Ignore OFAC Sanctions list once, and you could be looking at a civil penalty running into the millions. That is not a hypothetical — it is the reality of how US sanctions enforcement works, and it applies to accounting firms just as much as it applies to banks.

OFAC is one of those compliance areas that quietly sits in the background until it becomes expensive. Most accountants know the name. Far fewer understand what the sanctions list actually contains, who it applies to, or what their firm’s obligations are. That gap is where violations happen.

This guide covers exactly that. What OFAC is, what the OFAC sanctions list includes, who is on it, why it matters to your practice, and what you should be doing about it today.

What Is OFAC & Who Runs It?

OFAC (Office of Foreign Assets Control)

A division of the US Department of the Treasury and the primary body responsible for administering and enforcing US economic and trade sanctions against foreign individuals, entities, and governments.

OFAC acts under a range of federal laws and executive orders, giving it broad authority to target individuals, entities, and entire countries whose activities threaten US national security, foreign policy, or economic interests.

The organisation has been around since 1950, when it was established in response to the nationalisation of US property in China. Its original remit was narrow — managing frozen assets and overseeing foreign investments. Today, OFAC administers more than 30 active sanctions programmes targeting foreign governments, terrorist organisations, narcotics traffickers, weapons proliferators, human rights violators, and transnational criminal networks.

Its jurisdiction is broader than most people expect. OFAC covers:

- all US citizens and permanent residents, regardless of location

- all individuals and entities physically present in the US

- all US-incorporated entities, including their foreign branches

In certain programmes, it also extends to foreign subsidiaries owned or controlled by US persons. Even non-US firms can fall within OFAC’s reach if they conduct transactions in US dollars, use American banks, or route payments through the US financial system.

What Is the OFAC Sanctions List?

The OFAC sanctions list is a publicly maintained database identifying individuals, entities, and countries subject to US economic sanctions. It is not a single list but a collection of lists, each with different prohibitions and different levels of restriction, maintained and updated by OFAC on an ongoing basis.

The most significant of these is the List of Specially Designated Nationals and Blocked Persons, known as the SDN List. When a person or entity appears on the SDN List, all of their property and interests in property within US jurisdiction are frozen immediately. US persons are prohibited from conducting any transactions with SDN-listed parties, regardless of where those parties are located.

Beyond the SDN List, OFAC maintains a Consolidated Sanctions List, a collection of non-SDN lists that impose more targeted, non-blocking restrictions. These lists cover specific sectors, specific categories of activity, and specific geographies. Each list carries its own set of prohibitions, which means the compliance question is never just “are they on a list” but also “which list, and what does that mean for this transaction?”

Entries on these lists include names, known aliases, addresses, and the specific sanctions programme under which the designation was made.

Who Is on the OFAC Sanctions List?

The SDN List includes individuals and entities across a wide range of categories:

- Terrorists and terrorist organisations

- International narcotics traffickers

- Weapons of mass destruction proliferators

- Human rights abusers

- Corrupt government officials

- Transnational criminal organisations

- Foreign government officials, oligarchs, and business figures tied to sanctioned regimes

At the country level, certain jurisdictions are subject to comprehensive sanctions programmes that broadly prohibit most transactions. Cuba, Iran, North Korea, and Syria currently fall into this category, as do Russia-related and Ukraine-related sanctions programmes. Other countries face more targeted restrictions rather than blanket embargoes.

OFAC also maintains separate lists for more targeted purposes. The Sectoral Sanctions Identifications List targets specific sectors of the Russian economy, particularly finance and energy, rather than sanctioning the country wholesale. The Foreign Sanctions Evaders List covers those who violate US sanctions on Syria or Iran. Each carries different restrictions, and each requires separate consideration.

Important: What Is the 50 Percent Rule in OFAC Sanctions?

Any entity owned 50 percent or more, directly or indirectly, by a blocked person is itself treated as blocked under OFAC rules, even if that entity does not appear on the SDN List by name. This means a client company can be effectively sanctioned without ever showing up in a search result. Ownership structures must be examined carefully, not just names.

Why Does the OFAC Sanctions List Matter to Accountants and Accounting Firms?

Accountants are regularly exposed to the kinds of financial relationships OFAC is designed to disrupt, and most do not realise it until something goes wrong. The assumption that sanctions compliance belongs solely to banks or financial institutions is one of the more costly misconceptions in professional services.

The reality is that accounting firms sit at the centre of exactly the transactions and structures OFAC scrutinises. Here is why that exposure is significant:

International Client Operations

Accounting firms work with businesses that have foreign investors, cross-border transactions, and supply chains spanning multiple jurisdictions. Any of those touchpoints could involve a sanctioned party, whether a supplier in a sanctioned country or an investor who appears on the SDN List.

Jurisdiction Reach

If your client is a US entity or a foreign company transacting in US dollars, OFAC compliance is not optional. The requirement falls on the client, but the obligation to understand and advise on that requirement often falls on the accountant. Firms handling tax, audit, financial advisory, or compliance work for US businesses cannot treat OFAC as someone else’s problem.

Sanctions risk does not announce itself. For accounting firms, the question is not whether OFAC is relevant to their work, but whether they have the processes in place to identify it before it becomes a problem.

What Are the Penalties for OFAC Violations?

OFAC penalties are substantial, and intent is not a defence for civil violations. You do not have to knowingly break sanctions to face a civil penalty. You just have to have done it.

The consequences of an OFAC violation fall into two broad categories:

Civil & Criminal Penalties

Civil penalties vary by sanctions programme and are adjusted annually under federal law, reaching into the millions of dollars per violation. Criminal penalties, reserved for wilful violations, can include imprisonment of up to 20 years. Enforcement actions have resulted in penalties exceeding hundreds of millions of dollars against financial institutions, and regulators have made clear that professional services firms are not exempt from scrutiny.

Secondary Consequences

Beyond financial exposure, violations carry significant collateral damage. Reputational harm, loss of business opportunities, restrictions on government contract participation, and potential personal liability for firm principals are all documented outcomes of enforcement actions.

There Are Consequences. But Voluntary Self-Disclosure Changes the Calculation.

If your firm discovers a potential violation, staying silent is the worst option. OFAC explicitly treats voluntary self-disclosure as a mitigating factor in enforcement proceedings, and its Economic Sanctions Enforcement Guidelines provide that self-disclosure will result in a reduction in the base civil penalty. Stop the activity, document everything, seek legal advice, and disclose to OFAC promptly. There is no amnesty programme, but cooperation counts.

How Do You Check the OFAC Sanctions List?

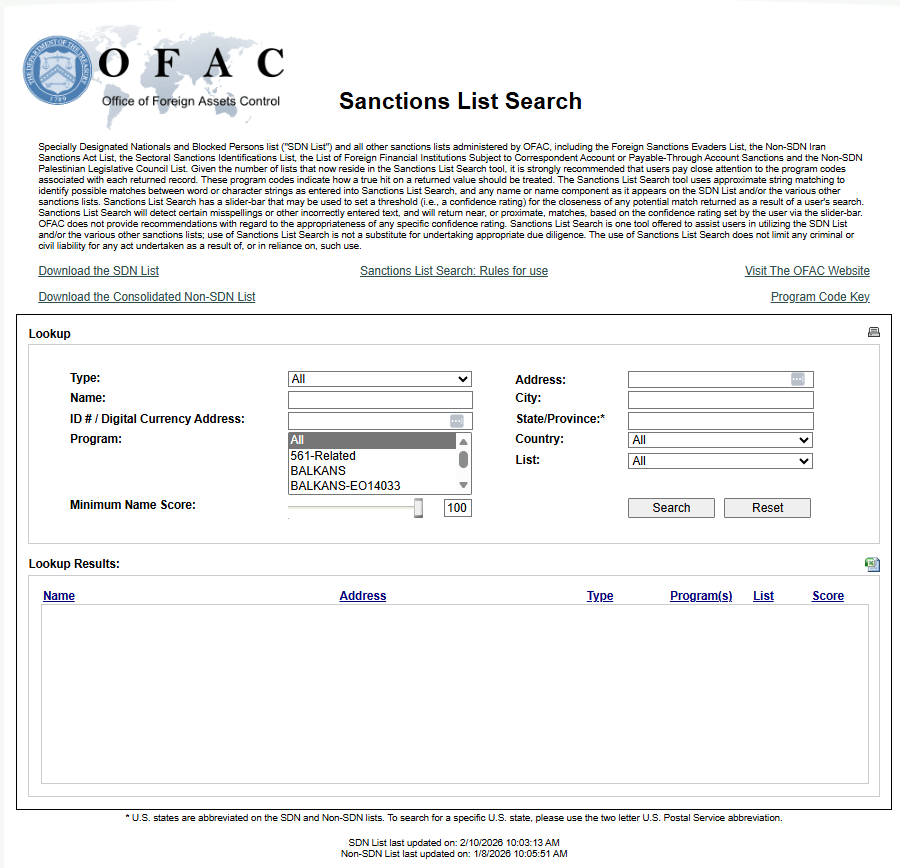

OFAC provides a free Sanctions List Search tool that allows you to search across the SDN List and all other OFAC-maintained sanctions lists simultaneously. Enter the name of the individual or entity, review the results, and document your search. You can access the tool here: Sanctions List Search

The challenge is that manual searching is not sufficient for firms handling volume. It does not catch fuzzy matches, aliases, or transliterations of names from other languages. It does not account for ownership structures that may link a client to a blocked person. And it does not provide ongoing monitoring. A client who was clean at onboarding can appear on a sanctions list six months later.

For firms with higher volumes or higher-risk client profiles, API-based automated screening integrated into your onboarding or AML software is the appropriate solution. More advanced platforms offer real-time alerts, fuzzy matching, alias detection, and continuous monitoring against updated lists.

If you receive a potential match during screening, the process is straightforward:

- Stop the transaction immediately

- Gather identifying details to confirm whether it is a true match

- Escalate to your compliance or legal team

- Report to OFAC as required

- Maintain a complete audit trail of every step taken

How Should Accounting Firms Build OFAC Compliance Into Their Practice?

OFAC compliance is not a one-time check. It is an ongoing programme, and firms that treat it as a box to tick at onboarding are exposed every day between that initial screen and the next engagement. Building it properly means embedding it into how your firm operates at every stage.

Here is what that looks like in practice:

Screen at Onboarding

Every new client relationship should include a search against OFAC sanctions lists before work begins. This applies to the client entity, its beneficial owners, and any counterparties identified during intake. Ownership structures need to be reviewed, not just the top-level entity name.

Build Ongoing Monitoring Into Your Processes

OFAC lists are updated frequently, sometimes daily. A client who passed screening at onboarding can become a sanctioned party without notice. Periodic rescreening and transaction-level monitoring are both appropriate depending on the risk profile of the relationship.

Train Your Team

Staff handling client intake, financial transactions, or advisory work need to understand what OFAC is, what a potential match looks like, and what to do when one arises. An untrained team is a compliance gap regardless of what systems you have in place.

Stay Current With Programme Updates

Sanctions programmes change. New designations, new sectors, and general licence modifications all affect what is permitted. Subscribing to OFAC updates and checking its website regularly is not optional for firms with international client exposure.

Document Everything

In the event of a regulatory review or enforcement inquiry, an auditable record of your screening activity, escalation decisions, and compliance steps is your most important asset.

A firm that screens thoroughly, monitors continuously, and documents carefully is a firm that can demonstrate compliance. That demonstration matters as much as the compliance itself.

Conclusion

OFAC compliance is not a specialist concern reserved for banks and financial institutions. It is a practical obligation for any accounting firm working with international clients, US entities, or cross-border transactions. The sanctions list is large, it changes frequently, and the consequences of getting it wrong are serious, whether the violation was intentional or not.

The firms that get this right are not necessarily the largest or the most resourced. They are the ones that have taken the time to understand what OFAC requires, built screening into their onboarding, trained their staff, and put a process in place for when a match arises. That is not a complicated programme. It is a deliberate one.

If your firm does not have sanctions screening in place today, that is the place to start. Not next quarter. Now.

Want to Go Deeper on Client Risk Screening?

Frequently Asked Questions (FAQs)

It is a publicly maintained database of individuals, entities, and countries subject to US economic sanctions. It is not a single list but a collection of lists, each carrying different restrictions, updated by OFAC on an ongoing basis.

The five key components of an OFAC Sanctions Compliance Programme are management commitment, risk assessment, internal controls, testing and auditing, and staff training.

One example is a trade embargo against an entire country, such as Iran, where most transactions are broadly prohibited. Another is a targeted asset freeze against a specific individual, blocking all their property within US jurisdiction.

They apply to all US citizens and permanent residents regardless of where they live, everyone physically present in the US, and all US-incorporated entities, including their foreign branches.

The three types are country-based sanctions, which target entire nations or regimes; sectoral sanctions, which restrict specific industries such as energy or finance; and list-based sanctions, which designate specific individuals and entities.

The most common violations involve transacting with a sanctioned individual or entity, doing business with a sanctioned country such as Iran or North Korea, and failing to properly screen counterparties before entering a financial relationship.