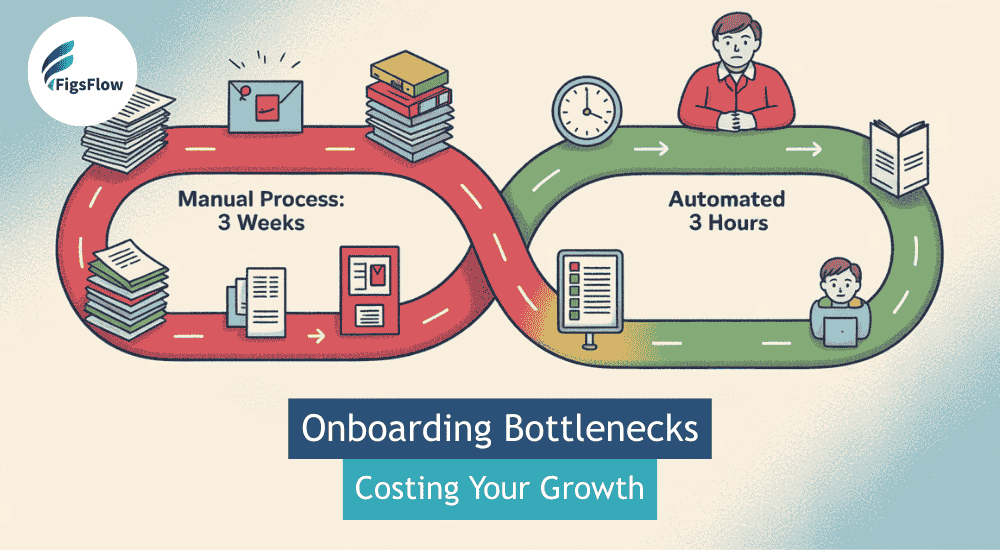

How long does it take you to onboard a new client? A week? Two weeks? Longer?

How many emails go back and forth before you have all the documents you need? Ten? Twenty?

How confident are you that every client file contains all required AML documentation? Completely certain? Mostly sure? Hoping for the best?

And here’s the big one: how many prospects have you lost because competitors simply moved faster?

If you hesitated on any of these questions, your onboarding process has a problem. And that problem is costing you growth, profit, and peace of mind. Let’s fix it. These challenges are not isolated inefficiencies. They are client onboarding mistakes that compound as firms grow.

KEY TAKEAWAYS

- Client onboarding mistakes directly affect conversion rates, AML compliance, and long-term client retention.

- Manual onboarding is one of the most costly client onboarding mistakes, causing firms to lose clients to competitors who move faster with automated systems.

- Scattered tools create compliance gaps that HMRC supervision visits expose immediately

- Delayed verification after contract signing triggers buyer’s remorse and client churn

- Inconsistent processes damage professional reputation, as quality varies by team member

- Missing audit trails expose firms to regulatory penalties during inspections

- Generic automation tools ignore accounting-specific requirements like MLR 2017 and beneficial owner verification

- FigsFlow automates the complete workflow from proposals through AML compliance for £18 monthly

What Are Client Onboarding Mistakes & Why Do They Happen?

Client onboarding mistakes are systematic failures in how accounting practices bring new clients from signed engagement letters to active service delivery. They’re predictable problems that emerge from the tension between sales momentum and compliance thoroughness. In practice, client onboarding mistakes arise when speed, compliance, and client experience are treated as competing priorities instead of complementary ones.

When you close a new client, momentum matters.

- Sign quickly.

- Collect documents fast.

- Start work immediately.

Your client is excited. Your team wants to begin. Revenue depends on it.

But compliance pulls the opposite direction. MLR 2017 requires proper verification. Complete documentation. Risk assessment. Beneficial owner identification. Sanctions screening. Enhanced Due Diligence for high-risk clients. These steps take time.

That tension creates the mistakes.

Practices trying to move fast skip verification steps. They collect documents but don’t verify them properly. They complete sanctions screening but don’t document it. They assess risk informally without recording the rationale. Speed wins but compliance suffers.

Mistake #1: Onboarding the "Wrong" Type of Client (The Filter)

Accepting the wrong-fit client is one of the most damaging client onboarding mistakes accounting firms make. Not every prospect deserves to become a client.

Some businesses are unprofitable from day one.

- Accounts so messy that cleanup takes 40 hours before you can start regular work.

- Clients who want accountancy fees but expect business advisory service.

- High-risk industries that require Enhanced Due Diligence but won’t pay for the additional compliance work.

Most practices discover these problems after signing the engagement letter. By then, you’ve invested proposal time, onboarding effort, and professional reputation. Walking away damages your image. Continuing loses money.

The mistake happens because practices treat onboarding as a sales process rather than a qualification process. Every prospect who shows interest gets a proposal. Every proposal that’s accepted becomes a client. No filtering. No qualification. No consideration of whether the relationship will be profitable or sustainable.

Here’s what accepting wrong-fit clients costs:

- Unprofitable work: Hours spent on cleanup that should’ve been scoped separately

- Compliance stress: High-risk clients requiring Enhanced Due Diligence you weren’t prepared to deliver

- Team burnout: Staff handling difficult clients who demand constant attention

- Opportunity cost: Resources spent on bad fits instead of ideal clients who refer others

Some prospects aren’t worth the engagement letter. FigsFlow helps you identify them early.

FigsFlow’s risk assessment tools help you identify red flags during the proposal stage. PEP screening. Sanctions checks. Beneficial owner complexity. Source of wealth requirements. You see compliance obligations before signing, not after. The system flags high-risk factors that trigger Enhanced Due Diligence, letting you adjust pricing or decline before investing effort.

Mistake #2: Manual Document Chasing That Loses Clients (The Friction)

Nothing kills new client excitement faster than document chaos.

Three days to send the engagement letter. A long email listing 12 required documents. Confusion about formats. Reminders about the missing utility bill. Three weeks later, you’re still chasing a passport photo.

Your client is wondering if they made a mistake.

Here’s what it costs you:

- Professional reputation: Clumsy onboarding signals disorganisation

- Lost referrals: Frustrated clients mention your “complicated process” to prospects

- Wasted time: 45 minutes per client equals 7.5 hours monthly for practices onboarding 10 clients

- Client churn: Prospects who signed choose competitors who moved faster

The problem isn’t that clients are difficult. It’s that manual processes create unnecessary friction. Generic email instructions. Unclear requirements. No guidance on formats. Clients want to comply but don’t know how.

Meanwhile, competitors with automated portals collect everything in hours. Mobile-friendly uploads. Clear instructions for each document type. Real-time tracking showing what’s missing. Liveness detection preventing fraudulent submissions.

Your manual process loses to their automation. Every time.

FigsFlow eliminates document chasing with an intelligent portal that tells clients exactly what to provide based on their type and risk profile. Companies see beneficial owner requirements automatically. High-risk clients get Enhanced Due Diligence document lists. Individuals see simplified individual verification requirements.

Mistake #3: Slow Verification Triggering Buyer's Remorse (The Speed)

Your client signs the engagement letter. They’re excited. Then… silence for two weeks while you collect documents and process paperwork.

That gap kills momentum. Slow verification is a classic client onboarding mistake that erodes confidence before meaningful work even begins.

Clients make decisions emotionally, then justify them rationally. Their emotional commitment peaks at signing. Every day of delay lets doubt creep in. They remember the other firms they considered. They wonder if competitors would’ve moved faster. By the time you start work, buyer’s remorse has damaged the relationship.

Worse: disappointed clients rarely complain directly. They just don’t refer others. They give lukewarm testimonials. “The firm is fine, but onboarding took forever.” You lose future opportunities without knowing why.

FigsFlow eliminates the gap.

The AML workflow triggers automatically when clients e-sign, electronic verification against government databases takes 30 seconds or less, and PEP and sanctions screening takes place simultaneously.

Mistake #4: Mismanaging Cleanup Expectations (The First Impression)

“Your Books are a disaster. This will take three months to sort out.”

That’s what your client hears on day one. Not “welcome to the firm.” Not “we’re excited to work with you.” Just immediate criticism of their existing setup.

Even when you’re right, the delivery creates problems.

Clients know their books are messy. That’s why they hired you. But starting the relationship by emphasising how much work you face makes them feel judged. They wonder if you resent taking them on. They question whether you’re inflating hours. They doubt whether the relationship will be positive.

The mistake happens because practices don’t separate cleanup from ongoing work during onboarding. The engagement letter combines both. Pricing doesn’t distinguish between getting current and staying current. The first conversation focuses on problems rather than solutions.

Here’s what poor cleanup expectation management costs:

- Client dissatisfaction: They feel criticised rather than supported

- Scope disputes: Unclear boundaries between cleanup and ongoing work lead to billing arguments

- Lost upsell opportunities: Clients hesitant to discuss additional services after negative first impression

- Damaged referrals: Clients remember the awkward start, not the quality work that followed

FigsFlow’s engagement letter templates let you separate cleanup from ongoing engagements. Distinct pricing. Clear scope definitions. Professional language that acknowledges the current state without blame.

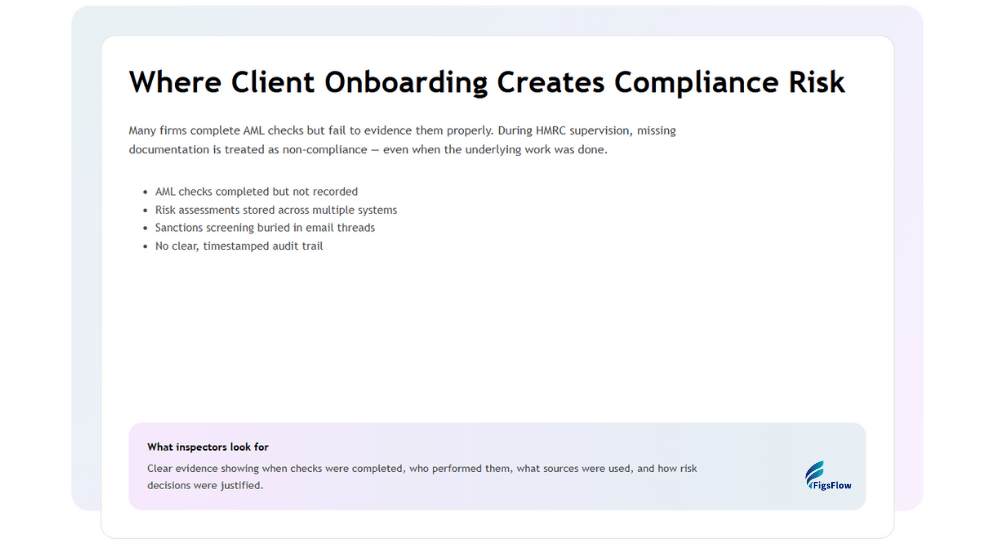

Mistake #5: Scattered Systems Creating Compliance Gaps (The Compliance)

Four different tools. Five different logins. Zero integration.

Most practices cobble together proposals, engagement letters, document storage, AML checks, and compliance filing across disconnected systems. It works until the regulator asks questions.

“Show me your complete AML documentation for this client.”

- Passport copy: Google Drive

- Risk assessment: different folder

- Sanctions screening: buried in email

- Verification date: not recorded anywhere

You completed the work but can’t prove compliance. The inspector sees failures, not scattered documentation. One gap suggests deeper problems. Routine visits become investigations.

Meanwhile, your team wastes time juggling platforms. Entering data multiple times. Maintaining manual spreadsheets that are always outdated. Logging into separate systems to check sanctions lists, verify identities, and document risk assessments.

The compliance exposure is real.

Missing audit trails expose you to penalties. HMRC expects timestamped records showing when verification occurred, who performed it, and what sources were checked. “We did the check but didn’t record it” isn’t acceptable.

Incomplete beneficial owner records violate MLR 2017 requirements. Enhanced Due Diligence triggers that weren’t identified create liability. Sanctions screening that wasn’t performed exposes you to financial crime risk.

FigsFlow eliminates fragmentation. One platform handles proposals through compliance.

- Automatic timestamped audit trails.

- HubSpot deals import automatically.

- Risk assessments trigger appropriate due diligence levels.

Mistake #6: Over-Automation Without the "Human Touch" (The Relationship)

Automation improves efficiency. But removing every human interaction damages the relationship.

Some practices automate everything.

- Proposals generate automatically.

- Engagement letters deploy through workflows.

- Client portals collect documents without staff involvement.

- AML verification runs electronically.

The entire onboarding completes without a single phone call.

Clients feel processed, not welcomed.

Accounting relationships drive referrals. Clients recommend firms where they feel known and valued. “I have a great accountant” means “I have someone who understands my business and responds personally.” Over-automation strips that connection.

The mistake happens when practices confuse efficiency with effectiveness. Yes, automation handles repetitive tasks faster. But some moments require personal attention. The welcome call after signing. The verification explanation for first-time business owners. The risk assessment discussion for complex structures.

Here’s what over-automation costs:

- Weak relationships: Clients see you as a service provider, not a trusted adviser

- Reduced referrals: Satisfied clients who don’t feel connected rarely recommend others

- Lost advisory opportunities: Automated onboarding misses chances to discuss broader needs

- Higher churn: Clients leave for competitors who provide more personal attention

FigsFlow automates admin work while preserving relationship moments. Document collection happens automatically. Verification runs electronically. Compliance workflows handle repetitive steps. But the system prompts human touchpoints at critical moments.

Mistake #7: The "Set and Forget" Compliance Trap (The Longevity)

You verify the client once during onboarding. Risk assessment: low. Sanctions screening: clear. Beneficial owners: documented. File complete.

Then circumstances change.

Your client becomes a PEP after winning a local council election. Their company structure changes with new shareholders. Their business expands into high-risk jurisdictions. Source of wealth shifts from employment to property sales. Risk factors evolve but your assessment doesn’t.

Set-and-forget compliance creates exposure over time. Treating onboarding as a one-off task is another common client onboarding mistake, particularly as client risk profiles change.

MLR 2017 requires ongoing monitoring appropriate to client risk. “We verified them three years ago” doesn’t satisfy HMRC when the client’s current circumstances trigger Enhanced Due Diligence. Sanctions lists update continuously. PEP status changes. Regulations evolve. Fragmented systems are among the most serious client onboarding mistakes because they create compliance failures that only surface during supervision visits.

The mistake happens because practices treat compliance as an onboarding task rather than an ongoing obligation. Complete verification. File documentation. Move on. No system for periodic review. No triggers for reassessment when circumstances change. No process for updating risk classifications.

Here’s what set-and-forget compliance costs:

- Regulatory penalties: HMRC supervision identifies clients whose risk profiles haven’t been updated

- Missed red flags: Changes in client circumstances that should trigger Enhanced Due Diligence go unnoticed

- Inadequate monitoring: Ongoing relationship activities that should prompt reassessment don’t

- Liability exposure: You’re responsible for maintaining current risk assessments, not historical ones

FigsFlow builds ongoing monitoring into your compliance workflow. Automatic review reminders based on risk classification. High-risk clients flagged for annual reassessment. System prompts when client circumstances change significantly.

How FigsFlow Brings It All Together

FigsFlow isn’t just AML software or proposal automation. It’s a complete onboarding platform built by accountants tired of stitching together five different systems.

The Workflow:

Create professional proposals in nine clicks (30 seconds). Built-in pricing calculators consider client risk, complexity, and market trends. Clients e-sign through the platform.

The moment they sign, compliance workflow triggers automatically. The secure portal guides clients through uploading documents based on their risk profile, adapting for individuals, companies, or trusts.

Electronic verification: 30 seconds. Sanctions screening runs simultaneously (PEP lists, financial sanctions, adverse media). Risk assessment templates help you evaluate and document classification systematically.

High-risk factors trigger Enhanced Due Diligence and route to senior managers for approval. Every action creates timestamped audit trail entries automatically. Complete compliance documentation, instantly accessible for HMRC visits.

Time Comparison:

- Manual process: 50 minutes per client

- FigsFlow: Under 3 minutes active work (more thorough verification, complete audit trails)

Cost Comparison:

- Multiple tools: £95-£320 monthly

- FigsFlow: From £18 monthly (platform + AML module, £2.10 per verification)

Scale without proportional staff increases.

Whether you onboard 5 or 50 clients monthly, workflow stays consistent and per-client time stays low. Automation handles repetitive work; your team focuses on professional judgment.

Integrates with your existing tools.

HubSpot, Xero, QuickBooks, Stripe, Companies House, Outlook, Google. Client data flows seamlessly with no duplicate entry.

Fix client onboarding mistakes without slowing your firm down

FigsFlow brings proposals, engagement letters, and AML checks into one simple onboarding workflow built for UK accounting firms.

Start your free trialAdditional Resources

- See how FigsFlow Automates Client Onboarding Process: Stop Losing Clients: FigsFlow Fixes Client Onboarding | FigsFlow

- Learn the three easy steps to complete Identity Verification: 3 Easy Steps to Client ID Verification | FigsFlow

- Explore the magic of FigsFlow & HubSpot Integration in your CRM: Enhance Client Management with FigsFlow & HubSpot Integration

- Win Clients with Automated Proposals from FigsFlow: Automate Proposals with FigsFlow and Win Clients

- Send Professional & Regulatory Compliant LOE in Seconds with FigsFlow: Draft and Send a Professional Letter of Engagement to Clients

Conclusion

Most firms don’t lose clients because of poor technical work. They lose them because unresolved client onboarding mistakes damage trust, delay progress, and weaken compliance from day one.

Addressing client onboarding mistakes early transforms onboarding from a bottleneck into a competitive advantage. While you juggle email chains and scattered systems, competitors with automated workflows are closing deals faster and scaling without adding headcount.

The gap between what clients expect and what manual processes deliver is widening. Prospects compare experiences during selection, and slow onboarding signals disorganisation before work even begins.

Purpose-built automation transforms onboarding from a bottleneck into a competitive advantage.

Transform Onboarding from Bottleneck to Competitive Advantage

Frequently Asked Questions (FAQs)

The most common mistakes include:

- manual document chasing that frustrates clients,

- using scattered systems that create compliance gaps,

- slow verification processes that trigger buyer’s remorse,

- relying on generic tools that miss accounting-specific requirements, and

- lacking standardised processes that prevent scaling.

These mistakes cost practices lost clients, wasted time, regulatory risk, and missed growth opportunities.

With manual processes, onboarding typically takes 2-3 weeks of back-and-forth emails, document collection, and verification. Automated platforms like FigsFlow reduce this to under 3 hours of total time while providing more thorough verification and complete audit trails. Faster onboarding maintains client momentum and prevents buyer’s remorse.

HMRC expects complete AML documentation, including identity verification records, proof of address, beneficial owner identification, PEP and sanctions screening results, risk assessments, and timestamped audit trails showing when each step was completed. Scattered documentation across multiple systems makes it difficult to produce these records quickly during inspections.

Generic tools lack understanding of Money Laundering Regulations 2017, beneficial owner requirements, Enhanced Due Diligence triggers, and UK accounting professional standards. They create professional-looking documents that miss critical compliance requirements, leading to gaps discovered during HMRC visits or client disputes.

Manual onboarding capacity scales linearly with headcount. Doubling client volume means doubling the administrative staff. Automated platforms handle repetitive tasks like document collection, electronic verification, and audit trail creation, allowing practices to scale from 10 to 100 monthly clients without proportional staff increases. Teams focus on professional judgment rather than admin work.

A complete checklist includes proposal creation and acceptance, engagement letter generation and e-signature, identity document collection, electronic verification against government databases, PEP and sanctions screening, risk assessment, Enhanced Due Diligence for high-risk clients, senior management approval where required, and automatic audit trail generation. All steps should integrate seamlessly without switching systems.

Clients make decisions emotionally and justify them rationally afterwards. Emotional commitment peaks at signing. Delays between signing and starting work create space for doubt. Two weeks of silence make clients question their choice, remember competitors, and wonder if others would move faster. This damages relationships before work begins and reduces referral likelihood.

Manual processes require approximately 50 minutes of staff time per client for document collection, verification, recording, and audit trail maintenance. For practices onboarding 10 clients monthly, that’s over 8 hours of billable time wasted on administrative work. Additional costs include multiple software subscriptions (typically £95-£320 monthly), lost clients who choose faster competitors, and regulatory risk from incomplete documentation.