Ever notice a client making multiple cash deposits just under $10,000?

That pattern has a name: smurfing. It’s one of the most common money laundering techniques, and as an accountant, you’re legally required to recognize it.

But here’s the problem.

Smurfing often looks legitimate. The transactions stay small. Your clients might not realize they’re breaking federal law. But regulators focus on patterns, not intentions. When those patterns appear in your client files, you’re the professional who should have spotted them.

This guide explains what smurfing in money laundering means, how to recognize the warning signs, and the specific steps you must take to protect your practice and your clients.

KEY TAKEAWAYS

- Smurfing is breaking large cash amounts into multiple smaller transactions below $10,000 using different people, accounts, or locations to avoid Currency Transaction Reports and hide the money’s origin

- Structuring means deliberately arranging transactions to evade reporting requirements – it’s illegal even with legitimate funds. Smurfing in money laundering involves structuring transactions across multiple participants and typically involves illicit funds

- Accountants must file Form 8300 for cash payments exceeding $10,000 and face potential criminal liability if they knowingly facilitate money laundering or willfully ignore obvious red flags

- Penalties for non-compliance include civil fines up to $100,000 per violation, criminal fines up to $500,000, prison sentences up to 10 years, and state license revocation

- When you suspect smurfing, document everything immediately, question the client for explanations, and terminate the relationship if answers aren’t satisfactory while consulting legal counsel about reporting obligations

- Accountants must be proactive in identifying signs of smurfing in money laundering to protect their clients.

What Is Smurfing in Money Laundering?

The Basic Definition of Smurfing in Money Laundering

Smurfing is a money laundering technique where criminals break large amounts of illicit cash into multiple smaller transactions. Each transaction stays below the $10,000 reporting threshold that triggers automatic Currency Transaction Reports to FinCEN. By keeping every deposit small, launderers avoid the scrutiny that comes with large cash movements.

The technique gets its name from those little blue cartoon characters who worked together to accomplish big tasks. In money laundering, many small deposits combine to move substantial sums into the financial system without detection. Each transaction looks innocent. Collectively, they represent serious criminal activity.

Why It's Called "Smurfing"

The individuals making these small deposits are called “smurfs.” They might be willing participants getting paid to make deposits. They could be unwitting accomplices who don’t understand they’re facilitating money laundering. Sometimes they’re employees of legitimate businesses being exploited by criminal operators.

What makes smurfing effective is the distributed nature. Instead of one person depositing $100,000, ten people each deposit $9,500 across different branches over several days. Banks see ten unremarkable transactions. Regulators see nothing triggering automatic reports. The money moves cleanly into the system.

How Smurfing Fits Into the Money Laundering Process

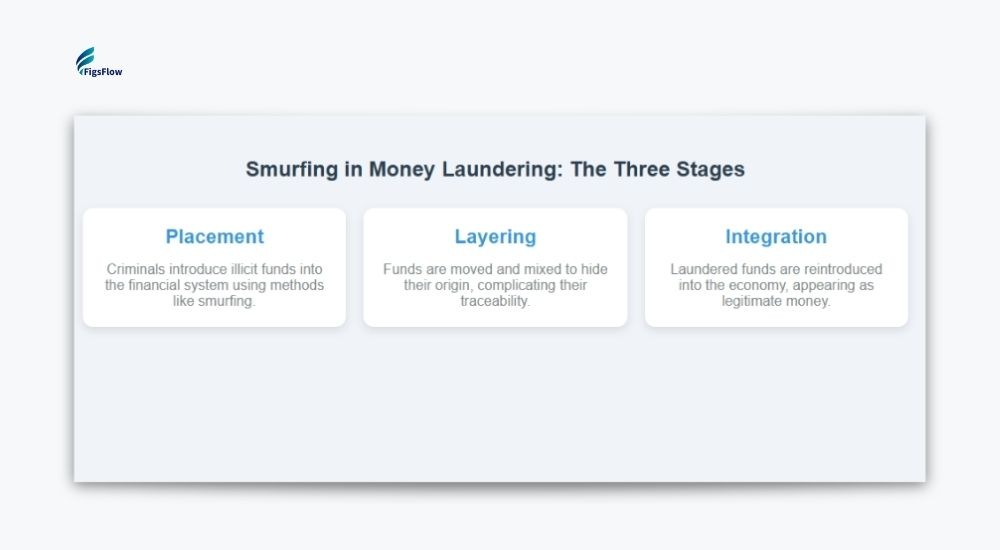

Money laundering happens in three stages:

- placement,

- layering, and

- integration

Smurfing in money laundering primarily occurs during placement, the first stage, where criminals introduce dirty money into legitimate financial channels.

During placement, the goal is simple. Get cash from illegal activities into bank accounts without raising flags. Smurfing accomplishes this by fragmenting the placement across multiple transactions, institutions, and individuals.

Once the money enters the banking system through smurfing, criminals move to layering. They transfer funds between accounts, purchase assets, conduct business transactions, and create complex paper trails. The smurfed deposits become increasingly difficult to trace back to their criminal origins.

Finally comes integration. The laundered funds reenter the legitimate economy as apparently clean money. They purchase real estate, fund businesses, or simply sit in accounts appearing as legitimate wealth.

Understanding the Complete Money Laundering Process

Smurfing in money laundering typically occurs during the placement stage of money laundering. Learn how all three stages work together, what happens after smurfed funds enter the banking system, and how criminals layer and integrate dirty money into the legitimate economy.

Smurfing vs. Structuring: Understanding the Critical Difference

Definition of Structuring Under Federal Law

Structuring is the deliberate act of breaking transactions into smaller amounts to avoid Bank Secrecy Act reporting requirements. Under federal law, structuring is illegal regardless of whether the underlying funds are legitimate or criminal.

Understanding the implications of smurfing in money laundering is crucial for compliance.

The implications of smurfing in money laundering extend beyond immediate compliance issues.

The Bank Secrecy Act requires financial institutions to file Currency Transaction Reports for any cash transaction exceeding $10,000. This includes deposits, withdrawals, currency exchanges, and other cash movements. Structuring specifically means arranging transactions to evade this reporting requirement.

Here’s the critical part that many clients misunderstand. Even if your money is completely legal, structuring those deposits to avoid the CTR is still a federal crime. The act of evasion itself violates the law.

When Structuring Becomes Smurfing

Effective identification of smurfing in money laundering practices is crucial for sustainable business growth.

Smurfing is structured with additional criminal elements. While all smurfing involves structuring, not all structuring qualifies as smurfing in the technical sense.

Smurfing specifically involves multiple people or entities making the structured deposits. A business owner making ten separate $9,000 deposits personally commits structuring. That same owner recruiting ten employees to each make one $9,000 deposit commits smurfing.

Smurfing also typically involves illicit funds from the start. The money comes from drug trafficking, fraud, corruption, tax evasion, or other criminal activity. Structuring might involve illegal deposit of legal funds. Smurfing moves dirty money through deliberate fragmentation.

Understanding how smurfing in money laundering operates is vital for effective risk management.

Why the Distinction Matters for Accounting Professionals

You need to understand this difference because your response differs based on what you observe.

A client who structures legitimate business receipts to avoid paperwork needs education about federal law. That’s a compliance issue requiring immediate correction and possibly a Suspicious Activity Report depending on the facts.

A client showing smurfing patterns with questionable income sources represents a criminal enterprise. You’re looking at potential complicity in money laundering if you continue the relationship without reporting. Your firm faces liability. Your professional license faces risk. You need to document everything and consider disengagement.

How Smurfing Works: Common Techniques

Smurfing succeeds by exploiting reporting thresholds and fragmenting transactions across time, locations, and people. Understanding these techniques helps accountants recognize patterns that individual transactions conceal.

Here are the four primary methods criminals use to structure illicit funds through the financial system.

Multiple Small Cash Deposits

The foundation of smurfing involves breaking large cash amounts into deposits that stay below the $10,000 reporting requirements. A criminal operation with $500,000 monthly might recruit fifty individuals to each deposit $9,500 across different institutions. Modern smurfers typically keep amounts under $5,000 to avoid informal scrutiny. They space transactions strategically across different days and times, avoiding patterns like weekly Tuesday deposits or repeated visits to the same branch.

Geographic Distribution Across Branches & Institutions

Spreading deposits across multiple banks and branches prevents any single institution from seeing the complete pattern. Deposits might occur at branches in different cities or states, with morning transactions at one location and afternoon deposits across town. This geographic fragmentation exploits limitations in transaction monitoring systems. While banks track activity within their own networks, they have limited visibility into customer behavior at competing institutions. Only aggregated data analysis through FinCEN reports reveals the full scope of structured transactions.

Recruiting Money Mules for Account Access

Money mules provide accounts and identities that criminals use to move illicit funds. Some mules participate knowingly for payment, while others become victims through romance scams or fraudulent employment offers. Mules might open accounts specifically for receiving criminal deposits, provide account credentials for remote transactions, or physically visit banks to make deposits for cash compensation. This creates detection complexity for accountants, as suspicious employee deposit patterns might indicate either willing criminal participation or unwitting victimization, requiring different responses.

Digital Payment Platform Structuring

Modern smurfing extends beyond cash deposits into digital payment networks and cryptocurrency exchanges. Criminals fragment large transfers through platforms like Venmo, PayPal, and Cash App, with twenty people each sending $500 to accumulate $10,000 without triggering scrutiny. Cryptocurrency adds additional layers, as criminals make multiple small Bitcoin purchases across different exchanges or ATMs, each staying below Know Your Customer thresholds. The accumulated cryptocurrency moves through mixing services before conversion back to cash through separate channels.

Why Accountants Need to Understand Smurfing

Smurfing in money laundering creates direct legal, professional, and financial risks for accounting practices. Your involvement in client financial reporting, tax preparation, and advisory services places you in the regulatory crosshairs when structured transactions appear in client records. Smurfing in money laundering can lead to serious consequences.

Understanding these risks is essential for protecting your practice and maintaining compliance with smurfing in money laundering regulations.

Your Legal Reporting Obligations

Federal anti-money laundering laws impose specific reporting requirements on accounting professionals regardless of practice area. IRS Form 8300 must be filed for any cash payment exceeding $10,000 received for professional services, including multiple related payments totaling over $10,000 within twelve months. Certain financial advisory services may trigger additional FinCEN obligations under Bank Secrecy Act regulations. Most critically, you face professional and ethical duties to avoid facilitating illegal activity, with potential criminal and civil liability if you knowingly continue relationships involving money laundering.

Client Activities That Create Practice Risk

Your work preparing financial statements, tax returns, and management reports using structured transaction data potentially provides legitimacy to money laundering operations. A restaurant client with $400,000 in annual deposits consisting of hundreds of transactions between $7,000 and $9,500 made by different individuals represents clear structuring regardless of business legitimacy. Similarly, construction clients paying subcontractors through cash and multiple small transfers from various accounts suggest smurfing, even with explanations about unbanked workers. Tax preparation creates particular exposure, as your signature on returns reporting income from smurfed deposits directly connects you to potentially illegal activity.

Protecting Your Practice from Regulatory Action

Protection requires documented policies and consistent application across all client relationships. Implement client acceptance procedures, screening for money laundering risk, engagement letters preserving your right to withdraw upon discovering illegal activity, and documentation practices demonstrating due diligence. When suspicious patterns emerge, record observation dates, questions asked, responses received, and copies of bank statements showing concerning patterns. Consider specialized insurance covering professional liability related to financial crimes, as standard malpractice policies often exclude money laundering claims. Most importantly, terminate client relationships when satisfactory explanations aren’t provided or structuring behavior continues, documenting your concerns and consulting legal counsel about SAR filing obligations.

Red Flags Every Accountant Should Recognize

Recognizing smurfing requires understanding the patterns that distinguish structured transactions from legitimate business activity. These red flags appear in bank statements, client behavior, and business structures.

Training yourself to spot these indicators protects your practice and helps you identify when clients need intervention or termination.

Suspicious Cash Transaction Patterns

Watch for frequent cash deposits just below $10,000, especially round numbers like $9,000 or $9,500 that suggest deliberate threshold avoidance. Legitimate businesses generate varied daily receipts, while consistent amounts right under reporting limits indicate structuring. Pay attention to deposits at different branch locations, multiple people making deposits to business accounts, and sudden changes in banking behavior like switching from large weekly deposits to daily small amounts.

Client Behavior Warning Signs

Legitimate business owners readily explain cash handling procedures and provide documentation, while clients involved in structuring become defensive when questioned about deposit patterns. Watch for vague explanations that don’t align with the business model, claims of privacy concerns, or insistence on paying your fees through multiple cash payments or checks from different accounts. Reluctance to provide complete bank statements is another critical indicator, as legitimate clients understand that comprehensive financial data improves service quality.

Business Structure Indicators

Cash-intensive businesses like restaurants, car washes, and check cashing services face higher scrutiny due to opportunities for commingling illegal funds with legitimate receipts. Be cautious with multiple related entities having unclear business purposes, circular transactions between entities, or ownership structures lacking economic substance. Businesses operating with minimal documentation, no formal contracts, verbal agreements for major transactions, or suspicious invoicing patterns may reflect intentional efforts to avoid creating paper trails rather than simple disorganization.

Smurfing Detection: Your Role in Prevention

Detection requires understanding reporting thresholds, recognizing your filing obligations, and knowing when to dig deeper into client activities. Your position reviewing financial records places you at a critical detection point that banks and regulators cannot access directly.

Bank Secrecy Act Reporting Thresholds

The Bank Secrecy Act establishes the $10,000 threshold for Currency Transaction Reports, applying to single transactions and related transactions that banks must aggregate. Understanding these thresholds helps you identify client structuring, as any pattern showing transactions consistently below $10,000 deserves scrutiny. Banks must also file Suspicious Activity Reports when detecting potential money laundering, regardless of amounts, meaning patterns of $5,000 deposits designed to avoid attention can trigger SARs even without crossing CTR thresholds.

Form 8300 Requirements & Overlaps

You must file Form 8300 within 15 days of receiving more than $10,000 in cash, including multiple related payments within twelve months. If clients structure payments to you through multiple cash payments under $10,000, they’re violating federal law, and you must aggregate related payments and file. The IRS defines related transactions as those connected by the same payer or occurring within connected timeframes, so a $25,000 bill paid with three $8,000 cash payments over two months requires reporting. Willfully failing to file to help clients avoid reporting creates potential criminal liability beyond simple negligence penalties.

When Client Activity Demands Enhanced Due Diligence

Enhanced due diligence means investigating deeper when standard information reveals concerning patterns. Visit business locations to verify operations match reported revenue, such as checking whether restaurant foot traffic supports claimed cash deposits. Request supporting documentation like daily cash receipts records, POS system reports, and contemporaneous sales logs that should exist if deposits reflect legitimate business. Interview key personnel involved in making deposits to ensure their explanations remain consistent with each other and observed patterns, as discrepancies suggest coaching or fabrication.

Real-World Consequences: Penalties & Enforcement

Federal and state enforcement of anti-money laundering laws carries severe financial penalties, criminal sanctions, and professional consequences. Understanding these real-world outcomes demonstrates why smurfing detection cannot be treated as theoretical compliance.

FinCEN Penalties for Non-Compliance

Understanding smurfing in money laundering will empower you to make informed decisions on client matters.

Financial Crimes Enforcement Network penalties for Bank Secrecy Act violations are substantial. Civil penalties can reach $100,000 per violation or the amount involved in the transaction, whichever is greater. Criminal penalties include fines up to $500,000 and prison sentences up to ten years.

These penalties apply to willful violations. Willful means knowing about reporting requirements and deliberately disregarding them. It also includes willful blindness, deliberately avoiding knowledge you should have.

For professionals who should know about money laundering patterns, the willful blindness standard creates risk. If suspicious patterns are obvious and you ignore them without inquiry, that could constitute willful blindness even if you didn’t have actual knowledge of money laundering.

Recent Enforcement Actions

Smurfing in money laundering is a pervasive issue that every accountant must be equipped to handle.

In 2023, federal prosecutors convicted multiple business owners across the United States for structuring violations. A Florida car dealership owner received prison time for structuring $1.2 million in deposits. A California restaurant operator forfeited assets and paid fines for structuring $800,000.

These cases typically start with bank SARs. The suspicious activity gets reported. Federal agents investigate. They subpoena records from the business and its professionals. They interview accountants, bookkeepers, and tax preparers about their knowledge and involvement.

In several cases, accounting professionals faced questioning about whether they knew about the structuring. While most weren’t charged criminally, they incurred legal fees defending themselves, faced regulatory scrutiny, and lost clients during the investigations.

State-Level Implications

Beyond federal enforcement, many states have their own money laundering and structuring laws. These state statutes sometimes carry additional penalties and create parallel enforcement actions.

State licensing boards also take action against professionals involved in money laundering schemes. CPAs have lost their licenses after being connected to client structuring. Even without criminal charges, state boards can suspend or revoke licenses based on professional misconduct.

The reputational damage extends beyond formal penalties. News coverage of money laundering investigations mentions the accountants and firms involved. Your practice suffers when potential clients see your name connected to financial crimes, even if you weren’t charged.

Proactively addressing smurfing in money laundering will significantly enhance your firm’s credibility.

What to Do When You Suspect Smurfing

Suspicion requires immediate action and careful documentation. Your response must balance professional obligations, legal requirements, and practical risk management. Following a systematic approach protects both your practice and ensures regulatory compliance.

Client education about smurfing in money laundering is an essential part of your professional responsibilities.

Document Everything First

Create a memo immediately describing what you observed, when you observed it, and why it concerns you. Include copies of bank statements showing the patterns and document all client conversations, including questions asked, explanations provided, and whether supporting documentation was offered or refused. Maintain this documentation separately from normal engagement files in a secure location with limited access, especially if you later file a SAR that must remain confidential.

Understanding SAR Filing Requirements

Suspicious Activity Reports go to FinCEN when you detect transactions suggesting possible money laundering. While traditional accounting firms aren’t usually considered financial institutions, certain activities like facilitating transactions or advising on cash management can trigger coverage. Even without direct SAR obligations, consider whether the activity requires other reporting, like Form 8300 for cash receipts. Consult with an attorney experienced in Bank Secrecy Act compliance before filing, as you cannot tell the client about the SAR.

Protecting Client Confidentiality While Staying Compliant

Client confidentiality creates tension with reporting obligations, but reporting requirements override confidentiality in specific circumstances. When you file Form 8300 or a SAR, the law explicitly permits disclosure and protects you from civil liability. Limit disclosures to what regulations mandate, file required reports with appropriate authorities, and maintain confidentiality about everything else.

When to Disengage from a Client Relationship

Not every suspicious pattern requires immediate termination. Sometimes clients make honest mistakes that education can solve.

Termination becomes necessary when clients refuse reasonable explanations for suspicious patterns or when explanations don’t hold up under scrutiny.

If you discover active money laundering, terminate it immediately. Document your concerns, send a termination letter citing your inability to continue the relationship, and consult with counsel about reporting obligations.

Best Practices for Accounting Firms

Systematic prevention requires embedding anti-money laundering controls throughout your firm’s operations. From client acceptance through ongoing monitoring, these practices create defensible compliance frameworks that protect your practice while fulfilling legal obligations.

Implementing Effective Client Screening

Prevention starts at client acceptance with risk assessments covering industry type, services needed, and exposure levels. Run background checks on new clients searching for prior criminal charges or regulatory actions while verifying business licenses. Request several months of bank statements during onboarding to understand transaction patterns and decline engagements showing immediate red flags. Include representations in engagement letters affirming clients aren’t engaged in illegal activity and stating your right to withdraw if problems arise.

Staff Training Requirements

Everyone handling client information needs training on money laundering red flags, from bookkeepers to partners. Conduct annual training covering Bank Secrecy Act basics, common techniques, and firm policies using real examples and decision trees for escalation. Document all training with sign-in sheets demonstrating your compliance culture. Create clear escalation procedures ensuring suspicious activity reaches partners quickly without staff facing retaliation for flagging concerns.

Building a Compliance-First Culture

Compliance must be core to firm operations, with partners setting the tone through dedicated resources and willingness to terminate problematic clients. Develop written policies covering client acceptance, suspicious activity identification, and reporting obligations specific to your practice areas. Conduct annual risk reassessments of existing clients, as money laundering can start at any time. Designate a compliance officer or committee responsible for reviewing suspicious activity reports, making termination decisions, and ensuring reporting obligations are met.

Additional Resources

- Understand Sanctions: What Are Sanctions? Meaning, Types & Impact on Business | FigsFlow

- Here’s how US Firms Can Stay Compliant with Cross-Border Accounting & AML: Cross-Border Accounting & AML Compliance for US Firms (2026)

- Spot These Red Flags in Financial Statements of Your Clients Before It’s Too Late: Red Flags in Financial Statements: Money Laundering USA

- Here’s Some Best CDD Practices To Ensure Compliance Under USA AML: Client Due Diligence for US Accountants: AML Risks & Rules(

- Understand Your Role as a Bookkeeper in AML Compliance: US Bookkeepers in Anti-Money Laundering (AML) Compliance

- 2024 National Money Laundering Risk Assessment (NMLRA): 2024 National Money Laundering Risk Assessment (NMLRA)

Conclusion

Smurfing destroys accounting practices.

Six-figure fines. Criminal charges. License revocation. Decades of reputation-building were erased. FinCEN, the IRS, and state boards show no mercy for accountants who miss structured transactions flowing through their client files.

Act immediately. Document suspicious activity today. Confront problematic clients this week. Terminate relationships that can’t be explained. Build screening procedures now. Train staff this quarter. Get legal guidance before you need defense counsel.

Your practice’s survival depends on the decisions you make right now.

Frequently Asked Questions (FAQs)

The three primary money laundering methods are structuring (smurfing), where criminals break large transactions into smaller amounts below reporting thresholds; cash-intensive business schemes that commingle illegal funds with legitimate receipts; and shell company operations using complex ownership structures to obscure fund sources.

Smurfing breaks large cash amounts into multiple smaller transactions below $10,000 to avoid Currency Transaction Report requirements. Criminals recruit multiple individuals or use various accounts to make deposits across different banks and branches, keeping each transaction under regulatory thresholds.

The term originates from money launderers using multiple individuals to make structured deposits, similar to how the cartoon Smurfs worked as a group. Each person acts as a “smurf,” making small deposits that collectively move large sums while staying below reporting thresholds.

Hawala is an informal money transfer system operating outside traditional banking through trust-based broker networks. While legitimate in many cultural contexts, criminals exploit hawala to move funds internationally without creating paper trails or triggering bank reporting requirements.

Bank structuring occurs when someone with $50,000 makes multiple deposits of $9,000 across different days or branches to avoid the $10,000 threshold. Another example is directing employees to each deposit $8,000 from daily receipts rather than making single larger deposits.