You’ve just wrapped up a promising consultation with a potential client. The conversation went well, they seem interested, and now they’re waiting for your proposal. You sit down to write it, and suddenly the doubts creep in: Am I explaining our services clearly enough? Is the pricing right? Will this proposal actually convince them to choose us?

If this scenario sounds familiar, you’re not alone.

Many UK accountants struggle with creating proposals that consistently win new business. The difference between a proposal that gets signed and one that gets ignored often comes down to a few critical elements most practitioners overlook.

In this guide, we’ll show you how to craft a client-winning accounting proposals that convert prospects into clients, plus give you a free template to get started.

KEY TAKEAWAYS

- Accounting proposals are sales documents that present your services, while engagement letters are the binding contracts that follow acceptance

- Every winning proposal must include seven essential components: professional branding, client needs assessment, detailed scope, credentials, transparent pricing, legal terms, and a strong call to action

- The difference between accepted and ignored proposals comes down to showing you’ve listened, being crystal clear, and making acceptance effortless

- Customise every proposal to each client’s unique situation rather than sending generic templates with names swapped

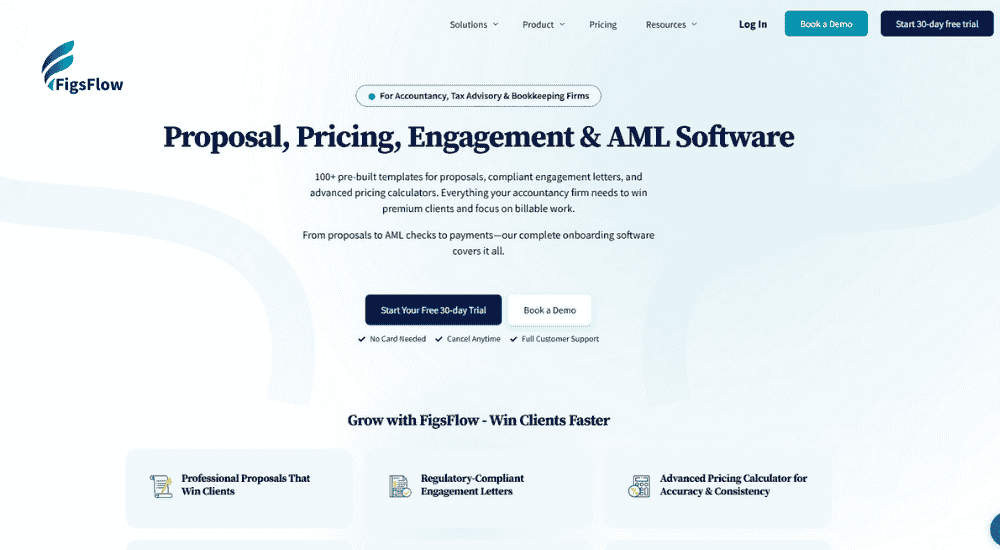

- FigsFlow generates compliant, professional proposals and engagement letters in under 30 seconds with built-in e-signatures

What Is an Accounting Proposal?

Definition of an Accounting Proposal

An accounting proposal is a formal document that presents your firm’s services to a prospective client and explains exactly how you’ll solve their specific financial challenges. Unlike a generic brochure or simple price quote, a proper accounting proposal is tailored to each Client’s unique situation.

Most effective proposals are sent after you’ve had an initial conversation or consultation with the prospect. This gives you the opportunity to understand their needs, identify their pain points, and gather the information necessary to create a personalised solution.

It’s worth noting that an accounting proposal differs from an engagement letter, though the two documents work together. Your accounting proposal is the sales document that convinces a client to work with you. Once they accept, the engagement letter becomes the legally binding contract that governs your professional relationship. Some firms combine these documents, whilst others keep them separate. Either approach can work, depending on your preferred workflow and the complexity of the services you’re offering.

A well-crafted accounting proposal serves three essential purposes for your practice.

-

Clarifies expectations.

Provides a detailed roadmap of what the client can expect, preventing misunderstandings and giving both parties a clear reference point.

-

Highlights your difference.

Showcases what sets your firm apart, whether that's industry specialisation, modern technology, responsiveness, or your proven track record.

-

Enables informed decisions.

Presents comprehensive information about your services, qualifications, pricing, and process so clients can make a confident choice without endless follow-up.

The importance of a strong accounting proposal cannot be overlooked in today’s competitive accounting landscape. With clients more informed and selective than ever, your proposal often makes the difference between winning the business and watching it go to another firm. It’s worth investing the time to get it right.

Accounting Proposal or Engagement Letter: Which Do You Need?

Understanding the difference between these two critical documents can save you from costly mistakes and protect your practice from disputes

Why a Strategic Proposal is Vital for UK Accounting Practices

In today’s competitive accounting landscape, your proposal isn’t just a formality. It’s a strategic business tool that directly impacts your practice’s growth and profitability.

The difference between firms that consistently win quality clients and those that struggle often comes down to how they approach accounting proposals.

Establishes Professional Credibility from Day One

Your proposal is typically the first substantial document a prospect receives from your firm. A well-structured, professional accounting proposal immediately positions you as an organised, competent practitioner. Conversely, a generic or poorly presented proposal raises doubts about service quality before the engagement even begins.

Protects Your Practice from Scope Creep

Clear, detailed proposals set boundaries that protect your time and profitability. When you explicitly define what’s included and what’s not, you prevent the all-too-common scenario where clients expect additional services without additional fees. This clarity protects both your margins and your client relationships.

Differentiates You in a Crowded Market

With thousands of accounting practices competing for the same clients, your proposal is often the deciding factor. A strategic accounting proposal that demonstrates genuine understanding of the client’s situation and communicates your unique value proposition gives prospects a compelling reason to choose your firm over competitors offering similar services.

Reduces Decision-Making Friction

Prospects who receive vague or incomplete proposals often delay decisions because they lack the information needed to commit. A comprehensive accounting proposal answers questions before they’re asked, addresses concerns proactively, and provides all the details needed for confident decision-making, significantly shortening your sales cycle.

When you approach proposals strategically rather than as administrative tasks to rush through, you transform them into powerful business development tools that consistently deliver results.

Why Your Proposal is Key to Winning Clients?

7 Essential Elements of a Winning UK Accounting Proposal

Creating a proposal that actually wins clients requires more than just listing your services and fees. The most effective proposals follow a proven structure that addresses client concerns, builds confidence in your expertise, and makes the next step obvious and easy.

Here are the essential components every winning accounting proposal must include:

-

Professional presentation and branding.

Your accounting proposal's appearance speaks volumes about your professionalism before the client reads a single word.

-

Client needs assessment.

Demonstrate that you genuinely understand the prospect's specific situation and challenges.

-

Detailed service scope.

Clearly define what's included in your engagement and what's not to prevent mismatched expectations.

-

Firm expertise and credentials.

Establish why your firm is the best choice through qualifications, experience, and social proof.

-

Transparent pricing structure.

Present your fees clearly with detailed breakdowns that show exactly what clients are paying for.

-

Legal and administrative elements.

Include essential terms, data security measures, and implementation timelines.

-

Strong call to action.

Guide clients toward the next step with clear, specific instructions.

Let’s explore each of these components in detail to help you craft proposals that convert.

A transparent pricing structure in your accounting proposal is essential. Learn more about setting up competitive pricing structures on the ACCA website.

Professional Presentation & Branding

First impressions matter enormously. A polished, well-branded accounting proposal signals that you’re detail-oriented and take your work seriously, whilst a poorly formatted document raises questions about service quality before the client reads a single word.

-

Strong Visual Identity

Feature a professional cover page with your firm's name, logo, and contact information. Use brand colours consistently throughout and choose fonts that are both professional and easy to read.

-

Clear Structure and Hierarchy

Maintain well-organised headings, appropriate white space, and logical flow. This helps clients navigate your accounting proposal easily and find the information they need without confusion.

-

Smart Format Selection

Traditional PDFs work well, but interactive proposals offer advantages like easy navigation on any device, package selection options, and electronic signatures without printing or scanning.

Whatever format you choose, ensure it looks professional and is easy to navigate. A cluttered or confusing document creates unnecessary friction in the decision-making process.

Client Needs Assessment

The single most important element of a winning proposal is showing you understand the client’s specific situation. Generic accounting proposals rarely win against customised ones that speak directly to the prospect’s unique circumstances.

Here’s how to demonstrate that understanding:

-

Reference Specific Challenges

Summarise what you learned during your initial consultation. Reference the challenges they mentioned, whether that's falling behind on bookkeeping, navigating MTD requirements, or managing seasonal cash flow. Use their own words when possible.

-

Demonstrate Your Homework

Include relevant details about their business: industry, size, and goals. This shows you aren't simply sending a template with their name inserted at the top.

-

Highlight Relevant Experience

If you have experience with similar businesses, mention this specifically. It reassures prospects that you understand their industry's nuances and compliance requirements.

This personalised approach demonstrates genuine interest in their success and sets you apart from competitors.

Detailed Service Scope

Vagueness is the enemy of good accounting proposals. Clients need to know exactly what you’re offering and what’s included to prevent scope creep and frustration later.

Focus on three key areas:

-

Specify What's Included

Create a detailed breakdown of each service. Rather than "monthly bookkeeping," specify: bank reconciliation, transaction categorisation, monthly profit and loss statements, balance sheet preparation, and quarterly review calls.

-

Clarify What's Excluded

Be equally clear about what's not included. If monthly management accounts don't cover ad hoc financial analysis or business planning, say so explicitly.

-

Consider Tiered Packages

Present services in tiers: Basic (essential compliance and bookkeeping), Standard (adds monthly reporting and quarterly reviews), and Premium (includes strategic advisory). This gives clients options at different price points.

Well-defined scope protects both parties and makes for healthier client relationships.

Firm Expertise & Credentials

Once you’ve shown you understand the client’s needs and defined how you’ll address them, establish why your firm is the best choice. This builds confidence in your ability to deliver.

Demonstrate your expertise through:

-

Qualifications and Experience

Detail your credentials and how long you've been practising. If you're a chartered accountant or hold relevant specialisations, make this prominent. If proposing tax services to a medical professional and you specialise in healthcare tax planning, emphasise that expertise.

-

Team Information

Include who will work on this account and their qualifications. This personalises the engagement and shows clients exactly who they'll be working with.

-

Social Proof and Track Record

Include testimonials from satisfied clients in similar industries. A brief case study showing how you solved a similar problem can be incredibly persuasive. Mention professional memberships like ICAEW, ACCA, CIOT, or ICB.

The goal isn’t to boast but to provide evidence of your expertise and track record.

Transparent Pricing Structure

Pricing is often the section prospects turn to first. How you present it significantly influences their decision. Transparency and clarity are essential, as clients become wary when pricing feels hidden or complicated.

You can build trust through:

-

Clear Fee Structure

Present your fees clearly. If you charge monthly retainers, state the amount. For hourly work, specify rates. For project work like year-end accounts or tax returns, provide fixed fees when possible. Break down costs so clients see exactly what they're paying for.

-

Upfront About Additional Costs

Be clear about additional costs like Companies House filings, VAT registrations, or HMRC enquiry responses. Specify how you'll handle out-of-scope work to prevent surprises later.

-

Detailed Payment Terms

State when invoices are issued, payment due dates, and accepted methods. This removes ambiguity and sets clear expectations from the start.

-

Value-Based Framing

Frame fees in terms of value received. Rather than "Monthly bookkeeping: £300," say "Monthly bookkeeping and management reporting: £300. Includes up-to-date records, profit and loss statements, balance sheet, and quarterly performance reviews."

Legal & Administrative Elements

Every accounting proposal needs foundational elements that protect both parties and set clear expectations for how the engagement will work.

Cover these essential areas:

-

Terms and Conditions

Outline the basic framework: liability limitations, termination circumstances, dispute resolution, and communication expectations. Whilst less exciting than other sections, this protects your practice.

-

Confidentiality and Data Security

Explain your security measures: file encryption, secure cloud storage, two-factor authentication, and UK GDPR compliance. Reference your professional indemnity insurance and money laundering regulation compliance, if relevant.

-

Implementation Plan and Timeline

Provide clear timelines for deliverables. For monthly bookkeeping, specify when work will be completed and reports delivered. For project work, break down phases and deadlines. Include transition milestones if the client is moving from another accountant.

Transparency about timelines manages expectations and reduces anxiety about the engagement process.

Strong Call to Action

After presenting all this information, guide the client toward the next step. A weak or missing call to action leaves prospects uncertain, and uncertainty leads to inaction.

Make acceptance effortless:

-

Clear, Specific Instructions

Provide direct instructions rather than vague statements. Instead of "Please let us know if you have questions," say "To accept this proposal, simply sign the agreement section below and return it by email. We'll then schedule our onboarding call and get started immediately."

-

Remove Friction

If using a modern accounting proposal system with electronic signatures, clients can review and sign with a few clicks without printing or scanning. This reduces the time between proposal and signed agreement.

-

Create Gentle Urgency

Consider appropriate urgency: limited capacity with guaranteed start dates for prompt responses, or waived setup fees for clients who sign within a week.

End on a positive note, expressing enthusiasm for the partnership.

What Makes a Client-Winning Accounting Proposal?

Understanding the essential components is important, but knowing what actually makes clients sign is equally crucial. The difference between proposals that get accepted and those that get filed away often comes down to three key factors.

It Shows You've Been Listening

The most compelling accounting proposals demonstrate a genuine understanding of the Client’s specific situation. Reference specific challenges they mentioned during consultation, whether that’s bookkeeping backlogs, MTD compliance concerns, or tax uncertainties. Use industry-specific language like CIS obligations for construction firms or NHS income management for medical practices. Your recommended services should feel tailored to their needs, and your timeline should account for their year-end Date or upcoming events.

It's Crystal Clear and Comprehensive

Confusion is the enemy of closed deals. Winning accounting proposals eliminate confusion through clarity. Every section should be easy to understand, with a specific scope, transparent pricing, and no hidden fees. Use bullet points to break down complex information and format pricing tables for quick scanning. Anticipate questions before clients ask them by addressing transition processes, data security safeguards, and potential concerns proactively.

It Makes Saying 'Yes' Easy

Even compelling proposals can fail if the acceptance process is cumbersome. Traditional proposals requiring printing, signing, scanning, and emailing create unnecessary friction. Modern electronic proposals that clients can sign from any device make acceptance simple. Clear instructions, prominent signature fields, and straightforward next steps reduce confusion and hesitation. The easier you make it to say yes, the more yeses you’ll receive.

When you combine genuine understanding, crystal-clear communication, and an effortless acceptance process, you create accounting proposals that prospects find difficult to refuse.

Download: Free UK-Compliant Accounting Proposal Template

To help you implement everything we’ve discussed, we’ve created a comprehensive proposal template specifically designed for UK accountants, bookkeepers, and tax advisers. You can customise this template for your own practice, adapting the content to reflect your services, branding, and approach.

This template includes all the essential sections we’ve discussed, with example content to guide you in creating your own proposals. Remember that whilst templates provide an excellent starting point, the most effective proposals are always customised to each individual Client’s needs.

[YOUR FIRM NAME]

[Your Address]

[City, Postcode]

[Phone Number]

[Email Address]

[Website]

[Date]

ACCOUNTING SERVICES PROPOSAL & ENGAGEMENT LETTER

Prepared for:

[Client Name]

[Client Company Name]

[Client Address]

[City, Postcode]

Introduction

Dear [Client Name],

Thank you for taking the time to discuss your accounting needs with us. We appreciate the opportunity to present this combined proposal and engagement letter for [Client Company Name].

[Your Firm Name] is a [chartered/certified] accounting practice with [number] years of experience providing comprehensive accounting, bookkeeping, and tax services to businesses throughout [your region]. We specialise in working with [your specialisation] and have a proven track record of helping clients achieve their financial goals.

This document outlines our understanding of your specific needs, presents a tailored solution, and establishes the terms of our professional engagement.

Understanding Your Needs

Based on our consultation on [Date], we understand that [Client Company Name] is seeking accounting support to address the following:

Your Current Situation:

[Brief Description of Client’s current circumstances]

Your Key Challenges:

- [Specific challenge mentioned by Client]

- [Another challenge]

Your Goals:

- [Client’s stated goal]

- [Another Goal]

Our Proposed Services

[Service Name 1]

- [Description of what’s included]

- [Description of what’s included]

- [Description of what’s included]

[Service Name 2]

- [Description of what’s included]

- [Description of what’s included]

Services Not Included

- [List services that would be provided separately if required] [List services that would be provided separately if required]

Why Choose [Your Firm Name]?

- Relevant Experience and Qualifications

[Brief Description of credentials, specialisation, and professional memberships]

- Proven Track Record

[Brief case study example]

- Client Testimonial

“[Include relevant testimonial]”

- Modern Technology and Processes

[Description of software and tools used]

- Accessibility and Communication

[Response times and communication approach]

- Professional Standards

[Insurance coverage, data security, and compliance details]

Investment & Payment Terms

- [Fee Type 1]: £[amount]

[Description of what’s covered]

- [Fee Type 2]: £[amount] per month

[Description of what’s included]

- Additional Services:

[Description of how additional work is billed]

- Payment Terms:

- [Payment term detail]

- [Payment term detail]

- [Payment term detail]

Implementation Timeline

- [Timeframe 1]: [Phase Name]

[Description of activities during this phase]

- [Timeframe 2]: [Phase Name]

[Description of activities during this phase]

- [Timeframe 3]: [Phase Name]

[Description of activities during this phase]

- Ongoing:

- [Recurring deliverable and timeline]

- [Recurring deliverable and timeline]

- [Recurring deliverable and timeline]

Terms & Conditions

- Engagement Period: Ongoing until terminated by either party with [30 days] written notice.

- Client Responsibilities: Timely provision of all necessary financial information and documentation.

- Scope Changes: Any changes to services will be agreed in writing. Additional fees may apply.

- Confidentiality: All information is treated as strictly confidential except where disclosure is required by law.

- Professional Standards: All services performed in accordance with [relevant professional body] standards.

- Limitation of Liability: Our liability is limited to [amount or multiple of fees] as detailed in our full terms.

- Governing Law: This agreement is governed by the laws of England and Wales.

Confidentiality & Data Security

Our data protection measures include:

- Secure, encrypted cloud storage with [provider name]

- Two-factor authentication for all system access

- Regular security audits and updates

- Full UK GDPR compliance

- Secure document exchange through an encrypted client portal

- ICO registration number: [your registration number]

Your information will never be shared with third parties except where required by law or with your explicit consent.

Next Steps

We’re excited about the opportunity to work with [Client Company Name]. To accept this proposal and begin our work together:

- Review this proposal thoroughly and contact us with any questions

- Sign in the acceptance section below

- Return the signed proposal to us by email at [your email]

- We’ll send you our onboarding documents and schedule our initial meeting

We aim to begin work within [one week] of receiving your signed acceptance.

This proposal remains valid until [Date]. We look forward to working with you.

Yours sincerely,

[Your Name]

[Your Position]

[Your Firm Name]

[Phone Number]

[Email Address]

Proposal Acceptance

I/We accept the terms of this proposal and engagement letter and authorise [Your Firm Name] to proceed with the services outlined above.

Signed: ___________________________________

Print Name: ___________________________________

Position: ___________________________________

Date: ___________________________________

Company: ___________________________________

This overview provides the essential structure for a combined accounting proposal and engagement letter. Depending on your practice, you may prefer to keep these documents separate for clarity and workflow purposes.

Get Your Free accounting Proposal & Engagement Letter Templates

Complete, customisable templates specifically designed for UK accounting firms

Best Practices: Create Compliant, High-Converting Accounting Proposals

Having a solid template is an excellent starting point, but the most successful proposals go beyond simply filling in blanks. Follow these best practices to transform your accounting proposals from good to exceptional and consistently win more clients.

Do Your Homework First

Before writing your proposal, invest time in thorough research and preparation. Research the Client’s industry to understand typical challenges and compliance requirements. Review their Website and check their Companies House filings if they’re a limited company. During your initial consultation, ask thoughtful questions beyond surface needs. What are their biggest frustrations? What are their goals for the next few years? Take detailed notes and reference specific comments when writing your proposal. This preparation ensures your accounting proposal is informed by a genuine understanding rather than generic assumptions.

Customise Every Single Proposal

Treat each accounting proposal as a unique document tailored to that specific ClientClient. Use terminology that mirrors how the ClientClient speaks about their business. Tailor your service recommendations to their specific situation rather than offering your standard package. Adapt your examples and case studies to be as relevant as possible. If proposing to a construction company, reference your CIS experience. Match your writing style to their communication preferences. The effort you invest in customisation shows they’re not just another potential client, but a unique business whose needs you’ve taken time to understand.

Use Clear, Jargon-Free Language

Demonstrate expertise through clarity, not complexity. Write for an intelligent business owner who doesn’t have your specialist knowledge. Avoid jargon when simpler language works. When technical terms are necessary, provide brief explanations. Break complex ideas into digestible pieces using lists or bullet points. Test your accounting proposal on someone outside accounting. If they understand what you’re offering and why it matters, your language is clear enough. Clarity builds trust and makes prospects far more likely to say yes.

Make It Easy to Scan and Read

Most prospects won’t read every word in detail. Use descriptive headings that clearly indicate what each section contains. Break long paragraphs into shorter ones, generally no more than four or five lines. Employ bullet points and numbered lists where appropriate. Use bold text sparingly to highlight key points, amounts, or deadlines. Ensure consistent formatting throughout with the same fonts and styles for similar elements. Good formatting respects the reader’s time and makes your proposal easier to navigate.

Proofread Meticulously

Nothing undermines credibility faster than errors. After completing your accounting proposal, step away for at least a few hours before reviewing with fresh eyes. Check for spelling and grammar errors, correct client names, ensure accurate figures, ensure consistent formatting, and ensure working hyperlinks. Read the proposal aloud to catch awkward phrasing. Have a colleague review it if possible. Pay special attention to ensure you haven’t left placeholder text or another client’s name anywhere. This attention to detail demonstrates the care and precision you bring to your work.

Include a Strong Call to Action

After presenting a compelling case, make the next step obvious and easy. Be specific and direct with instructions like “To begin our work together, please sign the acceptance section below and return this proposal by email by [specific date].” Create gentle urgency when appropriate, such as mentioning limited capacity. Make the acceptance process simple with clear signing instructions. End on a positive note, and look forward to the partnership. Follow up if you don’t receive a response within your stated timeframe.

These best practices will help you create accounting proposals that stand out, resonate with prospects, and consistently convert into new client relationships.

How to Present Value-Based Pricing in Proposals for Maximum Conversion

Value-based pricing shifts the conversation from “how much does this cost” to “what will I gain from this investment.” When presented effectively in your accounting proposals, it helps prospects understand the return they’ll receive, making your fees feel justified rather than expensive.

Here’s how you can frame value-based pricing for maximum impact.

Lead with Outcomes, Not Tasks

Don’t list what you’ll do, explain what clients will achieve. Instead of “Monthly bookkeeping and VAT returns,” frame it as “Complete financial clarity and HMRC compliance, giving you confidence in every business decision.” This positions your services as solutions to their problems, not just administrative tasks.

Quantify the Value Where Possible

Help clients see the tangible return on their investment. If your tax planning typically saves clients several thousand pounds annually whilst your fee is a fraction of that, make this clear. If your monthly management reporting helps clients identify significant profit leaks, state it. Numbers make value concrete and justify your pricing.

Break Down What's Included in Each Fee

Show clients exactly what they’re getting for their investment. Rather than a single line item, break down your monthly retainer into its components: financial record maintenance, monthly reporting packages, quarterly strategy sessions, and unlimited email support. This demonstrates the comprehensive nature of your service.

Compare Against the Cost of Inaction

Subtly highlight what happens without your services. Mention the penalties for late filing, the cost of poor cash flow management, or the missed opportunities from lacking financial insights. This creates urgency and frames your fee as protection against far larger costs.

Offer Strategic Pricing Tiers

Present three options that let clients self-select based on their needs and budget: Essential for compliance-focused needs, Professional that adds proactive reporting, and Strategic that includes advisory and planning. Most clients choose the middle option, but having tiers makes your pricing feel flexible and client-centric rather than take it or leave it.

When you shift from cost-based to value-based pricing presentation, you transform your accounting proposal from an expense to be minimised into an investment worth making.

Master Value-Based Pricing

How FigsFlow Automates UK-Specific Proposals & Engagement

As helpful as the above resources and templates may sound, they’re time-consuming and include lots of human components, prone to errors and emotions.

But what if we could take that out and systematise it, while still keeping it personal and tailored to client needs?

Well, FigsFlow helps you do exactly that.

With FigsFlow, you can create professional accounting proposals and engagement letters that are compliant with ACCA, ICAEW, and other UK and global regulations in less than 30 seconds.

Here’s how the entire process works:

- Select your services from pre-built templates covering accounting, bookkeeping, tax advisory, and compliance work

- Configure client details and pricing with real-time calculations that factor in service complexity and transaction volumes

- Preview your branded documents with proposals and engagement letters generated together automatically

- Send directly to clients with built-in e-signature functionality for instant acceptance

FigsFlow handles all the admin burden, while letting you focus on what matters most: winning clients and delivering exceptional service.

See How FigsFlow Creates accounting Proposals in 3 Simple Steps

Complete walkthrough showing how to generate compliant proposals and engagement letters in under 30 seconds, with screenshots, real examples, and step-by-step instructions

Helpful Resources

- Stop doomscrolling the internet only to end up with generic WordPress wrappers & templates dressed up as “proposal solutions”? Here’s the top 5 real solutions every bookkeeper should know: Top 5 Proposal Solutions for Bookkeepers

- Done with bland templates posing as solutions? Here are 5 proposal mistakes to steer clear of: Avoid These 5 Proposal Mistakes & Boost Success | FigsFlow

- Stop guessing what belongs in an accounting proposal. Get the key legal and professional insights in this blog: Understanding Proposals for Accountants | FigsFlow

- Here are the 5 must‑have features of the best proposal software for accountants: Top 5 Features of Best Proposal Software for Accountants

- A quick guide to writing a project proposal that stands out and wins clients: How to Write a Winning Project Proposal | FigsFlow

Conclusion: Win More Clients, Safely

Creating proposals that consistently win clients requires both structure and personalisation. The structure involves including all essential components: detailed service descriptions, transparent pricing, clear timelines, and professional credentials. The personalisation lies in demonstrating a genuine understanding of each prospect’s unique situation and communicating your value in compelling language.

Your proposal is more than a sales document. It’s the foundation of your client relationship, setting expectations and establishing the professional tone for all future interactions.

Use the template provided as your starting point, but never send it unchanged. Every proposal should reflect the unique needs of the business you’re hoping to serve. Reference specific conversations, address particular challenges, and present solutions tailored to their situation.

The accounting profession is competitive, and your proposal is often your best opportunity to differentiate your firm. Make it count, and start winning the clients you deserve.

Frequently Asked Questions (FAQs)

Start by thoroughly researching the Client’s business and industry to understand their specific challenges. Customise every section to address their unique needs rather than using generic templates. Present your services with clear scope definitions, transparent pricing, and concrete timelines. End with a strong call to action that makes acceptance effortless, ideally using electronic signatures for instant response.

Create personalised proposals that demonstrate a genuine understanding of each prospect’s situation by referencing specific challenges discussed during consultations. Showcase relevant expertise through industry-specific case studies and testimonials from similar clients. Use professional branding and clear formatting to make proposals easy to navigate. Make the acceptance process simple with electronic signatures and follow up promptly if you don’t receive a response.

AI tools can help draft proposal content and structure, but they cannot replace the personalisation that wins clients. The most effective proposals reference specific conversations, industry nuances, and client challenges that only emerge from genuine consultation. Use AI for initial templates and structure, then heavily customise every section to reflect your understanding of the prospect’s unique situation.

Begin with a client needs assessment summarising challenges discussed during consultation, using their own terminology. Define your proposed services with specific deliverables and clear exclusions to prevent scope creep. Present transparent pricing broken down by service type with payment terms clearly stated. Include your credentials, relevant case studies, and a direct call to action with simple acceptance instructions.

Using generic templates without customisation makes prospects feel like just another number rather than a valued potential partner. Vague service descriptions without clear scope definitions lead to mismatched expectations and scope creep. Hidden fees or complicated pricing structures create distrust and hesitation. Weak or missing calls to action leave prospects uncertain about next steps, causing delays or abandoned decisions.