When did you last update your firm’s AML risk assessment? Can you explain the three stages of money laundering to a new team member? Do you know which client activities require a Suspicious Activity Report?

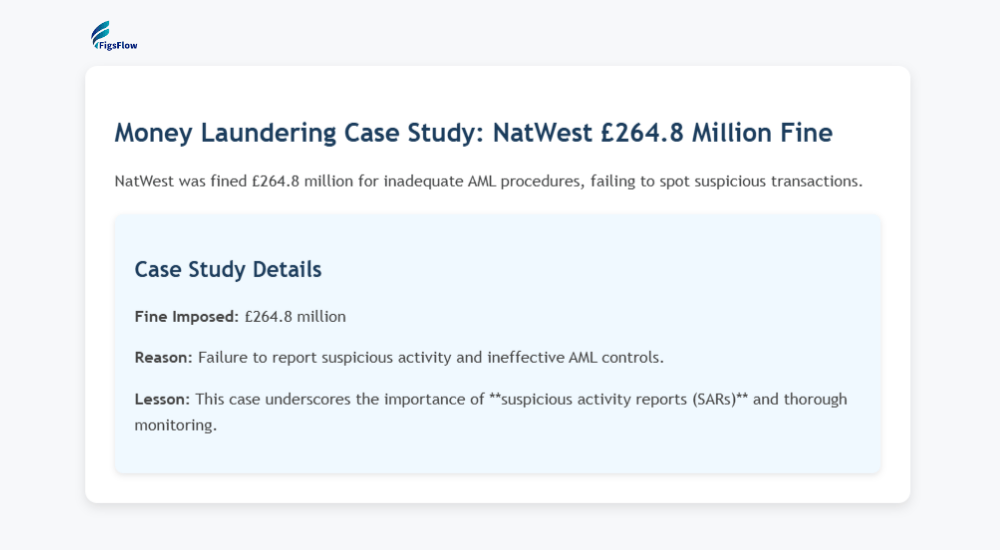

These questions matter because the penalties for getting them wrong are severe. NatWest’s £264.8 million fine, Metro Bank’s £17 million penalty, and Starling Bank’s £29 million settlement weren’t punishment for criminal behaviour. They were consequences of inadequate AML procedures and missed red flags.

But don’t worry.

This guide covers the definition and process of money laundering, real UK examples, your obligations under the Money Laundering Regulations 2017, warning signs to recognise during client work, and prevention strategies that satisfy regulators while protecting your firm.

Sounds good! Let’s dive in.

KEY TAKEAWAYS

- Money laundering conceals criminal proceeds through three stages: Placement (introducing funds), layering (obscuring origins), and integration (legitimising proceeds)

- UK accountants face direct obligations under MLR 2017, including client due diligence, risk assessments, ongoing monitoring, and suspicious activity reporting

- £100 billion is laundered through UK financial systems annually, with accountants regularly exploited as unwitting facilitators

- Non-compliance carries severe consequences: up to 14 years imprisonment, unlimited fines, and professional practice closure

- The cost of compliance is minimal compared to the cost of failure: reputation, practice, professional registration, and personal freedom

What Is Money Laundering?

What Is Money Laundering?

Money laundering is the process criminals use to disguise the origin of illegally obtained funds, making “dirty money” appear legitimate.

Money Laundering as per The Proceeds of Crime Act 2002

The process by which the proceeds of crime are converted into assets which appear to have a legitimate origin, so that they can be retained permanently or recycled into further criminal enterprises.

Money Laundering matters for UK accountants for three critical reasons.

- First, professional services firms are primary targets. Criminals need legitimate businesses to process funds, and your professional credibility makes you valuable

- Second, MLR 2017 places direct obligations on HMRC-supervised practices: client due diligence, risk assessments, ongoing monitoring, and suspicious activity reporting

- Third, the penalties for failures are catastrophic: criminal prosecution, unlimited fines, and practice closure

The scale is staggering. The National Crime Agency estimates £100 billion is laundered through UK systems annually. Over 460,000 Suspicious Activity Reports are filed each year. The Metropolitan Police’s Proceeds of Crime unit alone seizes £180 million in criminal assets annually.

How Money Laundering Works: 3 Key Stages Explained

Money laundering follows a predictable pattern. Three stages. Each is designed to distance criminal proceeds from their illegal source.

Stage 1: Placement (Introducing Dirty Money)

What Is Placement in Money laundering?

Placement is when criminals first introduce illicit funds into the legitimate financial system. This is the most vulnerable stage because large cash amounts or suspicious transfers attract attention.

Common placement methods include:

- Structuring (Smurfing) – Criminals divide large sums into smaller deposits below £10,000 reporting thresholds, spreading transactions across multiple accounts and time periods.

- Cash-Intensive Businesses – Car washes, restaurants, and retail shops mix illegal cash with legitimate daily takings.

- High-Value Goods – Converting cash into portable assets like luxury watches, jewellery, or vehicles.

- Business Account Deposits – Using apparently legitimate company accounts to disguise illegal fund origins.

UK accountants encounter Placement through unexplained cash deposits on client bank statements, cash-heavy businesses with revenue inconsistent with their premises or staffing, or vague source of funds explanations during client onboarding.

Here's a practical example of Placement in Money laundering.

A restaurant owner takes £2,000 in legitimate daily sales, adds £2,000 of drug proceeds, and deposits £4,000. The bank sees normal business activity. HMRC sees declared income. The criminal has placed dirty money into the banking system.

Stage 2: Layering (Obscuring the Trail)

What Is Layering in Money Laundering?

Layering creates distance between funds and their criminal source through complex transactions. Multiple transfers, currency conversions, asset purchases, and investment movements make tracing progressively harder. By the time investigators work backwards, the trail has gone cold across jurisdictions and transaction types.

Common layering techniques include:

- International Wire Transfers – Moving funds through multiple countries, particularly those with weak AML enforcement.

- Shell Company Transactions – Transferring funds between entities with no genuine business purpose, creating paperwork that appears to justify movements.

- Trade-Based Laundering – Using falsified invoices to move money. Over-invoicing exports sends extra funds abroad. Under-invoicing imports brings money back.

- Real Estate Transactions – Converting cash into property, then property back into clean sale proceeds.

- Cryptocurrency Conversions – Exploiting digital asset anonymity through mixing services and chain-hopping.

- Investment Purchases – Creating legitimate-looking portfolio statements through stocks, bonds, or collective funds.

This stage matters for accountants because you’re reviewing exactly these transactions: supplier payments, international transfers, related-party arrangements, and investment purchases. Your transactional review either detects layering or allows it to continue.

Here's a practical example of Layering in Money Laundering.

A UK company pays £150,000 to a Hong Kong supplier for components worth £50,000. The inflated invoice disguises £100,000 of laundered funds as legitimate trade. Professional invoices, shipping documents, and correspondent bank transfers make it appear routine.

Stage 3: Integration (Legitimising Criminal Proceeds)

What Is Integration in Money Laundering?

Integration is the final stage where laundered funds re-enter the legitimate economy. Criminals can now use the money freely without triggering suspicion. The funds appear to come from legitimate sources: property sales, investment returns, or business profits.

Common integration methods include:

- High-Value Property Purchases – UK real estate, particularly in London, where large transactions are common, and prices provide cover for substantial fund movements.

- Business Acquisitions – Creating operational companies that generate legitimate income and provide ongoing integration opportunities.

- Luxury Asset Purchases – Art, vehicles, and jewellery bought with clean funds, then sold through legitimate channels.

- Loan Repayments – Extracting funds from companies as debt repayment rather than taxable income.

- Dividend Distributions – Paying shareholders from apparently profitable legitimate businesses.

Your role as an accountant includes reviewing source of funds declarations for business purchases, preparing accounts showing loan repayments or dividend distributions, and advising on tax treatment of property sales. Without recognising integration patterns, you risk facilitating the final stage of money laundering.

Here's a practical example of integration in Money Laundering.

A criminal purchases a £2 million London flat using funds layered through offshore companies. Two years later, they sell for £2.3 million through a legitimate estate agent. The proceeds appear to be property investment returns. The buyer conducted due diligence. The solicitor handled conveyancing. Everyone involved saw a standard high-value transaction. The criminal now has £2.3 million of completely clean funds.

Money Laundering Examples: UK & Global Case Studies

Money laundering isn’t abstract regulatory theory. It happens in ordinary businesses with professional advisers who missed the warning signs.

Here are three UK cases that demonstrate what money laundering looks like in practice.

The Greater Manchester Restaurant Chain

A restaurant chain operated fifteen locations across Greater Manchester, reporting daily takings of £8,000 per site. HMRC investigation revealed that the actual legitimate revenue was only £4,500 per site. The difference of £3,500 daily per location represented drug trafficking proceeds. Over three years, the operation laundered £19.2 million. The accountant who prepared annual accounts without questioning the revenue-to-footfall ratio faced professional sanctions and criminal investigation. The practice closed.

The London Law Firm Client Account

A London law firm’s client account received £840,000 from a Hong Kong entity described as “property investment funds.” The solicitor transferred £780,000 to a UK property purchase after keeping £60,000 in fees. The Hong Kong source turned out to be a shell company controlled by a politically exposed person facing corruption charges. The law firm failed to meet enhanced due diligence requirements. The Solicitors Regulation Authority imposed a £250,000 fine, and two partners received 12-month practice suspensions.

The Import-Export Business Over-Invoicing

An import-export business showed supplier payments to a Turkish entity totalling £4.2 million annually. Physical shipments valued by customs were only £1.8 million. The company over-invoiced by 133%, moving £2.4 million of criminal proceeds offshore, disguised as legitimate trade. The accountant prepared accounts showing these transactions as the ordinary cost of sales. When HMRC discovered the fraud, the accountant faced unlimited fines for failing to submit a Suspicious Activity Report despite obvious red flags.

The common pattern is clear: inadequate due diligence, failure to question inconsistent information, reluctance to submit Suspicious Activity Reports, and reliance on client explanations without independent verification.

Common Money Laundering Methods: Red Flags for Accountants

UK accountants are targeted because professional credibility grants access to financial systems, client trust enables transaction facilitation, and regulated status provides apparent legitimacy to suspicious activities.

Cash-Intensive Business Exploitation

Car washes, restaurants, nail bars, and convenience stores provide cover for mixing criminal cash with legitimate takings. Revenue patterns inconsistent with staffing, premises, or location signal potential laundering. Your responsibility: comparing reported revenue against business capacity indicators and questioning unexplained discrepancies.

Shell Company Structures

Companies House formation takes 24 hours and costs £50. Criminals exploit this ease, creating entities with no genuine trading activity, nominee directors concealing true ownership, and registered offices at formation agent addresses. Dormant companies suddenly becoming active with large transactions warrant enhanced scrutiny.

Invoice Manipulation

Over-invoicing services transfers excess funds between related parties. Under-invoicing creates undeclared offshore funds. Phantom consultancy agreements justify payments with no genuine service delivery. Round-tripping routes funds through offshore entities, then back as apparently legitimate foreign investment.

Property Transactions

London property remains attractive for laundering. Cash purchases avoid mortgage scrutiny. Below-market sales to related parties. Beneficial ownership is concealed through trust structures or offshore holding companies. Rapid purchase-and-sale cycles are inconsistent with a genuine investment strategy.

Professional Service Abuse

Client account deposits for non-existent retainers. Fee arrangements are disproportionate to the work performed. Settlement funds are routed through professional accounts to add legitimacy. Loan arrangements between professional firms and clients are lacking commercial justification.

Digital Assets & Cryptocurrency

FCA-regulated cryptoasset activities now face full AML requirements. Mixing services obscures transaction trails. Peer-to-peer platforms avoid exchange controls. Rapid conversions between fiat and crypto frustrate tracking. High-value NFT transactions create clean proceeds from dirty deposits.

UK Money Laundering Regulations: What Accountants Need

UK accountants face direct obligations under the Money Laundering Regulations 2017. HMRC supervises most accounting practices, while ICAEW, ACCA, and ICAS supervise their members.

The Money Laundering Regulations 2017

MLR 2017 requires accountants to:

- Conduct firm-wide risk assessments annually, identifying money laundering and terrorist financing risks in your client base, services, and operations

- Apply customer due diligence to all clients: verify identity using reliable sources, understand business nature and ownership structure, and determine beneficial owners controlling more than 25%

- Enhanced due diligence for politically exposed persons, high-risk third countries, complex ownership structures, or higher-risk situations

- Submit Suspicious Activity Reports (SARs) to the National Crime Agency when you know or suspect money laundering

- Maintain records for a minimum of five years: due diligence documents, transaction records, and internal reports

- Provide regular AML training to all relevant staff covering legislation, red flags, and procedures

- Appoint a nominated officer responsible for receiving internal reports and submitting SARs

Proceeds of Crime Act 2002

POCA creates three principal offences:

- Concealing criminal property; concealing, disguising, converting, transferring, or removing criminal property.

- Arranging; becoming concerned in an arrangement facilitating acquisition, retention, use, or control of criminal property.

- Acquisition, use, possession; acquiring, using, or possessing criminal property.

Your defence is authorised disclosure to the NCA before acting. This SAR submission protects you from prosecution. Tipping off after submitting a SAR is a separate criminal offence.

Penalties reach 14 years imprisonment and unlimited fines for individuals. For practices: unlimited financial penalties, supervisory sanctions, and potential closure.

Suspicious Activity Report Requirements

Submit a SAR when you have reasonable grounds for suspicion based on available facts. Not proof. Not certainty. Reasonable suspicion.

The NCA portal (ukciu.gov.uk) processes submissions 24/7. The consent regime applies when you need to proceed with a suspicious transaction: submit a SAR requesting consent, and the NCA has seven working days to respond. Proceeding without consent is a criminal offence.

The £264.8 Million Lesson

Automated Systems mean nothing without human judgment and appropriate action. Red flags without response equal regulatory catastrophe.

NatWest's record fine resulted from processing £264 million for a single Bradford jewellery business. The business deposited £365 million total, including £264 million in cash. Red flags were everywhere: cash deposits inconsistent with jewellery retail, structured amounts, and deposits across multiple branches. NatWest's systems flagged concerns 2,175 times. Staff raised alerts. The bank proceeded anyway without adequate investigation or SAR submission.

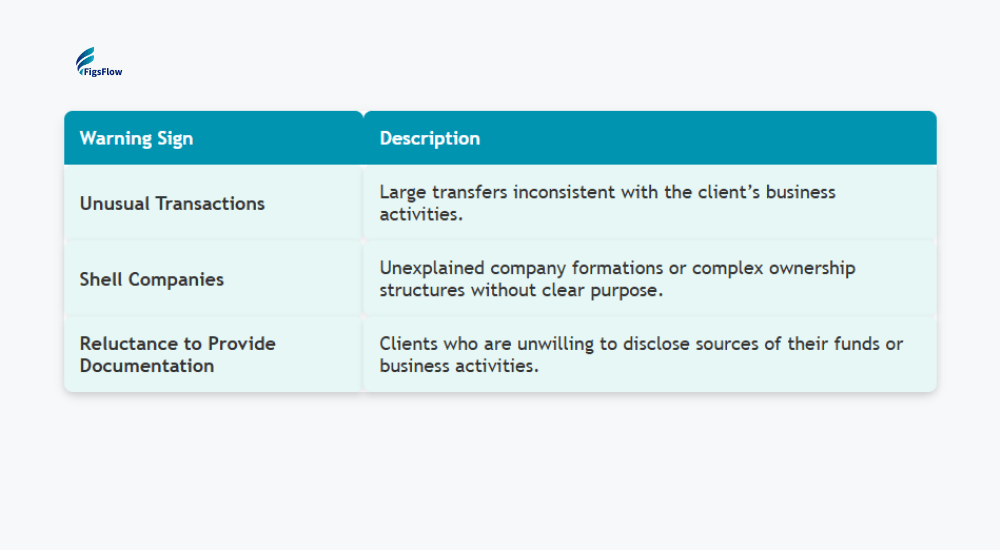

Money Laundering Warning Signs for Accountants

MLR 2017 requires you to recognise and respond to suspicious activity. These red flags demand enhanced scrutiny.

Client Behaviour Indicators

Unusual secrecy about business operations, ownership, or funding sources. Reluctance to provide identification documents or beneficial ownership details. Evasive responses about transaction purposes. Cash preference, despite the business type, is unsuited to cash. Sudden wealth increases are inconsistent with known income. Pressure to complete transactions quickly without due diligence. Indifference to tax efficiency or professional fees.

Transaction Patterns

Large transactions are inconsistent with the business type or client profile. Round-number transfers (£50,000, £100,000) suggest planned movements. Frequent international payments to high-risk jurisdictions without a business rationale. Payments just below the £10,000 reporting thresholds. Complex structures lacking economic logic. Rapid money movement between multiple accounts. Circular flows where funds return to the source through intermediaries.

Documentation & Structure Issues

An incomplete or inconsistent source of wealth documentation. Recently formed companies are conducting high-value transactions immediately. Beneficial ownership complexity through trusts, nominees, or offshore entities. Shell companies with no genuine trading activity or employees. Dormant companies are suddenly active with large transactions. Cash-intensive businesses with unusual banking patterns.

Specific UK Indicators

Companies House filings are inconsistent with the information provided to you. HMRC correspondence suggesting a tax investigation. Property acquisitions disproportionate to known income. Large cash deposits into professional client accounts. VAT registration patterns suggesting fraud. Beneficial ownership declarations contradict other information.

Red Flag Response Protocol

When suspicious activity appears:

- Document your concerns internally with specific facts and dates

- Escalate to your nominated officer immediately

- Conduct enhanced due diligence before proceeding

- Consider whether a SAR submission to the NCA is required

- Maintain detailed records of your entire decision-making process

How Accountants Can Prevent Money Laundering in UK

Effective AML prevention requires systematic implementation across your practice. These measures satisfy regulatory obligations while protecting your firm from professional and criminal liability.

Implement Robust Client Due Diligence

Take a risk-based approach proportionate to money laundering risk. Standard procedures verify identity, understand business nature, and identify beneficial owners controlling more than 25%. Enhanced due diligence applies to higher-risk situations with additional verification, detailed source of wealth investigation, and senior management approval.

Conduct Comprehensive Risk Assessments

MLR 2017 requires an annual firm-wide risk assessment covering client risk, service risk, and geographic risk. Categorise clients by risk level and tailor due diligence accordingly. Document your assessment methodology and conclusions clearly.

Establish Internal Controls & Procedures

Create written AML policies covering client acceptance criteria, due diligence procedures, monitoring frequency, and SAR submission protocols. Define clear escalation procedures and maintain records for a minimum of five years, including customer due diligence evidence, transaction records, and training documentation.

Appoint & Empower Your Nominated Officer

Designate someone responsible for receiving internal suspicious activity reports, deciding on SAR submissions to the NCA, and managing consent regime interactions. Provide adequate training, authority, and resources. Smaller firms can use external MLROs if lacking internal expertise.

Provide Regular AML Training

Train all relevant staff on POCA and MLR 2017 requirements, common money laundering methods, red flags, and firm-specific procedures. Conduct training at onboarding, annually at a minimum, and when regulations change. Document completion with signed attendance records.

Use Technology to Enhance Compliance

Digital identity verification accelerates client onboarding while meeting MLR 2017 standards. Transaction monitoring software flags unusual patterns automatically. Risk assessment platforms standardise client categorisation. FigsFlow provides UK accounting practices with automated client onboarding, AML compliance tracking, document management, and integration with practice management systems.

The combination of systematic procedures, trained staff, and appropriate technology creates defensible compliance that satisfies regulators while protecting your practice from money laundering risks.

Resources to Enhance Your Money Laundering Knowledge

- National Crime Agency SAR Submission Portal: SAR Portal | Landing page

- Role of Money Laundering Reporting Officer: Money Laundering Reporting Officer: Role & Responsibilities | FigsFlow

- Anti-Money Laundering Regulations Around the World: Anti-Money Laundering Regulations Worldwide | FigsFlow

- A Complete Guide to AML Risk for Accountants & UK Firms: Complete Guide to AML Risk for Accountants | FigsFlow

- AML Meaning- A Simple Explanation for Accountants: AML Meaning: Explanation for Accountants| FigsFlow

Conclusion

Understanding money laundering protects three critical assets: your clients, your practice, and your professional registration.

The £264.8 million NatWest fine demonstrates what happens when red flags are ignored. The Greater Manchester restaurant chain case shows how accountants become unwitting facilitators. The London law firm example proves that professional services don’t provide immunity from regulatory consequences.

Your next steps are straightforward.

- Update your firm-wide risk assessment

- Review client due diligence procedures against MLR 2017 standards

- Train staff on the three-stage laundering process and warning signs

- Empower your nominated officer with adequate authority and resources

- Implement technology that enhances rather than replaces professional judgement

The regulatory framework exists to protect you, not burden you. Use it.

Frequently Asked Questions

Money laundering disguises illegally obtained funds as legitimate income. A common example is a criminal purchasing a cash-intensive business like a restaurant, mixing illegal proceeds with genuine daily sales, and depositing the combined amount as business revenue. The illegal funds now appear to be legitimate business income that can be used freely.

The three stages are Placement, layering, and integration. Placement introduces illegal cash into the financial system through deposits or purchases. Layering obscures the criminal origins through complex transactions across multiple accounts and jurisdictions. Integration returns the cleaned funds to criminals through apparently legitimate sources like property sales or business profits.

A criminal purchases property using offshore companies funded with illegal proceeds. Several years later, they sell the property through a legitimate estate agent at a profit. The sale proceeds appear to be standard investment returns. All parties involved see routine transactions, and the criminal now has completely clean funds.

Key warning signs include unusual client secrecy about operations or funding sources, complex offshore company structures without a clear business purpose, transactions inconsistent with the client’s known business type, reluctance to provide standard documentation, and unnecessarily complicated arrangements lacking commercial logic.

The four risk management approaches are Tolerate (accept low risks with standard monitoring), Treat (implement enhanced controls for medium risks), Transfer (share risk through insurance or outsourcing), and Terminate (exit high-risk relationships). Your approach depends on risk assessment and regulatory obligations.

Legitimisation. It’s the process of transforming illegally obtained funds into apparently legitimate assets through the financial system.

Look for transactions disproportionate to known income, unexplained cash deposits, complex payment structures, recently formed companies conducting immediate high-value transactions, beneficial ownership concealed through offshore entities, and reluctance to provide documentation. Professional judgement combines multiple red flags into reasonable suspicion requiring enhanced scrutiny or SAR submission.

Money laundering is the process of concealing, disguising, or converting criminal proceeds to make them appear legitimate. Under UK law, it includes any activity that facilitates the acquisition, retention, use, or control of assets derived from criminal conduct while obscuring their illegal origins.