboarding 30 clients costs £90. The price scales perfectly with actual usage.

Seasonal practices benefit most dramatically. Tax firms performing 40 verifications during tax season and 8 verifications in summer pay £144 annually under PAYG versus £480 to £600 under subscriptions covering peak capacity.

Growing practices avoid tier-jumping penalties. Adding clients gradually increases costs proportionally without sudden subscription upgrade jumps. A practice growing from 15 to 25 clients monthly pays £45 to £75 under PAYG versus jumping from a £60 tier to a £120 tier under subscriptions.

Every pound spent produces an actual verification, preventing the cost of id verification from being inflated by unused capacity.

Did you know?

ICAEW found that 19.3% of firms reviewed were non-compliant with AML regulations.

Why FigsFlow's Pay-As-You-Go Model Wins

FigsFlow structures pricing to reduce the cost of id verification by aligning charges with how accounting practices actually onboard clients.

The Cost Structure

FigsFlow charges £3 plus VAT per ID check with a minimum initial purchase of 10 credits. This £30 minimum gets you started without monthly recurring charges. This approach keeps the cost of id verification predictable and proportional to actual usage.

Credits never expire. Purchase 10 credits in January and use them gradually over six months.

- No penalty.

- No subscription renewal.

- No monthly minimum spend beyond initial purchase.

The alternative bundle option costs £2.10 plus VAT per check, plus a £8 monthly fixed fee. This includes risk assessment templates and Enhanced Due Diligence workflows alongside standard verification. Practices performing 15 or more verifications monthly save money with this structure.

Both options include the same verification capabilities. The pay-as-you-go model suits practices with variable onboarding volume. The bundle suits practices with consistent monthly client intake wanting risk assessment tools.

What's Included in Each ID Check

Every FigsFlow ID check provides comprehensive verification that satisfies MLR 2017 requirements without requiring multiple systems or manual processes.

Each check includes:

- Electronic verification against government databases and credit reference agencies, reading machine-readable zones on identity documents to confirm data matches official records

- Sanctions and PEP screening against financial sanctions lists, PEP databases, and adverse media sources running automatically for every client relationship

- Companies House integration verifying corporate clients, checking incorporation details, company status, and PSC register to identify beneficial owners holding 25% or more control

- Address verification confirming proof of address documents against utility databases and electoral registers

- Face match capability comparing photographs on identity documents to client selfies, preventing the use of stolen or borrowed documents for Enhanced Due Diligence situations

- Compliance certificates generating automatically with timestamped records showing what was verified, which databases were checked, what results were obtained, and when each action occurred

The system handles audit trail documentation automatically. Document uploads, verification checks, risk assessments, and senior management approvals all get timestamped without manual logging, creating the complete compliance record MLR 2017 requires.

Verify Only When You Need To

FigsFlow triggers verification when clients accept engagement letters through the integrated e-signature system. The moment they sign, verification begins.

This eliminates the gap between client acceptance and compliance checks that creates risk in manual processes. You’re not relying on someone remembering to log into a separate system and start verification.

HubSpot integration imports won deals automatically. Client data flows from your CRM to the compliance dashboard without duplicate data entry. The information is already there when verification triggers.

Ideal for Startups, Sole Practitioners &,rowing Firms

New practices benefit from no monthly commitments draining cash flow during client acquisition phases. Purchase 10 credits to verify your first clients without ongoing subscription overhead.

Sole practitioners with limited client intake avoid overpaying for enterprise-level capacity. Onboarding 3 to 5 clients monthly costs £9 to £15 under PAYG versus £40 to £90 under typical subscription minimums.

Growing firms scale verification costs proportionally with revenue growth. Adding clients increases compliance costs gradually rather than forcing premature jumps to expensive subscription tiers.

Seasonal practices align verification spending with revenue patterns. High-income months with intensive client onboarding see higher verification costs. Quiet months with limited new business see minimal compliance spending.

Start verifying clients without monthly commitments

FigsFlow’s AML module starts at £3 per check with no recurring fees. And the best part: it’s free for the first 30 days.

Claim your free trial and verify your first clients at no cost. No credit card required, no automatic subscriptions, no monthly minimums after trial ends.

So, What's Next?

At this point, the difference in the cost of id verification between subscription and usage-based models should be clear.

Here’s your action plan to switch to smarter ID verification:

Step 1: Book a FigsFlow demo

See how pay-as-you-go verification integrates with your client onboarding workflow and generates automated compliance records.

Step 2: Calculate your actual verification costs

Count completed verifications over the past 12 months and compare what you spent to what you’d pay at £3 per check.

Step 3: Review your onboarding patterns

Identify whether your practice has consistent monthly intake or seasonal variation that makes usage-based pricing more efficient.

Step 4: Start your free trial

Test FigsFlow with real clients for 30 days at no cost. No credit card required, no commitments.

Ready for your first step?

Book a FigsFlow demo and see exactly how much you could save by paying only for verifications you actually perform.

Additional Resources

- ID Verification Checklist for AML: AML ID Verification Checklist: Essential Steps | FigsFlow

- Digital ID Verification for AML: Digital ID Verification for AML: Why Switch? | FigsFlow

- ID Verification in AML with FigsFlow: ID Verification & AML: 2025 Guide | FigsFlow

- Common ID Verification Mistakes in AML: Common ID Verification Mistakes in AML | FigsFlow

- Verify Identity Through ACSP: Identity Verification Through ACSP Is Now a Business Essential

Conclusion

ID verification costs extend beyond the per-check price. Wasted subscription capacity, manual processing time, and compliance gaps from incomplete systems add up fast.

FigsFlow’s £3 per check eliminates this waste. Electronic verification, sanctions screening, Companies House integration, and automatic audit trails work together without monthly minimums or tier limits.

It’s your call. Either keep paying for capacity you don’t use, or switch to pricing that matches how you actually work.

Ready to stop overpaying for ID verification?

Frequently Asked Questions

ID verification costs range from £2 to £15 per check, depending on the provider and what’s included. Basic verification with limited database coverage starts around £2 to £5, while comprehensive checks, including sanctions screening and Companies House integration, typically cost £3 to £10 per verification.

Subscription models charge monthly fees for a set number of verifications, whether you use them or not. Pay-as-you-go charges only for verifications you actually perform. Practices with seasonal or variable client intake typically waste 30% to 60% of subscription capacity during quiet months.

A compliant ID verification check should include electronic document verification against government databases, sanctions, and PEP screening, address verification, and automated audit trail generation. For corporate clients, add Companies House integration to verify incorporation details and identify beneficial owners through PSC register checks.

This depends on your provider. FigsFlow credits never expire, so you can purchase them and use them over months without penalty. Many subscription models require a monthly minimum spending, and unused capacity disappears at the end of each billing cycle.

Automated systems eliminate 30 to 45 minutes of manual work per client by reading documents electronically, checking multiple databases simultaneously, running sanctions screening automatically, and generating timestamped audit trails without manual logging. Integration with practice management software prevents duplicate data entry.