$850,000. That’s what one tax advisor paid for ignoring money laundering red flags.

The case seemed routine: preparing returns for an import business, except that the business was a front for laundering drug proceeds. The preparer claimed ignorance. FinCEN wasn’t convinced.

Here’s the uncomfortable truth: criminals deliberately target tax advisors.

The 2024 National Money Laundering Risk Assessment classified tax professionals as high-risk enablers, highlighting their role in schemes that obscure beneficial ownership and legitimize criminal proceeds. For US tax advisors, the stakes have never been higher.

This guide explains the common AML risks in tax preparation, your legal obligations, how to recognize red flags, and practical steps to build a compliant practice. The consequences of ignorance are too severe to ignore.

KEY TAKEAWAYS

- Tax preparers face severe penalties for AML violations, including $500,000 fines, 20-year imprisonment, and license revocation

- You must file Form 8300 when receiving more than $10,000 in cash and watch for clients structuring transactions to avoid this threshold

- Red flags include clients being evasive about ownership, using unnecessary offshore structures, or resisting compliance questions

- Customer due diligence requires verifying client identity, understanding beneficial ownership, and conducting risk-based assessments

- Build an AML framework with client risk assessments, enhanced due diligence procedures, ongoing monitoring, and staff training

What Are AML Risks in Tax Preparation?

Defining AML Risks in Tax Preparation

AML risks in tax preparation refer to the potential for tax professionals to be unwittingly (or wittingly) used by criminals to legitimize illicit funds, conceal asset ownership, or facilitate tax evasion. These risks emerge when criminals exploit tax services to move, layer, or integrate “dirty money” into the legal financial system.

The core problem is structural. Tax preparers help clients minimize tax liability through legal planning and optimization. This legitimate work involves the same tools criminals need:

- creating entities,

- structuring ownership,

- managing offshore accounts, and

- documenting income sources

The line between legal tax planning and money laundering facilitation can be razor-thin.

Consider a typical engagement: a client arrives with complex business arrangements and international transactions. But what if those arrangements exist primarily to hide criminal proceeds? What if the consulting income actually represents bribes? What if the offshore trust was established to evade sanctions?

A properly filed tax return creates a paper trail that suggests income is legitimate. This is why organized crime syndicates, corrupt officials, and fraudsters specifically target tax professionals as enablers.

Why Tax Preparers Are Vulnerable to Money Laundering

Tax professionals occupy a unique position in the AML ecosystem. Unlike banks or money services businesses that face comprehensive AML regulations, tax preparers operate in a grey zone with expectations that often exceed explicit requirements.

Several factors create this vulnerability:

Intimate Financial Access

Tax preparers have complete knowledge of client finances, business structures, and asset holdings. You often see the financial picture more clearly than banks do. This makes you valuable to criminals who need someone with both technical expertise and system access.

Professional Culture

Tax preparers are trained to advocate for clients, minimize tax burden, and maintain confidentiality. These professional values can be exploited. A client’s insistence on “privacy” might feel like normal tax planning prudence, but it could mask money laundering.

Business Model Pressure

Tax preparation is competitive and price-sensitive. When a wealthy client arrives with complex needs and promises ongoing business, the financial incentive to overlook red flags is real. Asking too many questions might mean losing lucrative engagements.

Technical Complexity

Modern tax planning legitimately involves trusts, offshore structures, and complex transactions. Distinguishing between sophisticated tax optimization and money laundering schemes requires expertise most preparers don’t have. Criminals exploit this complexity, presenting arrangements that look professionally designed but serve criminal purposes.

Lack of Awareness

Many tax preparers simply don’t know they have AML obligations. The requirements aren’t as clear-cut as they are for banks. There’s no dedicated regulator sending examination teams. The result is widespread ignorance about legal responsibilities, leaving practitioners exposed to both criminal exploitation and regulatory penalties.

The Legal Framework: AML Requirements for US Tax Advisors

Understanding your AML obligations starts with recognizing that tax preparers exist in an evolving regulatory landscape. While you’re not subject to the same comprehensive AML program requirements as banks, you do have specific legal obligations that carry serious penalties for non-compliance.

The Bank Secrecy Act & Form 8300

The Bank Secrecy Act establishes the foundation for AML obligations in the United States. For tax preparers, the most direct requirement comes through Form 8300, which must be filed when you receive more than $10,000 in cash in a single transaction or related transactions.

This isn’t optional. Failure to file Form 8300 can result in penalties up to $25,000 per violation, and criminal penalties include fines up to $250,000 and five years imprisonment. The IRS has made clear that “cash” includes cashier’s checks, bank drafts, traveler’s checks, and money orders with face amounts of $10,000 or less.

The reporting requirement triggers when you receive cash in your trade or business. This means if a client pays your fee in cash exceeding $10,000, you must file. It also applies if you’re aware that the client used cash in related transactions, even if you didn’t directly receive all of it.

FinCEN's Expectations

The Financial Crimes Enforcement Network (FinCEN) has increasingly signaled that tax professionals fall under broader AML expectations, even without explicit statutory requirements. Several guidance documents and enforcement actions make clear that tax preparers are expected to recognize and report suspicious activity.

While tax preparers aren’t currently required to file Suspicious Activity Reports (SARs) the way banks are, FinCEN has indicated this could change. More importantly, if you knowingly assist in money laundering or structuring transactions to avoid reporting requirements, you face criminal liability under existing laws.

The practical expectation is that tax professionals should conduct reasonable due diligence on clients, understand the source of funds being reported, and refuse engagements where money laundering is suspected. Courts have upheld prosecutions of tax preparers who were willfully blind to obvious criminal activity.

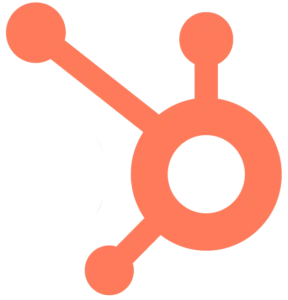

Five Major AML Risks in Tax Preparation

Understanding the specific ways criminals exploit tax services is essential for protecting your practice. These five AML risks in tax preparation represent the most common vulnerabilities that tax professionals face.

Client Identity & Beneficial Ownership Concealment

Criminals use layers of companies, trusts, and nominees to hide their involvement. You might prepare returns for a corporation with a legitimate registered agent, never knowing the beneficial owner is under indictment for fraud or sanctions evasion. When clients are evasive about ownership, refuse to provide beneficial owner information, or present unnecessarily complex structures for their business size, you’re facing significant risk.

Complex Tax Structuring & Offshore Schemes

Legitimate tax planning often involves trusts, holding companies, and offshore entities. Criminals exploit this by presenting identical structures for money laundering purposes. Red flags emerge when structures lack a business purpose beyond tax reduction, involve secrecy jurisdictions with weak AML controls, or change frequently without a clear reason.

Cash-Based Transactions & Structuring

Cash remains the lifeblood of money laundering. “Structuring” refers to deliberately breaking up transactions to stay under the $10,000 Form 8300 threshold. A client might pay your $15,000 fee with two $7,500 cashier’s checks specifically to avoid reporting. Clients who insist on cash payments or show unusual concern about the $10,000 reporting threshold warrant heightened scrutiny.

Tax Evasion as a Predicate Offense

Many tax preparers don’t realize that tax evasion itself is a predicate offense for money laundering. When a client evades taxes and then takes steps to conceal the unreported income, they’re committing money laundering. If you help prepare false returns showing legitimate sources for income that’s actually unreported, you’re potentially facilitating money laundering.

Politically Exposed Persons (PEPs) & High-Risk Clients

PEPs include current or former senior government officials, their family members, and close associates. These individuals present elevated corruption and money laundering risks because they may have opportunities to receive bribes or embezzle public funds. When a client or beneficial owner is a PEP, especially from a country with high corruption levels, enhanced due diligence is essential.

Recognizing these five risk categories allows you to implement targeted controls and escalate concerns when red flags appear.

How to Spot AML Risks in Tax Preparation: Red Flags for Tax Preparers

Recognizing warning signs early is your first line of defense against AML risks in tax preparation. These red flags don’t automatically indicate criminal activity, but they warrant enhanced scrutiny and documentation.

Secrecy & Evasiveness

The client refuses to provide basic information about business operations, ownership structure, or source of funds. They become defensive when asked routine questions about their financial affairs or insist on extreme confidentiality, such as demanding you not document certain aspects of their situation.

Inconsistent or Implausible Information

Financial records don’t match the client’s stated business activities or income sources. The client’s lifestyle and assets appear inconsistent with reported income, or documentation looks altered or manufactured. A consulting business that can’t explain its services or clients raises immediate concerns.

Unusual Business Structures & Jurisdictions

The corporate structure is unnecessarily complex for the size and nature of the business. Ownership chains involve numerous jurisdictions, particularly those on FATF’s high-risk lists or known for weak AML controls. The client maintains offshore accounts without plausible business reasons and provides vague explanations when questioned.

Suspicious Transaction Patterns

The client makes large cash deposits inconsistent with their stated business or structures transactions to fall just below reporting thresholds. Funds move rapidly between accounts with no clear business purpose, or transaction timing seems designed to avoid scrutiny, such as occurring right before reporting deadlines.

Resistance to Compliance

The client pressures you to expedite work in ways that would compromise due diligence. They become agitated when you mention filing requirements like Form 8300, ask you to omit information from returns, or threaten to take their business elsewhere when you ask compliance-related questions.

When you encounter multiple red flags in a single engagement, the risk increases exponentially and warrants serious consideration of whether to accept or continue the client relationship.

Your Clients Are Structuring Payments. Now What?

Your Legal Responsibilities Under AML Regulations

Understanding your legal obligations is essential for protecting your practice from criminal and civil liability. While tax preparers don’t face the same comprehensive AML program requirements as banks, you do have specific legal responsibilities that carry serious penalties for non-compliance.

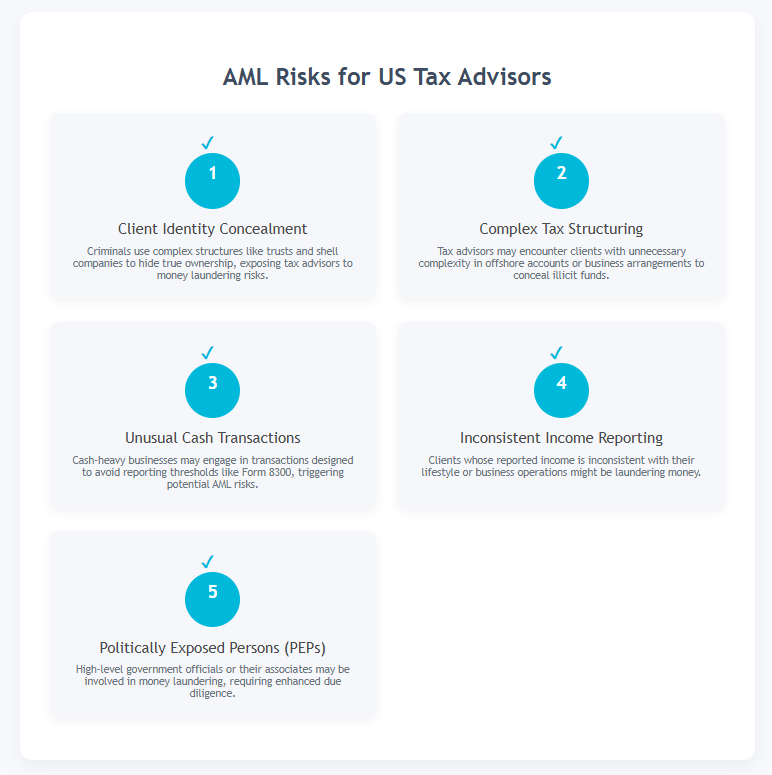

Your core AML obligations include:

-

Customer Due Diligence (CDD)

Verifying client identity, understanding beneficial ownership, and conducting risk-based assessments of all client relationships.

-

Form 8300 Reporting

Filing reports when you receive more than $10,000 in cash in a single transaction or related transactions.

-

Suspicious Activity Response

Disengaging from client relationships when you identify money laundering red flags and potentially reporting suspicious activity to authorities.

-

Record-Keeping

Maintaining comprehensive documentation of your due diligence efforts, client communications, and compliance decisions for at least five years.

For a detailed understanding of how to implement these obligations in your practice, refer to the following sections.

Customer Due Diligence (CDD) Requirements

Customer Due Diligence forms the foundation of AML compliance for tax preparers. The expectation is clear: you must know your client.

At a minimum, verify client identity through government-issued identification. For business entities, obtain formation documents and identify individuals with ownership or control. The Corporate Transparency Act now requires many entities to report beneficial ownership information to FinCEN, and tax preparers should obtain this information as part of standard intake procedures.

Beyond basic identification, understand the nature of the client’s business, the purpose of your engagement, and the anticipated scope of services. Your CDD intensity should match client risk levels. A local small business owner requires basic CDD. A client with offshore entities, complex ownership structures, and cash-intensive businesses demands enhanced due diligence, including bank statements, professional references, or adverse media searches.

Form 8300 Reporting Requirements

Form 8300 must be filed when you receive more than $10,000 in cash in a single transaction or related transactions. This isn’t optional.

Failure to file can result in penalties up to $25,000 per violation, and criminal penalties include fines up to $250,000 and five years imprisonment. “Cash” includes cashier’s checks, bank drafts, traveler’s checks, and money orders with face amounts of $10,000 or less.

The requirement triggers when you receive the cash in your trade or business, including client fee payments. Watch for “structuring,” where clients deliberately break up transactions to stay under the $10,000 threshold. Accepting structured payments makes you complicit.

Suspicious Activity Reporting (SAR) Obligations

While tax preparers don’t currently have a statutory SAR filing requirement, if you suspect a client is using your services for money laundering, you have legal and ethical obligations to act.

Knowingly assisting in money laundering is a federal crime carrying up to 20 years imprisonment. “Knowingly” includes willful blindness. If you have a reasonable suspicion of money laundering, continuing to provide services could constitute criminal facilitation.

The appropriate response is to disengage from the client relationship. This must be done carefully to avoid “tipping off” the client, as this itself can be a crime under 18 USC 1517. Consult with legal counsel experienced in AML matters before taking action. If you’ve already received cash payments triggering Form 8300 obligations, file that form even if you’re terminating the relationship.

Record-Keeping & Documentation Requirements

Robust record-keeping serves as your best defence against allegations of AML violations. Comprehensive documentation demonstrating your due diligence and decision-making process is essential.

For Form 8300 filings, retain copies for five years, including supporting documentation showing how you determined the amount, identified the payer, and verified transaction details. Beyond statutory requirements, maintain detailed engagement files showing your client acceptance process, due diligence performed, and questions asked about their business and financial situation.

For ongoing clients, document significant changes in their circumstances. If a client suddenly reports substantially higher income or opens offshore accounts, your file should reflect the questions you asked and the answers received. When terminating a client relationship due to AML concerns, document objective factors without explicitly stating you suspect money laundering.

Consequences of AML Non-Compliance

The penalties for AML violations by tax preparers are severe and career-ending. Understanding the full scope of potential consequences of AML Non-Compliance underscores why compliance must be taken seriously.

Federal money laundering convictions carry fines up to $500,000 or twice the value of the property involved, plus imprisonment up to 20 years. The Department of Justice has successfully prosecuted tax preparers who facilitated money laundering schemes with substantial sentences. Violations of Form 8300 requirements carry penalties up to $25,000 per violation, and if violations were due to intentional disregard, penalties have no statutory cap.

State boards of accountancy can suspend or revoke CPA licenses based on criminal convictions or professional misconduct. The IRS Office of Professional Responsibility can impose suspension or disbarment from practice before the IRS, effectively ending your ability to represent clients in tax matters. Once you lose your professional license, rebuilding a tax practice becomes nearly impossible.

Beyond legal penalties, reputational damage may be the longest-lasting consequence. News of criminal charges or regulatory penalties spreads quickly in professional communities. Referral sources dry up, clients leave, and even if you’re ultimately exonerated, the stigma can follow you for years. Legal defence in a federal criminal case typically costs hundreds of thousands of dollars, and lost business during investigations adds to the economic toll.

The message is clear: the cost of non-compliance far exceeds any investment in proper AML procedures.

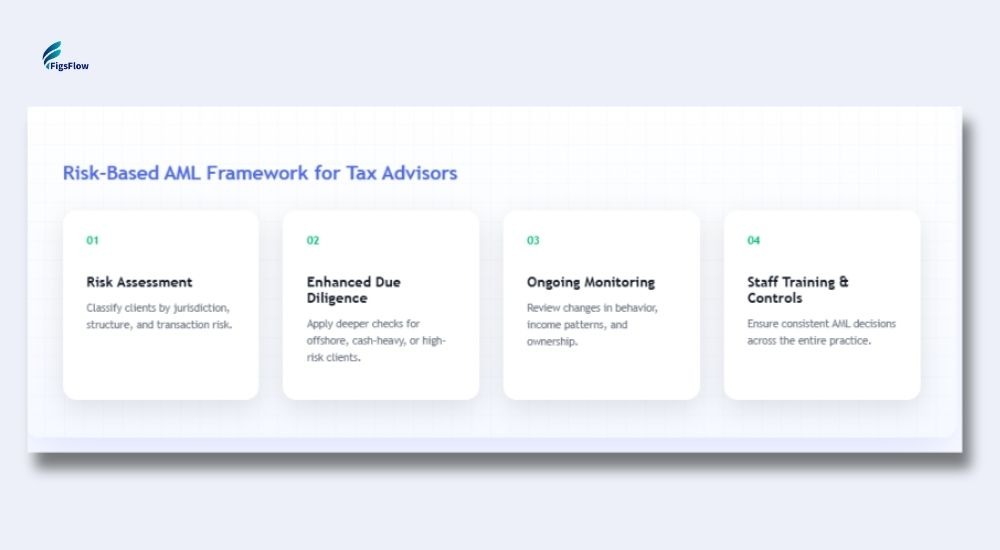

Building Your Risk-Based AML Framework

Effective AML compliance doesn’t require expensive software or consultants. It requires a systematic, risk-based approach applied consistently across all client engagements.

Here are the four essential steps to build your AML framework:

Step 1: Assess Client Risk Levels

Create a client risk assessment questionnaire covering business operations, ownership structure, jurisdictions involved, and transaction types. Assign risk ratings using a simple three-tier system: low risk (local small business with transparent ownership), medium risk (some complexity present), and high risk (multiple red flags or offshore connections). Build in annual reviews for existing clients and escalation protocols for high-risk prospects.

Step 2: Conduct Enhanced Due Diligence

For higher-risk clients, obtain organizational charts showing complete ownership chains to individual beneficial owners. When offshore connections exist, understand the business purpose and request account statements and formation documents. For cash-intensive businesses, compare reported receipts to industry benchmarks and request bank statements. Conduct adverse media searches and obtain references from other professional service providers.

Step 3: Monitor Clients Continuously

Establish monitoring procedures tied to your regular service delivery. During annual tax return preparation, review whether reported income and activities match expectations. Watch for changes in ownership, control, or client behavior during engagements. Set calendar reminders for periodic file reviews on high-risk clients every six months, even without active engagement work.

Step 4: Train Staff & Implement Controls

Conduct initial AML training for all client-facing staff covering what money laundering is, why tax preparers are vulnerable, and what red flags to watch for. Provide annual refresher training using case studies from enforcement actions. Create written policies and procedures staff can reference, implement supervisory review of high-risk client acceptances, and establish a confidential whistleblower mechanism.

A documented, risk-based AML framework protects your practice, demonstrates good faith compliance efforts, and ensures consistent application of procedures across all client relationships.

Tools and Resources for AML Compliance in Tax Preparation

- Financial Crimes Enforcement Network (FinCEN): Provides guidance documents, advisories, and FAQs for AML compliance: United States Department of the Treasury Financial Crimes Enforcement Network – Home | FinCEN.gov

- IRS Return Preparer Office: Offers resources on tax-related financial crimes and Form 8300 requirements: Tax professionals | Internal Revenue Service

- A Perfect Storm is About to Hit Tax Advisers Very Soon: 2026 US Tax Changes Guide for Advisers | FigsFlow

- Complete Guide to Cross-Border AML Compliance for US Accounting & Advisory Firms: Cross-Border Accounting & AML Compliance for US Firms (2026)

- Spot These Money Laundering Risks in Client’s Financial Statements Before FinCEN Does: Red Flags in Financial Statements: Money Laundering USA

Conclusion

The cost of AML non-compliance is career-ending.

Federal prosecutions. Six-figure penalties. Stripped licenses. Years of practice-building gone. Tax preparers face the same enforcement scrutiny as banks, with less guidance and fewer resources.

Effective AML compliance protects your practice from criminal entanglement and attracts quality clients who value thoroughness over shortcuts. Start with the basics: assess client risk, verify beneficial ownership, document due diligence, monitor for changes, and train your team. When red flags appear that can’t be resolved, walk away.

Money launderers deliberately target tax preparers because legitimate tax returns provide cover for dirty money. Don’t become an unwitting accomplice.

Your practice’s future depends on treating AML compliance as seriously as you treat tax technical knowledge.

Frequently Asked Questions (FAQs)

AML risk assessment identifies four distinct categories. Customer Risk Assessment examines money laundering vulnerabilities associated with specific clients. Product and Services Risk Assessment analyzes risks related to financial products offered. Geographical Risk Assessment considers risks connected to transaction locations and jurisdictions. Business Risk Assessment evaluates inherent risks within the organization’s overall operations.

Five primary AML red flags include: unusually large transactions inconsistent with the client’s profile, deliberate structuring of payments to avoid reporting thresholds, complex layering arrangements involving multiple transfers, reliance on shell companies to obscure ownership, and sudden, unexplained increases in wealth without legitimate income sources.

The $3000 rule requires financial institutions to verify and record the identity of anyone purchasing money orders, bank checks, cashier’s checks, or traveler’s checks with cash exceeding $3,000. This documentation is maintained as part of AML compliance obligations.

Tax advisors guide businesses and individuals through complex tax regulations. They combine expertise in tax law, finance, and accounting to help clients minimize legitimate tax obligations while maintaining compliance. Services include analyzing financial situations, preparing tax filings, and representing clients before tax authorities.

Tax advisors must provide accurate, honest advice based on current tax law while maintaining client confidentiality. They must refuse to assist in tax fraud or evasion schemes and ensure all filings contain truthful information. Ethical tax advisors prioritize compliance and integrity over client pressure to take questionable positions.

Tax advisors are known by several professional titles, including tax consultant, tax specialist, tax accountant, enrolled agent, tax attorney, and tax preparer. These professionals share taxation expertise but may have different credentials and scopes of practice.